1. Background

Consumer Scotland is the statutory body for consumers in Scotland. Established by the Consumer Scotland Act 2020, we are accountable to the Scottish Parliament. The Act defines consumers as individuals and small businesses that purchase, use or receive products or services.

Our purpose is to improve outcomes for current and future consumers and our strategic objectives are:

- to enhance understanding and awareness of consumer issues by strengthening the evidence base

- to serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- to enable the active participation of consumers in a fairer economy by improving access to information and support

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. In conjunction with that evidence base we seek a consumer perspective through the application of the consumer principles of access, choice, safety, information, fairness, representation, sustainability and redress.

We work across the private, public and third sectors and have a particular focus on three consumer challenges: affordability, climate change mitigation and adaptation, and consumers in vulnerable circumstances.

Consumer Scotland is the levy-funded advocacy body on postal services for consumers in Scotland.

As a new body, we have been building our evidence base during the past year on the experiences of consumers of postal services in Scotland.

Consumer Scotland commissioned YouGov plc to survey a representative sample of Scottish adults around their attitudes to postal services. Data was collected between 20 February to 14 March 2023, with a total sample size of 2,007 individuals.

The sample was adults aged 16+ in Scotland. The figures have been weighted and are representative of all adults by country, based on age, gender, social grade and region.

2. The parcels market

Competition in the UK market

The UK is estimated the be the most advanced e-commerce market in Europe,[i]with online retail accounting for 26.5% of total retail trade in 2022.[ii] With growing demand from consumers for online purchasing, parcel operators are responding accordingly. Technological innovations are supporting a range of innovations and service developments, including faster turnaround for delivery after ordering and detailed tracking information.

It is estimated that UK consumers receive on average 75 parcels per person per year, with 162 parcels being delivered per second across the UK.[iii] However, for the first time in 10 years, there was a decline in parcel volumes in the UK of 5.7% in 2021-22.[iv] IMRG, the UK e-commerce trade association, also predicts a decline in online purchasing in 2023 from 2020 levels.[v] This may be due to the significant growth in 2020-21 during the pandemic, as in-person shopping was not possible due to restrictions and lockdowns. With bricks and mortar shops once again open and operating, for the most part as they were prior to the pandemic, there may be some return by consumers to their previous physical shopping habits.

Overall, it is estimated that the UK parcels market will continue grow year-on-year,[vi] matching the trend between 2017 and 2021 where there was a compound annual growth rate (CAGR) of 8% experienced generally across Europe.[vii] The likely medium-long term increase will likely be driven by consumers purchasing habits moving further online with greater access to internet services as well as the seeking of competitive prices, particularly in the context of ongoing cost of living pressures, which are more readily comparable online.

There is significant competition between operators in the parcels market. Pitney Bowes estimates that Royal Mail remains the largest operator in the market by both volumes and revenues, however Amazon and Evri have taken significant market share.[viii] Our research concurs with this estimation.

When considering the market perspective of the 500 biggest retailers across the UK, DPD is the parcel operator most widely used. Royal Mail had previously been the most widely used but was overtaken in 2020.[ix] Royal Mail’s UK-wide reach (required under the Universal Service Obligation) and, until recently, monopoly availability of services through the network of Post Office branches has previously given it a competitive advantage, both for retailers and also for consumer sending services (C2X). The recent announcement from Post Office that Evri and DPD services will be also available for purchase alongside Royal Mail services in some branches for consumers sending parcels could lead to significant changes in the C2X market.[x]

Our research did not include the Business to Business (B2B) market segment, which may be an area for future exploration to develop Consumer Scotland’s understanding of the market for small businesses in Scotland.

