1. About us

Consumer Scotland is the statutory body for consumers in Scotland. Established by the Consumer Scotland Act 2020, we are accountable to the Scottish Parliament. The Act defines consumers as individuals and small businesses that purchase, use or receive in Scotland goods or services supplied by a business, profession, not for profit enterprise, or public body.

Our purpose is to improve outcomes for current and future consumers, and our strategic objectives are:

- to enhance understanding and awareness of consumer issues by strengthening the evidence base

- to serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- to enable the active participation of consumers in a fairer economy by improving access to information and support

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. In conjunction with that evidence base we seek a consumer perspective through the application of the consumer principles of access, choice, safety, information, fairness, representation, sustainability and redress.

2. Consumer Principles

The Consumer Principles are a set of principles developed by consumer organisations in the UK and overseas.

Consumer Scotland uses the Consumer Principles as a framework through which to analyse the evidence on markets and related issues from a consumer perspective.

The Consumer Principles are:

- Access: Can people get the goods or services they need or want?

- Choice: Is there any?

- Safety: Are the goods or services dangerous to health or welfare?

- Information: Is it available, accurate and useful?

- Fairness: Are some or all consumers unfairly discriminated against?

- Representation: Do consumers have a say in how goods or services are provided?

- Redress: If things go wrong, is there a system for making things right?

- Sustainability: Are consumers enabled to make sustainable choices?

We have identified access, fairness and sustainability as being particularly relevant to the consultation proposal that we are responding to.

3. Our response

Learnings from the Smart Meter Rollout and Radio Teleswitch Service (RTS) Switch-Off in Scotland

The current regulatory framework for smart meter installation targets comes to an end in December 2025. Ofgem is now consulting on a new framework for 2026 onwards. The low penetration of smart meter installations in Scotland to date presents a compelling reason to ensure that this new smart meter framework delivers effectively for all consumers across GB equally.

