1. Sizewell C nuclear regulated asset base

The UK government is planning to support the development of a new nuclear power station at Sizewell in East Anglia. It will be located next to the existing Sizewell B nuclear power station which has been operating since 1995 and is expected to reach the end of its life in the middle of the next decade.[1]

The new power station, Sizewell C, will be the second nuclear power station developed in the UK in recent years following on from Hinkley Point C in Devon, which is currently in construction and is expected to begin operation around the end of the decade. Sizewell C and Hinkley Point C are both being developed by EDF, who also own and operate the six existing nuclear power stations in Great Britain.[2]

In November 2023, the UK Government issued a consultation on proposed modifications to Sizewell C Ltd.’s (SZC) electricity generation license in order to implement a Regulated Asset Base (RAB) funding model[3] under the Nuclear Energy (Financing) Act 2022.[4] It asked Consumer Scotland to respond to the consultation on behalf of electricity consumers in Scotland. Consumer Scotland provided a detailed response to the consultation on 29 January 2024.[5]

Why is the UK Government supporting new nuclear power stations?

In 2022, the UK Government published its Great British Energy Security Strategy. This included an ambition for up to 24 GW of new nuclear capacity in Great Britain by 2050, around three and a half times the current level.[6] The strategy argues that a nuclear power station “returns more than 100 times as much power as a solar site of the same size” and that “we can only secure a big enough baseload of reliable power for our island by drawing on nuclear”.[7] It states that nuclear is likely to be an important part of the lowest cost decarbonised electricity system, and can support up to 10,000 jobs across the country. In terms of safety, it notes that the UK applies the highest level of nuclear safety standards.

What is the Scottish Government’s position on nuclear power?

The Scottish Government is opposed to new nuclear capacity under current technologies and argues for a greater focus on renewables and low or zero carbon hydrogen as the route to Net Zero.[8] Through its responsibility for giving consent for new power stations under Section 37 of the Electricity Act (1989), the Scottish Government is able to block the development of new nuclear power stations located in Scotland.

Why has Consumer Scotland responded to a consultation on a nuclear power station in England?

Electricity policy is reserved to the UK Government and Scotland forms part of an integrated Great Britain-wide electricity system.[9] This means that consumers in Scotland are directly affected by developments across Scotland, England, and Wales through the market price for electricity and through the cost of low carbon support mechanisms, both of which affect consumer bills.

Nuclear power stations cannot be financed on a purely commercial basis, and require government support. This is partly because repaying the investment costs and realising a return on investment is likely to take several decades. It is also partly because there are a number of low probability but high impact risks which the commercial sector is not able to insure against.

2. What is the proposal for Sizewell C?

The proposal is for a 3.2 GW power station, equivalent to 7% of the current electricity demand in Great Britain, and consisting of two 1.6 GW nuclear reactors based on the European pressurised water reactor (EPR) design.[10] The design is a near replica of Hinkley Point C.

Sizewell C will be developed by EDF. The UK Government is currently the majority shareholder in the project having invested £2.5 billion to date, and an “equity raise” process is currently in place to draw in significant new investment to cover the estimated £20 billion cost of the project.[11] This process is expected to culminate in a Final Investment Decision in summer 2024.

Two power stations based on the EPR design are operating elsewhere in the world: one at Olkiluoto in Finland (with a single reactor)[12] and one at Taishan in southern China (with two reactors).[13] Both projects suffered significant delays and cost overruns before operation began. In addition, a two-reactor EPR project has been under construction at Flamanvaille in France since 2007 and is currently expected to begin generation during 2024.[14]

What was the government support mechanism for Hinkley Point C?

Hinkley Point C received government support through a Contract for Difference (CfD) scheme which effectively locks in the price for each unit of electricity generated for a period of 35 years from the start of operation. The agreed price is known as the “strike price”, with the costs or revenues from the scheme shared across all electricity consumers in Great Britain. Since 2014, a similar subsidy scheme has been in place to support the development of renewable electricity generation, including technologies such as onshore and offshore wind and large-scale solar PV.

The strike price, agreed in 2016, was £92.50 / MWh (in 2012 prices).[15] This means that if wholesale prices turn out to be less than £92.50 / MWh, electricity consumers in Great Britain will pay Hinkley Point C the difference between the actual wholesale price and the strike price. This payment will come through a levy on bills. Conversely, if the wholesale price is greater than £92.50 / MWh, Hinkley Point C will pay back the difference.

Since agreeing the Hinckley Point CfD, the UK Government has decided to support future nuclear power stations through a “Regulated Asset Base” (RAB) model.