Consumers of parcel services in Scotland

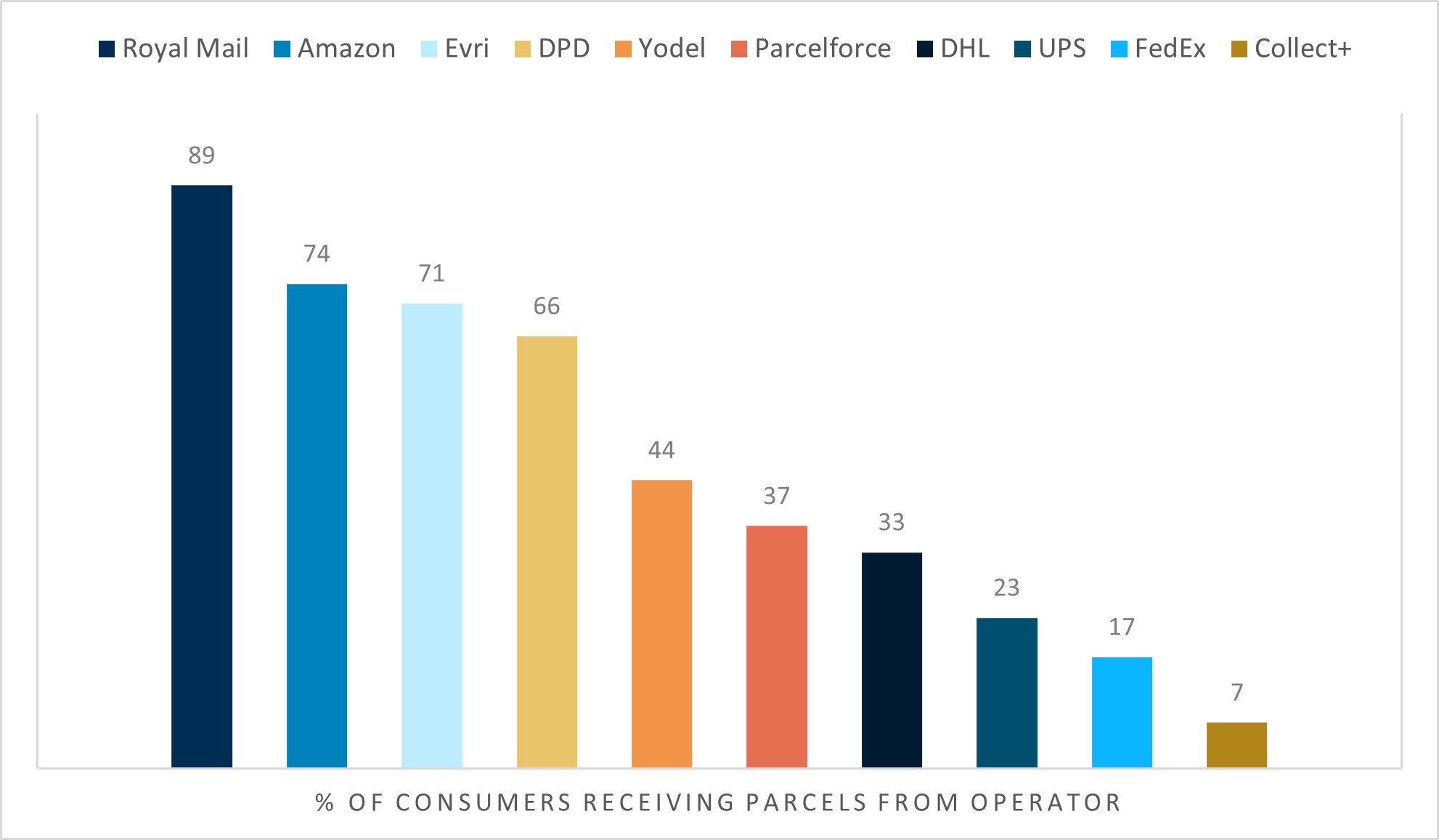

From our survey of domestic consumers in Scotland, Royal Mail remains the parcel operator that consumers are most likely to have received a delivery from, at 89%. There are, however, a cohort of operators who most consumers in Scotland have received a delivery from during the past year, including Amazon at 74%, Evri at 71% and DPD at 66%. Notably, four fifths (80%) of people have never used a parcel price comparison website and so may not be aware of the full range of postal services they can purchase.

Figure 1: The market for delivery to consumers in Scotland

Survey Question: In the past 12 months, to the best of your knowledge, which couriers or postal operators have delivered parcels to you? (Base: 2,007)

Rural consumers in Scotland rely more on Royal Mail for deliveries (94%) than those in urban areas (87%). Those in Highland & Islands still receive large amounts of parcels from DPD, Amazon and Yodel, however they were less likely to receive from these couriers when compared to other regions in Scotland. Consumers in this region are also the most likely to experience parcel surcharging, which we discuss later in this report.

Consumers in Scotland prefer to receive their parcel at home, rather than to another destination, with 39% preferring to have a parcel delivered to their designated safe place, 37% designating a delivery day and 33% to a neighbour. A quarter (27%) of consumers would prefer delivery in the evenings during the week or parcels being left at the post persons chosen safe place (25%).[xi]

Delivery to a designated shop (23%) and parcel lockerbanks (14%) remain less popular than the above home-delivery options.[xii]For consumers, convenience may be a significant driver for decisions they make over delivery preferences, with further research required to understand consumer preferences and motivations in more depth. These motivations may have implications for how the postal sector is decarbonised to support the transition to net zero.