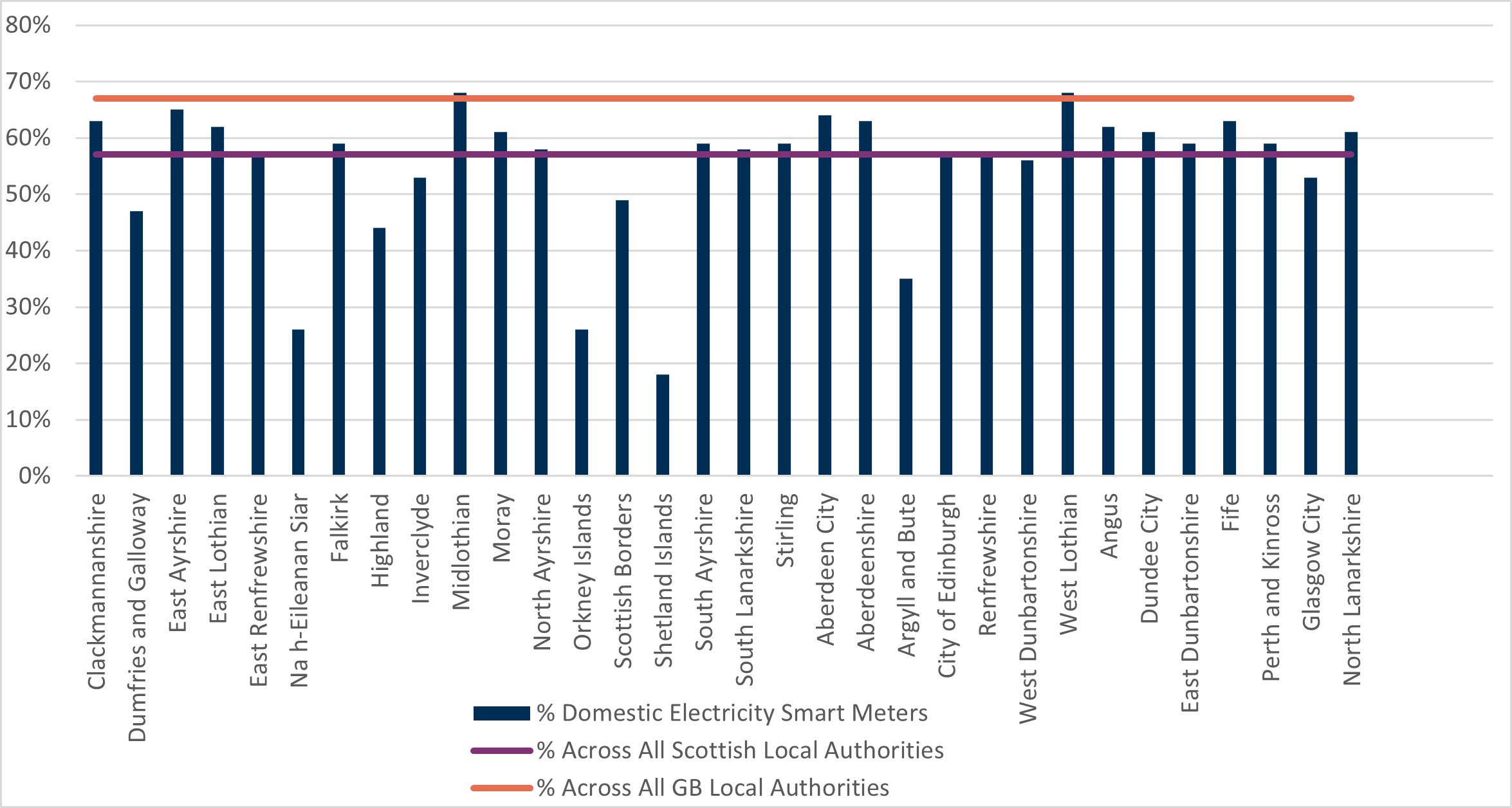

Despite GB-wide smart meter installation rates now reaching 67%, the level in Scotland has fallen behind at only 57%, with installation rates in many Scottish rural local authorities being far less.

Figure 1: Proportion of Domestic Electricity Smart Meters Operated by All Energy Suppliers by Scottish Local Authority, up to 31 March 2025 [1]

This low install rate has been caused by a number of factors, such as:

- technical signal and network challenges (although these may be mitigated in the coming years with recent regulatory changes to allow the use of 4g comms hubs in Scotland, as well as the rollout of VWAN networks),

- older building stock, and

- insufficient engineering resource and supplier incentive, especially in remote and sparsely populated areas[2].

There is now a clear divide between different parts of GB that results in inequitable consumer outcomes. Consumers in Scotland are at risk of enjoying having less choice in terms of smart tariffs and products as an increasing amount of smart and innovative products become available in the energy market. As smart meters can also be a tool to aid affordability and budgeting, the divide in smart meter penetration also risks compounding affordability premiums already faced by rural consumers in Scotland. Remote and rural Scottish households already face minimum living costs that are 15-30% higher than those in urban areas of the UK, and fuel poverty affects 47% of island households compared to 33% of those on the mainland[3]. A clear goal for the new smart meter framework must be to give a strong emphasis to improving the low smart meter installation rate in Scottish rural local authorities can empower households to make budgeting decisions on their domestic energy usage.

The RTS switch-off has also exposed a weakness in supplier-led metering transitions, particularly in rural and remote areas of Scotland where over a third of RTS meters remained at the time of the initial RTS signal cessation date[4]. Charities and community groups have repeatedly reported replacement challenges through Ofgem’s regular RTS Engagement sessions, including insufficient engineering capacity, poor supplier coordination, and issues with consumer-focused engagement strategies which have led to difficulties for some RTS consumers.

There are clear challenges and learnings from the RTS process that must be taken into account for the future smart meter rollout, particularly the replacement of older smart meters ahead of the 2G/3G network switch-off in 2033. To avoid a repetition of the same issues, the post-2025 smart meter framework must incorporate lessons from the RTS transition, ensuring better supplier coordination and tailored engagement strategies for rural and remote communities in Scotland.