3. What is a Regulated Asset Base model?

A RAB model is often used to finance large national infrastructure, particularly elements which form part of a natural monopoly. For example, financing for Great Britain’s electricity and gas networks,[16] and the water networks in England and Wales,[17] all use a RAB model, and it has also been used to fund the construction of Terminal 5 at Heathrow.[18]

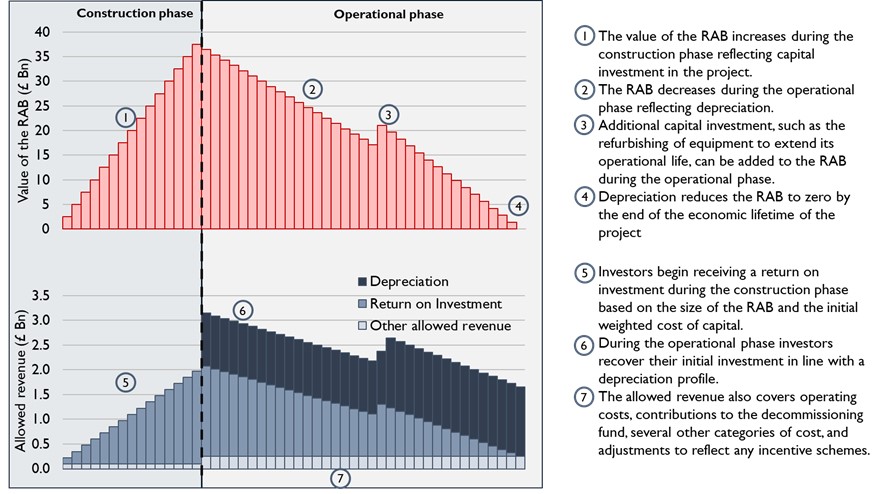

The RAB itself is effectively an estimate of the current capital value of a project. During the construction phase, capital investment is “added to the RAB”, whilst during the operational phase the RAB is depreciated over the economic lifetime of the project. There may also be additional capital investment during the operational phase, for example to refurbish or replace parts and extend the operating life of the project.

A RAB framework includes an agreed rate of return on investment, which is usually set as a percentage. For example a 5% rate of return would mean, in each year, the owner would receive 5% of the current value of the RAB.

Each year an “allowed revenue” is calculated. This includes a number of elements including:

- the agreed return on investment applied to the current value of the RAB;

- payback of the initial investment in line with depreciation

- a number of “pass-through costs” such as the fees associated with any licences that the project is required to hold

- rewards and penalties related to various incentive mechanisms that form part of the RAB agreement (more detail below)

At the end of the project’s lifetime, investors have revenue equal to the annual return on investment on the RAB, fully repaying the initial investment, and covering operating costs (assuming that the regulator agrees that these costs were efficient).

The allowed revenue is recovered from consumers; in the case of the nuclear RAB model, this will mean all electricity consumers in Great Britain. Figure 1 gives an illustration of the evolution of the RAB over the lifetime of a project, and the revenue received.

Figure 1: illustration of the evolution of the RAB (top) and the allowed revenue (bottom) across the lifetime of the project. All values are in base-year prices.

Why use a RAB model?

The UK Government has argued that a RAB model for new-build nuclear power stations can deliver better value to consumers than alternatives.[19] This is because the RAB model can draw in investment at a lower cost of capital than alternatives. The model provides a high level of confidence for investors that they won’t lose their investment, guarantees the rate of return they will receive, and means they will start to receive a return on investment from the first year of construction, rather than waiting until operation begins.

Investors are expected to accept a significantly lower rate of return on their investment under a RAB model than they would require if they faced the full commercial risk of investing in a project with a construction period of more than a decade, and a pay-back period lasting several more.

There has been criticism that the CfD strike price for Hinkley Point C rose significantly in the four years between the start of negotiations and a final agreement being reached because, once signed, investors face the full risk of cost and time overruns and will receive no revenue until operation begins. The result was an increase in costs to be recovered from consumer bills, regardless of the outturn cost of the project.

In 2017 the National Audit Office estimated that if a RAB model led to a reduction in the rate of return needed for investment from 9% to 6%, the saving to consumers would be the equivalent of a 75% to 100% overrun in construction costs.[20]

In common with similar frameworks for energy network companies, the nuclear RAB also provides an opportunity to build a framework of rewards and penalties to incentivise certain behaviours during the construction and operation of the project. For example, it can include mechanisms to:

- reward investors if construction of Sizewell C is delivered under budget or penalise them if over budget

- incentivise SZC to operate the power station efficiently and to mimic the pressures that would be felt in a commercial market

How has the RAB model been developed?