Parcel surcharging

Nearly one fifth (18%) of adults in Scotland experience surcharges,[xiii] with those in the Highlands (72%) disproportionately more likely to have experienced additional charges for parcels. 29% of consumers in North-East Scotland also regularly experienced parcel surcharging.[xiv] This would suggest that more action is needed to work with parcel operators and retailers to understand the actual costs they incur in delivering to regions that attract parcel surcharges, and to evaluate solutions to surcharging.

The majority (91%) of those who experienced surcharging said that it puts them off buying things that need to be delivered, with 70% saying it put them off frequently or always. Four fifths (79%) said they sometimes or never pay the surcharge. When those consumers encountered a surcharge, 70% said will always or often seek the item elsewhere as a result, while 40% will always or often get the item from a shop instead and 37% will do without the item always or often. Only 19% would at least often pay the surcharge.[xv] This would suggest that retailers are losing out on sales in those regions where they have contracted parcel operators who apply surcharges.

Three fifths (58%) of consumers, particularly older groups (73% if 65+), agree that parcel delivery across Scotland should cost the same regardless of location.[xvi] This shows the significant value consumers in Scotland place on uniform pricing and the overall equality of experience for all consumers.

For those who disagreed, one third (33%) said the increased cost should be less than 10%, one quarter (25%) said 10-25% and one quarter (23%) said any surcharge should be based on actual costs.[xvii] Younger consumers were less likely to say that the costs should be the same across Scotland, while also being the most in favour of saying any extra cost should be based on the actual costs to the delivery company.

For consumers within the UK market, there is a lack of choice for consumers over which operator is used by their retailer to deliver their goods. Currently consumers cannot indicate what they would prioritise in terms of delivery when buying from a retailer, whether it be speed or cost. More research is required to determine if consumers would prefer to have more choice in designating who delivers their goods, where they can make the decision and weigh up whether they would prioritise cost over tracking or speed, with clear and accurate pricing from retailers on those options.

When consumers are not at home

According to IMRG, nearly 1 in 3 (32.2%) of consumers said they did not have a place they considered safe at their home.[xviii] To meet this gap, there has been growth in alternative services for delivering to safe locations for consumers, such as parcel lockers or collection from shops or Post Offices. One third of people in Scotland have used a parcel locker, with those aged 25-44 most likely to have used such a service, however usage generally declines with age. Those in the Lothians and Glasgow regions were most likely to have used parcel lockers, while those in Highlands and Islands were the least likely, although that may be due to the distribution of parcel locker hubs.[xix]

Regular senders of parcel services were more likely to have used a parcel hub. Those people with a disability or long term health condition as well as those on lower incomes were less likely to use a parcel locker. This would suggest that there is a need to research how accessible parcel locker hubs are and whether the network of parcel locker hubs is meeting the needs of all consumers.

For third party Click and Collect (i.e., not from retailers directly but instead from parcel lockers or local shops/Post Office branches), Evri is the market leader for the biggest UK retailers, followed by Collect+ and Local Collect.[xx] Further research exploring consumer willingness to use alternative delivery points would be valuable in understanding drivers of consumer behaviours, particularly if there are potential benefits from these options for reducing emissions.

Notably, for the 500 biggest retailers, there has been a decline in those offering Click and Collect services, down from 68% in 2021 to 57% in 2022 of those retailers offering that as an option to consumers, mostly driven by reductions in using third party click and collect services, while own store collection remains strong.[xxi] This may be due to cost efficiency and reduction for businesses who have faced generally increased costs, allowing them to remain competitive.

3. Conclusions

Market trends suggest that retail will continue to shift steadily online, following the significant boost during Covid which allowed for habit forming across all demographics with internet access. As the market develops, there is a need to ensure that there are adequate consumer protections in place that are complied with by parcel operators but also crucially widely understood by consumers.

More generally, there is a lack of choice for consumers over which operator is used by their retailer to deliver their goods. Currently, consumers cannot indicate what they would prioritise in terms of delivery when buying from a retailer, whether it be speed or cost. Further research would be useful to understand whether consumers would prefer to have more choice in designating who delivers their goods, where they can make the decision and weigh up whether they would prioritise cost over tracking or speed. Additionally, this could include what other information would be useful to help consumers make those decisions (such as environmental impacts), alongside how best and accurate pricing from retailers could be presented on those options.