Summary of Response

Consumer Scotland broadly supports the proposed post 2025 Smart Meter framework. Our response to this consultation primarily focuses on provisions for supplier deployment plans. Supplier deployment plans are the primary mechanism through which smart meters will be rolled out, and we welcome proposals to give Ofgem greater forward-looking powers to scrutinise suppliers’ smart meter deployment plans. Past experience, such as the RTS switch-off, has shown that a weakness in planning and preparation, including taking into account regional and vulnerable consumer challenges, has led to consumer detriment, disproportionately affecting consumers in Scotland. Consumer Scotland believes that there is need for stronger accountability, improved coordination frameworks, and tailored approaches in suppliers’ proposed deployment plans to ensure consumers across Scotland have access to smart meters within the required timescales, in a way that works effectively for them.

To help achieve this, Consumer Scotland recommends that suppliers and the regulator should be required to report installation rates at a greater level than is currently required. We specifically recommend that suppliers should be required to report on their smart meter installation performance at a sub-GB level, either by local authority or DNO region. The costs of the smart meter rollout are borne by the consumer through their energy bills and it is appropriate that a range of data on the progress of the roll out should be made publicly available.

Further, while greater scrutiny of deployment plans is welcome, it is important that the content of deployment plans do not simply focus on installation rates across Great Britain. While an important metric, the experience in Scotland to date sets out a clear case for more detailed plans, including:

- regional targets and obligations

- appropriate considerations for reaching harder-to-serve and vulnerable consumers

- a high-quality consumer journey to support consumer confidence in the smart meter rollout.

Many of the remaining households without smart meters will be the least-engaged and hardest to serve consumers, for a variety of reasons. Therefore, if the rollout is to be successful, and support the Government’s goal of a just transition, it will be necessary for deployment plans to give appropriate considerations for all consumers.

2030 Domestic Rollout Obligation

Question 9. Do you agree with the proposed all reasonable steps obligation for energy suppliers to complete the domestic rollout by 2030 set out in Section 2. We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

We support the proposed “All Reasonable Steps” (ARS) approach with Ofgem providing a sufficient scrutinising role of energy suppliers’ annual plans.

The current smart meter framework was based on a Targets Framework. The rationale for this approach when introduced was to provide certainty for industry by setting clear annual targets through a prescribed methodology. However, a range of stakeholders have questioned the effectiveness of the Targets Framework, with persistent missed targets raising questions about its viability. In the National Audit Office’s (NAO) update report on the rollout of smart meters, suppliers argued that the initial targets set were too challenging due to consumer resistance to adopting smart meters, a shortage of engineering resource and difficulties in deploying the meters around the country[5]. Nearly all large suppliers fell short of installation targets in 2022 and 2023[6].

We support the proposed ARS framework when combined with annual milestones. The Government’s proposals still set an ambitious target of meeting 100% installation by 2030, while providing suppliers more flexibility to produce deployment plans that take account of the particular features of their customer portfolio. However, these self-set targets must be sufficiently scrutinised by the regulator, and we would recommend that Government provides Ofgem with the required powers to robustly review deployment plans for ambition and credibility to ensure the smart meter rollout is successful for all consumers.

Monitoring Progress and Ensuring Accountability

Question 12. Do you agree that we should require energy suppliers to provide Ofgem with annual deployment plans and report progress against those deployment plans, with annual milestones setting out what activities they will undertake each year for the domestic sector, to meet their smart meter installation, pre-emptive replacement, and operational obligations? If you disagree, please suggest alternative approaches that would enable monitoring and achieve accountability to ensure energy suppliers take sufficient action each year to meet the obligations set out in Sections 1 and 2 of the consultation. We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

Consumer Scotland supports the proposals to require energy suppliers to provide Ofgem with annual deployment plans for the regulator to scrutinise. This requirement forms a critical part of ensuring suppliers’ self-set targets are suitably ambitious and credible to meet the Government’s 2030 targets.