In 2019, the UK Government consulted on the idea of using a RAB model to finance further nuclear development and after reviewing responses to that consultation concluded:

“we believe that a RAB in line with the high-level design principles set out in the consultation remains a credible basis for financing large-scale nuclear projects”.

At that point the UK Government also committed to bringing at least one large scale nuclear project to Final Investment Decision by the end of that parliament.[21]

In 2022, the UK Parliament passed the Nuclear Energy (Financing) Act,[22] creating a legal framework for a nuclear RAB model. It allows the Secretary of State for Energy Security and Net Zero to designate an eligible company so that it can receive RAB support. This is put into practice by amending the company’s generation licence. In November 2022, the Secretary of State designated NNB Generation Company (SZC), now called Sizewell C Ltd, in relation to the project.[23]

The Act also sets out a framework for a government support package which will sit alongside the RAB. This is a mechanism to deal with low probability high impact risks which the government considers are not suitable to place on electricity consumers. Instead, these risks will be held by the UK Treasury and, ultimately, by UK taxpayers.

4. What is the November 2023 consultation about?

The UK Government, with support from Ofgem, has drafted licence conditions which will implement the RAB model in relation to Sizewell C. These are known as “modifications to the standard generation licence” which is held by any large electricity generator.

The modified licence provides the full details of the RAB framework, including the mechanisms by which it will operate, the responsibilities of the Secretary of State and Ofgem in setting key components of the framework, and the relationship between the RAB framework and the government support package.

The draft which the UK Government is consulting on includes the full details of the framework itself and some of the regulatory parameters within it. However, a number of the critical parameters, such as the allowed rate of return during the construction phase, known as the “Initial Weighted Cost of Capital” (IWACC), will only be set during the final negotiations between the Secretary of State and SZC in the run up to the Final Investment Decision.

The November 2023 consultation is focused on the licence modifications. In particular, the UK Government asked for comments related to five questions:[24]

Do consultees consider that the licence modifications outlined within this consultation strike a reasonable balance between the need to support the financeability of the licensee and safeguarding consumer interests?

Do consultees consider that the incentives and penalties placed on the project through the modifications will support the efficient and timely delivery of the project, ensuring greater value for money for consumers?

Do consultees consider that the operational performance incentives included in the proposed modifications encourage the right behaviours?

Do the modifications set sufficiently clear expectations and boundaries for how the project company should operate in the market over time, and do the modifications contain sufficient flexibilities to account for future uncertainties in the energy market?

Do consultees think that the modifications provide Ofgem sufficient oversight in its capacity as economic regulator of the licensee?

5. The Sizewell C RAB

The draft licence splits the project into two phases broadly corresponding to construction and operation.[25] The following sections describe the structure of the licence at each phase and common aspects across both phases.

The RAB model during the construction phase

Capital spending will be added to the RAB with a single rate of return, the IWACC, operating throughout the construction period.

The licence includes a mechanism, called the capex incentive framework, aimed at incentivising SZC to keep the cost of construction as low as possible. This involves rewarding or penalising SZC for building the project at a cost below or above a “lower regulatory threshold”. The value of this threshold has not yet been agreed and will be set at the point of the Final Investment Decision. It is expected to be set at a level higher than the prevailing best estimate of the cost of the project. If the project is delivered at a cost below the lower regulatory threshold, SZC will be able to add a fraction of the underspend to the RAB and receive a rate of return on that additional value. If the project is delivered at a cost higher than the lower regulatory threshold, only a fraction of additional costs above the threshold will be added to the RAB.

There is also an upper limit on the size of the RAB allowed under the initial licence. This is set by a “higher regulatory threshold” which is expected to be at the level of an extreme cost overrun and acts as a limit on what electricity consumers will be required to fund. If the higher regulatory threshold is reached, SZC has the option to apply for additional spending to be added. The Secretary of State can then consider granting the application, pressing SZC to complete the project without additional funding, or funding further investment from the UK Treasury.

There are a set of incentives to encourage timely delivery. These include a reduced rate of return for the duration of the delay and a limit on the amount of money investors are allowed to take out of the project, known as a “yield cap”.

In the run up to the Final Investment Decision, the Secretary of State will fix a number of the key regulatory parameters. These include the IWACC, the values of the lower and higher regulatory thresholds, the sharing factors for the capital incentive scheme, and the strength of the penalties associated with a delay.