The perennial issue of parcel surcharging for some consumers in Scotland suggests that a refresh of thinking and collaboration is required to solve this problem. Retailers could be more aware of their potential loss in business from consumers experiencing surcharging. More flexible contracts or layered contracts with parcel operators for delivery services could ensure there is market effectiveness and thereby better consumer outcomes. Further research to understand the impacts of surcharging on competition for those impacted consumers would be welcome.

Innovations in the market are welcome, and greater choice for consumers in how and where they receive parcels should be actively encouraged. New technology or services allow for businesses and consumers to reach mutually beneficial outcomes that work well, however there should be careful consideration given to the range of needs of all consumers.

4. Endnotes

[i] E-commerce in the UK - Statistics & Facts | Statista

[ii] Centre for Retail Research: Online Retail: UK, Europe & N. America: The Centre For Retail ResearchOnline Retail

[iii] Parcel and Postal Technology International: UK parcel volumes drop for the first time in a decade, Pitney Bowes finds - Parcel and Postal Technology International

[iv] Ofcom: Annual Monitoring Update Annual Monitoring Update for postal services: Financial year 2021-22 (ofcom.org.uk)

[v] IMRG and Huboo: ‘Consumer Home Delivery Review 2022/23’ IMRG-Huboo-Consumer-Home-Delivery-2022-23-1.pdf

[vi] Pitney bowes: ‘Parcel shipping index 2023’ 23-mktc-03596-2023_global_parcel_shipping_index_ebook-web.pdf (pitneybowes.com)

[vii] European Commission – Main developments in the postal sector (2017-2021) Volume 1

[viii] Pitney bowes: ‘Parcel shipping index 2023’ 23-mktc-03596-2023_global_parcel_shipping_index_ebook-web.pdf (pitneybowes.com)

[ix] Apex Insights: ‘Top UK retailers: delivery services and carriers used 2022’

[x] Post Office: ‘Post Office partners with DPD and Evri to launch new in-branch parcel delivery services’

[xi] Q. Royal Mail offers for free several options to make delivery of parcels more convenient if no one is in to accept the parcel. Which do you prefer? You can pick up to 3. (Base: All adults living in Scotland: 2,007)

[xii] Q. Royal Mail offers for free several options to make delivery of parcels more convenient if no one is in to accept the parcel. Which do you prefer? You can pick up to 3. (Base: All adults living in Scotland 2,007)

[xiii] There may be some issues with consumer understanding of the survey question, as 8% of respondents in both Central and West Scotland stated they had also experienced surcharging.

[xiv] Q. How often do you encounter extra delivery charges for parcels based on where you live? (Please select the option that best applies. If you never get any parcels delivered to where you live, then please select the 'Not applicable' option) (Base: 2,007)

[xv] Q. You previously said that you encounter extra delivery charges for parcels based on where you live...To what extent, if at all, do extra delivery charges based on where you live affect your likelihood to buy things that have to be delivered? (Base: All Scottish Adults who encounter extra delivery charges: 351)

[xvi] Q. Consumers and businesses in some parts of Scotland, mostly in the Highlands, Islands and North-East, are often asked to pay extra for parcel delivery (e.g., when shopping online). Parcel delivery operators say that this is because it costs more to deliver parcels in these areas, which they describe as remote. Which one, if any, of the following statements is closest to your opinion? (Base: All adults living in Scotland 2,007)

[xvii] Q. You previously said that you think it is fair that consumers and businesses in some parts of Scotland are often asked to pay extra for parcel delivery...On average, what do you think would be a fair extra cost for parcel delivery to these areas? (Please select the option that best applies) (Base All Scottish Adults who think it is fair for some consumers to pay extra for parcel delivery: 547)

[vix] IMRG and Huboo: ‘Consumer Home Delivery Review 2022/23’ IMRG-Huboo-Consumer-Home-Delivery-2022-23-1.pdf

[xx] Q. Have you ever used… A parcel locker (such as an Amazon Hub Locker or InPost) to receive a parcel or to send a return (Base: All adults living in Scotland: 2,007)

[xxi] Apex Insights: ‘Top UK retailers: delivery services and carriers used 2022’

[xxii] Apex Insights: ‘Top UK retailers: delivery services and carriers used 2022’