Building on these proposals, Consumer Scotland proposes additional measures that Government and Ofgem should mandate within these deployment plans to address the persistent regional disparities that have characterised the smart meter rollout to date. These additional requirements would ensure suppliers are held accountable for equitable smart meter coverage across all communities, providing Ofgem with enhanced regulatory tools to monitor progress, and to proactively intervene if there is evidence that communities or vulnerable consumers are not being reached.

The proposed mandates for greater data transparency at sub-national levels, coupled with targeted deployment milestones and explicit consumer-centric provisions, would strengthen the regulatory approach for all consumers.

Greater Transparency of Data

Greater transparency and granularity in supplier smart meter installation data is essential for effective regulatory oversight, providing Ofgem with the necessary information to take timely, proactive action in response to regional disparities and rollout challenges. Supplier reporting at only a GB level would risk obscuring significant regional disparities as we have already seen affecting Scotland generally, and rural, remote and island parts of Scotland more specifically.

Robust data reporting would enable Ofgem to identify:

- lagging suppliers,

- geographic disparities (such as lower penetration rates in Scotland and rural areas), and

- specific barriers impacting deployment.

- Granular reporting at sub-national levels, such as at distribution network operator (DNO) regions or smaller geographic units such as local authority level can enhance the regulator’s ability to:

- set targeted interventions,

- mandate remedial plans, and

- support policies, like sub-national targets, that help address equity gaps and ensure all consumers can participate in smart energy markets.

Suppliers should also be required to publish non-commercially sensitive sub-national installation data for accountability and to facilitate independent scrutiny from consumer advocates, such as Consumer Scotland. The costs of the smart meter rollout are borne by the consumer through their energy bills and it is appropriate that a range of data on the progress of the roll out should be made publicly available. Public transparency can:

- improve awareness of progress, ensuring suppliers’ plans and performance are visible

- highlight instances where persistent geographic gaps in the roll out programme risk limiting choice, affordability, and protections for some consumers.

- empower stakeholders to advocate for improved supplier coordination and consumer engagement to address such issues

- better enable collaborative responses to systemic risks, such as has been necessary with the RTS switch-off.

Sub-National Targets

Consumer Scotland recommends that supplier deployment plans should incorporate sub-national annual milestones for suppliers to address regional disparities. Granular, geographically specific milestones would enable Ofgem to more precisely monitor supplier performance and hold them accountable for equitable rollout progress. This approach supports targeted regulatory intervention where operational barriers exist and incentivises suppliers to prioritise harder-to-reach communities, reducing systemic risks exposed during events like the recent RTS switch-off.

Sub-national targets have been adopted to ensure regional equity in other regulated sectors. This includes, for example, broadband access, where Ofcom’s Quality of Service standards for fibre connectivity include sub-national targets[7]. Similarly, in the energy sector, sub-national targets or milestones could be set at DNO level or corresponding to local authority areas. These levels reflect operational boundaries and existing data granularity that DESNZ currently collects, making them suitable for tracking rollout progress.

Ultimately, incorporating sub-national milestones would align with the broader goals of the post-2025 Smart Meter Framework to ensure supplier delivery flexibility while maintaining accountability. As the rollout progresses, the remaining consumers without smart meters will be increasingly be more difficult to reach, and are currently concentrated in rural or underserved areas where deployment faces operational and consumer engagement challenges. Sub-national reporting and targets can enable Ofgem to better identify and address these challenges proactively, encourage suppliers to allocate sufficient resourcing and enable local engagement strategies. This targeted approach supports the government’s just transition commitments to ensure that all communities are included in the advance to net zero, while enhancing consumer confidence by improving service quality and inclusivity across all areas.

Consumer Journey

Consumer Scotland recommends that to enhance consumer confidence in the roll out programme, supplier deployment plans should be mandated to consider the consumer journey in the round, alongside specific installation targets.