During the construction phase, SZC will receive an allowed revenue. Key components include:

- return on investment calculated from the size of the RAB and the initial weighted cost of capital

- revenue to allow payments to be made to the decommissioning fund;

- company operating costs

- a number of pass-through costs

The allowed revenue will be collected from consumers via the Low Carbon Contracts Company (LCCC). The LCCC is an organisation which currently administers the flow of revenue associated with other low carbon support schemes including CfDs. The LCCC will levy the costs of SZC onto electricity supply companies, dividing the costs evenly across all electricity use.[26] Suppliers will recover those costs directly from their customers as part of the final bill.

The RAB model during the operational phase

As in the construction phase, SZC will receive an allowed revenue. Key components during this phase include:

- return on investment calculated from the size of the RAB and an updated weighted cost of capital (the “real WACC”)

- repayment of the initial capital investment in line with depreciation

- a combination of ongoing capital and operational costs known as “totex” which reflects the cost of operating and maintaining the power station efficientl

- a number of pass-through costs

The final allowed revenue during this phase will also include adjustments associated with several incentive schemes designed to encourage efficient operation throughout the project’s lifetime. These include incentives to maintain capacity, minimise totex spending, and operate effectively in the market.

SZC will recover its allowed revenue through two routes:

- Firstly, it is expected to operate competitively in the electricity market and any other market that it can access (e.g. it could transform some of its electrical output into hydrogen and sell in a future market for low carbon hydrogen). This will provide it with a market-based revenue

- Secondly, the market revenue will be topped up through “difference payments”. These will be recovered from electricity consumers via a levy administered by the LCCC following the same process as used during the construction phase. If market revenues exceed allowed revenues, difference payments reverse, with SZC paying the excess back to the LCCC, who redistribute it to suppliers and ultimately consumers

The operational phase will begin with a post construction review (PCR), at which point Ofgem will set the value of the key regulatory parameters for that phase. These will be further adjusted at regular periodic reviews.

Ofgem’s regulation during this phase will include the ability to change the rate of return to reflect the risk profile for investors, given that the project will no longer face construction risks. It will also determine the profile for depreciating the RAB and set parameters for each of the incentive schemes.

Throughout the project lifetime

SZC is expected to contribute costs to a decommissioning fund throughout the construction and operational phases. The costs of contributing to this fund constitute part of the allowed revenue and, as with other costs for the project, are ultimately paid for by electricity consumers in Great Britain. The decommissioning fund is ringfenced to ensure that the costs of decommissioning can be covered regardless of the future financial state of SZC, EDF, or other investors.

The value of the RAB for a particular year along with many components of the allowed revenue will initially be based on estimated data. Where these estimates turn out to be incorrect, the licence includes a framework to make adjustments in subsequent years.

6. Who is responsible for representing consumers?

Electricity consumers’ interests will be considered in different ways throughout the RAB model. They are represented by:

- The Secretary of State for Energy Security and Net Zero, who is responsible for agreeing the broad regulatory framework in line with legislation. This licence condition consultation is part of that process. In setting the framework, the Secretary of State will need to balance the interests of consumers against the need to draw in sufficient investment and will also need to consider which costs and risks best sit with investors, electricity consumers or taxpayers. The Secretary of State has a particularly important role in setting regulatory parameters, such as the IWACC, which will influence consumer costs during the construction phase

- Ofgem is formally the economic regulator and, in line with its founding legislation, has a duty to represent the interests of current and future electricity consumers. During the construction phase Ofgem’s role is primarily one of scrutinising costs and administrating the RAB framework. However, during the operational phase, Ofgem sets allowed rates of return, the strength of rewards and penalties under the incentive schemes, and has wider powers to adjust the structure of the framework to reflect changes to the energy market

- The independent technical advisor is a group of experts who, during the construction phase, will review SZC’s estimates of the costs incurred and added to the RAB, and provide comments and recommendations to Ofgem and the Secretary of State regarding evolving estimates of the total construction costs and the commissioning date for the project. The current draft licence states that the independent technical advisor is recruited by SZC, but that the group has a duty of care to Ofgem and the Secretary of State

- Consumer organisations such as Consumer Scotland and Citizens Advice have a general responsibility to represent the interests of electricity consumers and both organisations responded to this consultation. However, the regulatory and technical issues associated with nuclear power are complex and highly technical and consumer organisations do not have the resources to maintain expertise in all areas

7. Consumer Scotland's response to the consultation

On 6th November 2023 the Department of Energy Security and Net Zero wrote to Consumer Scotland to ask us to respond to the RAB licence consultation. The consultation document noted that the Secretary of State was specifically inviting our views on behalf of current and future consumers in Scotland.