Currently, around 8.7% of installed smart meters, equating to approximately 3.7 million meters, operate in traditional mode as opposed to smart mode[8]. Historical data suggest that this is a persistent problem, with smart meters operating in traditional mode reaching a high of 10.6% in 2024[9]. Citizen Advice research has found that smart meter faults can undermine confidence in the smart meter programme, finding that 21% of people who don’t have smart meters cite poor experience reported by friends or family as a reason for opting out[10]. Further, the research also found that 23% of consumers who have a smart meter yet still have to give regular manual meter readings to their supplier are unhappy with their smart meter.

When smart meters fail to operate in smart mode, consumers experience detriment, with their choices in the evolving smart energy market negatively affected. Consumers in these circumstances will continue to receive estimated billing, and potentially back-billing price shocks, despite having smart technology that promised convenience and accuracy. Consumers can also lose access to smart tariffs and time-of-use benefits.

While recent changes to the Guaranteed Standards of Performance, which provide consumers with greater access to redress and compensation, are welcome the new smart meter framework provides an opportunity to further strengthen a clear focus on the delivery of positive consumer outcomes. To achieve this, we recommend that the Government should ensure supplier deployment plans promote a high-quality consumer journey. This could be delivered through the inclusion in deployment plans of both quantitative installation targets and qualitative service standards, such as rapid fault resolution times and user satisfaction benchmarks, to promote an improved consumer journey. Incentive mechanisms tied to consumer experience outcomes can help to ensure that suppliers to take proper account of the importance of key issues such as service quality and responsive consumer support.

Harder to Reach/Serve and Vulnerable Consumers

Consumer Scotland recommends that smart meter deployment plans explicitly incorporate provisions to address the needs of consumers in vulnerable circumstances. Evidence from qualitative research commissioned by the former Department for Business, Energy and Industrial Strategy (BEIS) highlights several vulnerability factors, such as financial hardship, health and disability-related challenges, limited control over energy costs, and low digital literacy, as significant barriers to smart meter adoption[11].

Further insights from Citizens Advice’s Get Smarter report reveal that 27% of vulnerable consumers surveyed had never been offered a smart meter by their energy supplier, and only 10% had proactively requested one[12]. This data underscores a clear risk that vulnerable groups, who may potentially be able to derive significant benefits from smart meter technology, are currently experiencing a range of barriers to accessing this technology. .

As acknowledged by the DESNZ in its current consultation, while the national rollout of smart meters has achieved substantial coverage, persistent challenges remain in reaching harder-to-serve areas and consumer segments with complex needs. As roll out continues, the remaining pool of consumers yet to take up a smart meter is likely to increasingly be made up of consumers who may be less engaged and require different approaches in order to reach. To ensure a just transition, it is imperative that DESNZ mandates the inclusion of targeted measures within supplier deployment plans to effectively engage and support consumers in vulnerable circumstances.

Cross-Industry Coordination Mechanisms

In light of the evolving challenges facing the smart meter rollout post-2025, Consumer Scotland recommends that deployment plans incorporate provisions for effective cross-industry coordination.

The recent RTS switch-off in Scotland illustrates the critical importance of collaborative action. A high concentration of RTS-affected households are located in rural and island communities, where low population density and geographic isolation have posed significant logistical barriers, particularly in terms of engineering capacity and deployment.

One of the key operational challenges has been the limited availability of engineers able to service remote areas. This issue could have been mitigated earlier through better cross-industry collaboration, such as shared installer training and pooled resources, enabling a single engineer to carry out installations on behalf of multiple suppliers. Instead, the current model often requires separate engineers for each supplier, resulting in inefficiencies, delays and consumers facing difficulties in getting install appointments in a timely manner. Frontline advice services in Scotland have reported to us that these challenges risk significantly undermining consumer confidence in the process.

Taking the learning from this process, the RTS switch-off underscores the critical importance of proactive, cross-industry coordination in managing the energy system transition. To be effective, Consumer Scotland recommends that the new smart meter framework must prioritise clear coordination, shared accountability and timely communication between suppliers, the network operators and regulators, if it is to effectively reach and serve vulnerable consumers and remote communities.