Consumer Scotland responded to the licence consultation on 29 January 2024, and a full copy of that response can be found on our website.[27] That response contains fifteen specific recommendations and extensive detail explaining our view.

We have avoided commenting on decisions that have already been made, and our response focuses on the questions asked in this consultation. For example, the UK Government is committed to supporting new nuclear capacity and to using a RAB framework for Sizewell. As such, we have not commented on the consumer value of nuclear power more generally, or our view of the suitability of a RAB framework overall.

Overall, our assessment is that the proposed licence modifications and related documentation do not provide sufficient institutional and regulatory safeguards on consumer interests. Our more detailed recommendations can be summarised as follows:

- We welcome the opportunity to respond to this consultation. Consumer engagement is particularly important because the nuclear RAB model is designed to shift the balance of risk away from investors and onto future consumers when compared to the mechanisms deployed for Hinkley Point C. This is only valuable if there are concrete and material benefits to those consumers such as reductions in the likely overall cost of the project, for example, due to lower cost of capital. We make specific recommendations on steps the UK Government should take to quantify the impact on consumers of the proposed model and protect their interests

- We consider that the level of consumer engagement should be broadened and deepened going forward. We have suggested mechanisms to enhance the role of consumers and consumer representatives in the ongoing process of operating a nuclear RAB framework in the interests of those consumers

- Any RAB model which places a greater burden of risk onto future consumers should in turn include greater transparency, scrutiny, and institutional safeguards to protect consumer interests. we do not think the existing economic assessment, with quite limited disclosure of the detailed cost estimates, is sufficient, given the commitments being made on behalf of future consumers. We would propose that the Government sets itself a requirement on the face of the licence that there will be full transparency of decisions taken by the Secretary of State and clearer guidance on the criteria for decision making

- Ofgem’s role could and should be enhanced further, to bring it more in line with the role of the regulator in other recent RAB projects like the Thames Tideway Tunnel and ongoing regulation of gas and electricity networks. We have made recommendations on specific licence modifications which we think will bolster the protection for consumers

- We would like to see clear and strong penalties for delays in construction, and a clearer approach to incentivising timely completion of the project set out in the licence

- We support the considered approach to regulation of the operational phase of the project, and the published guidance from Ofgem. We make recommendations that the licence should acknowledge and recognise the extent of possible change in the electricity and non-electricity energy markets over the next few decades

8. Endnotes

[1] EDF Sizewell B

[2] Office of Nuclear Regulation (2023) Operational Reactors

[3] UK Government (2023) Modifications to the Sizewell C Regulated Asset Base licence

[4] Nuclear Energy (Financing) Act 2022

[5] Consumer Scotland (2024) Response to the UK Government’s consultation on the proposed amendments to Sizewell C Ltd’s electricity generation licence

[6] UK Parliament (2022) POSTnote 687: Nuclear energy in the UK

[7] UK Government (2022) British Energy Security Strategy

[8] Scottish Government (2023) Draft Energy Strategy and Just Transition Plan

[9] Note that Northern Ireland is part of a separate electricity system operating across the whole of the Island of Ireland. Therefore Scotland is part of the electricity system in Great Britain, rather than a UK-wide system.

[11] UK Government (2023) Sizewell C equity raise process

[12] TVO Olkiluoto 3

[13] EDF Taishan 1 & 2

[14] EDF (2022) Update on the Flamanville EPR

[15] UK Government (2016) Hinkley Point C

[16] Ofgem Network price controls 2021-2028 (RIIO-2)

[17] Ofwat Price reviews

[18] Heathrow Economic regulation: capital expenditure

[19] UK Government (2020) Regulated Asset Base (RAB) model for nuclear

[20] National Audit Office (2017) Hinkley Point C

[21] UK Government (2020) Regulated Asset Base (RAB) model for nuclear

[22] Nuclear Energy (Financing) Act 2022

[23] UK Government (2022) Designation of NNB Generation Company (SZC) Limited

[24] UK Government (2023) Modifications to the Sizewell C Regulated Asset Base licence

[25] The formal division between the two phases is at the post construction review (PCR) which will be around three years after the project reaches commercial operation. The initial phase is formally called the pre-PCR phase but is referred to as the “construction phase” here.

[26] Note that some electricity users, particularly energy intensive users, will be exempt from the levies to fund the RAB. This is in line with arrangement for other low carbon support schemes.

[27] Consumer Scotland (2024) Response to the UK Government’s consultation on the proposed amendments to Sizewell C Ltd’s electricity generation licence