These lessons should particularly inform the design of supplier deployment plans for the post-2025 smart meter framework. To ensure a more equitable and efficient rollout for smart meters, future deployment plans should embed mechanisms for cross-sector coordination. This includes aligning regulators, suppliers, industry bodies such as Smart Energy GB, and consumer and community organisations to jointly develop and implement installation strategies. A coordinated approach will be essential to address geographical disparities, deliver tailored support to hard-to-reach consumers, and optimise resource allocation across the sector.

Question 14. Do you agree that energy suppliers should (a) be required to submit updated deployment plans annually, and (b) be able to request re-submission to Ofgem in-year, in response to exceptional events that have a significant and negative impact on their ability to meet their annual milestones? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

We agree that suppliers should submit updated deployment plans annually. Suppliers and Ofgem will be familiar with the submission of delivery and operational plans to the regulator in other industry areas. For example, Ofgem already exercises scrutiny over energy supplier’s Energy Company Obligation (ECO) delivery plans, with powers to compel suppliers to provide specific information about its proposals for complying with any requirement under an ECO4 order[13]. Ofgem also reviews network companies’ business and price control plans, such as the RIIO-3 draft determinations or previous RIIO-T2 plan reviews, where a number of network companies faced modifications to their RIIO-T2 proposals[14].

In our assessment, a similar annual process would be appropriate for smart meter roll outs for two reasons. Firstly, with the Government’s target only five years away, less frequent reviews would risk suppliers and regulators not being agile enough to react to suppliers who are failing to meet their targets. Secondly, annual reviews will allow Ofgem to identify any cross-supplier trends or common challenges and take any appropriate regulatory action more quickly.

Further, we accept that suppliers will need some flexibility in their deployment plans, and the re-submission proposals better accounts for individual supplier challenges as opposed to a market-wide 5-10% target tolerance. Ofgem should set clear rules and guidance for when it will be appropriate to resubmit deployment plans in-year and sufficiently scrutinise resubmissions for similar ambition and credibility in a similar manner to the initial annual deployment plans.

Ofgem’s scrutiny of network companies’ business plans also allows for the regulator to consider requested adjustments to a licensee’s business plan through the reopener mechanisms in its RIIO framework. Through this mechanism, Ofgem guidance sets out various prescribed thresholds that must be met to accept a re-opener, either through automatic mechanisms (such as force majeure events) or others requiring materiality tests needing to be met.

We recommend that DESNZ and Ofgem consider appropriate prescribed reopener events for mid-year adjustments to smart meter deployment plans. Prescribed reopener events would provide a transparent mechanism that can enable proportionate adjustments without undermining long-term rollout objectives, an approach that aligns smart meter deployment governance with other established regulatory frameworks.

Question 15. Do you agree that the date from which the annual milestones for new installations and pre-emptive replacements should be binding is 1 January 2027? If you disagree, please provide an alternative earliest date, including rationale for how this would be achieved.

While suppliers are best placed to assess their readiness, we encourage DESNZ to make the annual milestone binding as early as practicable. Given the existing shortfall of smart meter installations in Scotland and the limited time remaining to mee the 2030 target, an early and ambitious implementation is essential to drive progress and ensure delivery momentum across all regions.

Question 16. Do you agree with the following measures to ensure deployment plans are of high quality and provide confidence that suppliers will meet their obligations:

a. Ofgem should be given the option to reject the plan and the option to provide guidance to suppliers on when it might reject the plan? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

We support Ofgem being given the option to scrutinise and reject deployment plans for the following reasons:

Consistent Delivery Failures - To date, the smart meter programme has demonstrated consistent delivery failures requiring prior regulator intervention[15]. Annual plan scrutiny provides an opportunity for early intervention by the regulator to address capacity constraints, unrealistic or unambitious targets, and delivery challenges. However, as discussed in response to question 9, this needs to be balanced with suppliers setting reasonable yet ambitious milestones for each year.

Ensuring Only Efficient Costs are Passed Through to Consumers - Smart meter costs are recovered through consumer bills, similar to network investment costs where Ofgem already exercises detailed plan scrutiny as we illustrated in our response to question 15. Plan scrutiny can help to ensure cost-effective deployment plans and reduce the risk of inefficient expenditure being passed to consumers.

Market Coordination and Strategic Intervention – Smart meter deployment involves complex supply chain coordination, with installers, manufacturers and the communication network provider needing to work together. It is also must take into account regional performance variations, such as the current split between connection signals in the north and south of Great Britain, and no-WAN areas in Scotland. At scale, this can require strategic regulatory intervention to address. The proposals for a post-2025 framework aim to s overcome the current framework’s lack of forward-looking planning, by allowing Ofgem to identify and address market-wide coordination challenges, installer capacity constraints or technology deployment challenges that may arise.

b. That suppliers should be required to provide evidence to support justification of the annual milestones, including justification for any numerical difference between the milestones provided for new installations and pre-emptive replacements, and a straight-line path to the relevant end-date, and supporting information on workforce and consumer engagement? Are there additional quantitative or qualitative information requirements that should be included in the deployment plan to support the assessment and justification of milestones? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

Deployment plan reporting must include regional breakdown of smart meter installations. Ideally this would include as granular data as possible. This should at least align with the current DESNZ smart meter data publications that breaks smart meter installation down by local authorities[16] or failing that by DNO region. More granular data can help Ofgem consider any necessary policy interventions to tackle regional inequalities and improve the take up of smart meters across Scotland.

c. Do you agree that each supplier’s deployment plan should be (a) approved by the supplier’s Board and (b) milestones and progress against those milestones published on the supplier’s website? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

We support mechanisms that enhance transparency and accountability in suppliers’ deployment plans. Publishing plans with regional-level data as we have recommended above will also enable scrutiny by consumer bodies, such as Consumer Scotland, particularly for suppliers with significant customer bases in Scotland.

d. If you disagree with Q16a, Q16b or Q16c, are there alternative or additional design approaches that would reduce the risk of activities concentrated towards the end-dates within the plan and/or to subsequent revisions to that plan? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

No answer.

Question 17. Do you agree that all energy suppliers, except those that supply gas or electricity, or both, to domestic sector customers via, in each case, fewer than 20,000 energy meter points, should be required to submit deployment plans? We welcome views from all stakeholders. Please provide rationale and evidence to support your answer.

We support DESNZ including as many energy suppliers as possible in the requirements to submit deployment plans, subject to realistic operational constraints. By obliging as many suppliers as possible government can ensure that more consumers benefit from incentives to have a smart meter installed, regardless of the size of the supplier they are with.

4. Endnotes

[2] Changeworks (2023) A Perfect Storm: Fuel Poverty in Rural Scotland, p. 20

[3] Scottish Government (2023) Rural Scotland Data Dashboard: 3. Challenges – Cost of Living

[5] National Audit Office (2023) Update on the Rollout of Smart Meters p. 14

[6] Ofgem (2024) Supplier Smart Metering Installation Targets | Ofgem

[7] Ofcom (2020) Statement: Promoting investment and competition in fibre networks – Wholesale Fixed Telecoms Market Review 2021-26

[10] Citizens Advice (2024) Get Smarter: Ensuring People Benefit from Smart Meters

[12] Citizens Advice (2024) Get Smarter: Ensuring People Benefit from Smart Meters

[13] Ofgem (2022) ECO4 Supplier Admin Guidance, Section 1.13

[14] SP Energy Networks (2020) RIIO-2 Draft Determination Consultation Response Executive Summary; National Grid (2020) Response to RIIO-2 Draft Determination Executive Summary

[15] Ofgem (2024) Supplier Smart Metering Installation Targets

[16] DESNZ (2025) Q1 2025 Smart Meters Statistics Report