1. About us

Consumer Scotland is the statutory body for consumers in Scotland. Established by the Consumer Scotland Act 2020, we are accountable to the Scottish Parliament. The Act defines consumers as individuals and small businesses that purchase, use or receive in Scotland goods or services supplied by a business, profession, not for profit enterprise, or public body.

Our purpose is to improve outcomes for current and future consumers, and our strategic objectives are:

- to enhance understanding and awareness of consumer issues by strengthening the evidence base

- to serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- to enable the active participation of consumers in a fairer economy by improving access to information and support

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. In conjunction with that evidence base we seek a consumer perspective through the application of the consumer principles of access, choice, safety, information, fairness, representation, sustainability and redress. The Consumer Principles are based on frameworks that have been developed over time by both UK and international consumer organisations. Reviewing policy against these principles enables the development of more consumer-focused policy and practice, and ultimately the delivery of better consumer outcomes.[1]

2. Our response

Consumer Scotland welcomes the opportunity to respond to the options paper on standing charges within the default tariff cap. We recognise that the scale of the increase in electricity standing charges under the cap since 2022 is a matter of significant consumer interest, and has occurred at a time when the majority of consumers have been subject to a default tariff due to the contraction of the fixed tariff market which followed elevated levels of volatility in wholesale gas and electricity markets.

We support Ofgem’s longer term commitment to keep the distributional impact of electricity network cost recovery under review. The promise of work alongside government to develop holistic solutions to the challenge of energy affordability in the context of wider market reforms such as those being progressed through the Review of Electricity Market Arrangements (REMA) is also welcome.

In our assessment, however, moving a proportion of suppliers’ fixed costs from standing charges to unit rates under the default tariff cap would result in consumers with high essential energy expenditure facing an adverse price signal to which many would be unable to respond. Consumers with high essential energy expenditure include households with an enhanced heating need, and consumers reliant on electrically powered medical equipment. These consumers are particularly vulnerable and would face an increase in overall energy costs that cannot reasonably be reduced through efficiency or self-rationing, whilst their characteristics also make it difficult to mitigate additional cost pressures through alternative schemes of support. Winter affordability challenges for many prepayment meter (PPM) consumers would also seem to be made worse by the changes discussed in the paper, and with median gas consumption in Scotland c. 6% higher than the national average and a greater proportion of households using traditional forms of electric heating than elsewhere in Great Britain, a typical consumer in Scotland would appear more likely to face higher costs as a result of the proposals explored in the options paper than an equivalent consumer in England or Wales.

Nevertheless, it is apparent that the electricity retail market is not currently providing products which meet the expectations of many consumers. While we have reservations about the use of the default tariff cap to mitigate this, we consider that the market as a whole has an opportunity to innovate beyond the restrictions of the default tariff cap, such that products to support consumers seeking a low or zero standing charge tariff can be made more widely available. By providing consumers with greater variety in tariff structures and requiring the uptake of such products to be the result of active consumer choice, many of the objectives which sit behind the ideas discussed in the options paper could still be met, whilst avoiding the less desirable impacts that would accrue if pursuing such reforms through revisions to the default tariff cap methodology.

Q1. Do you have any views on our case for change?

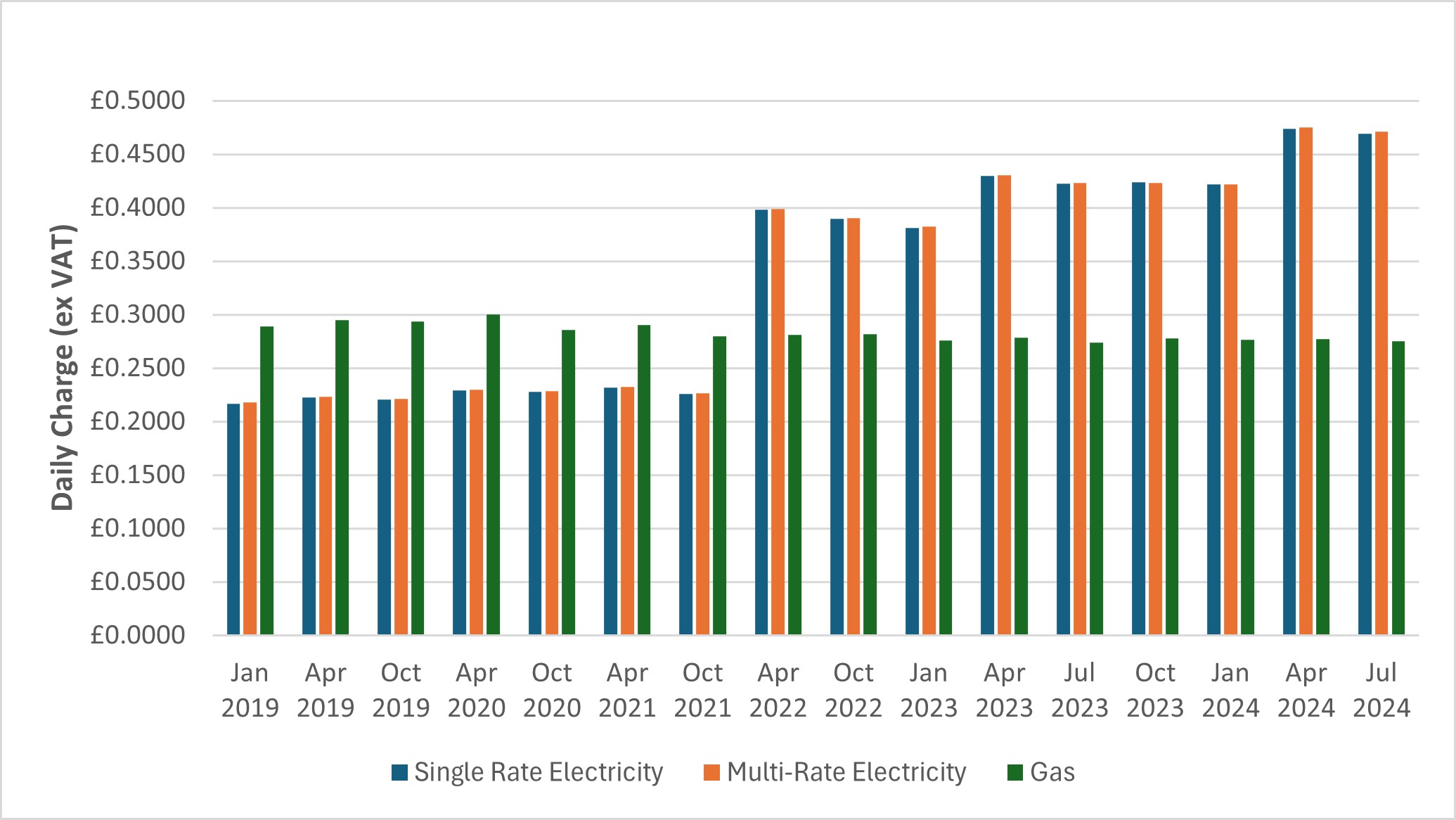

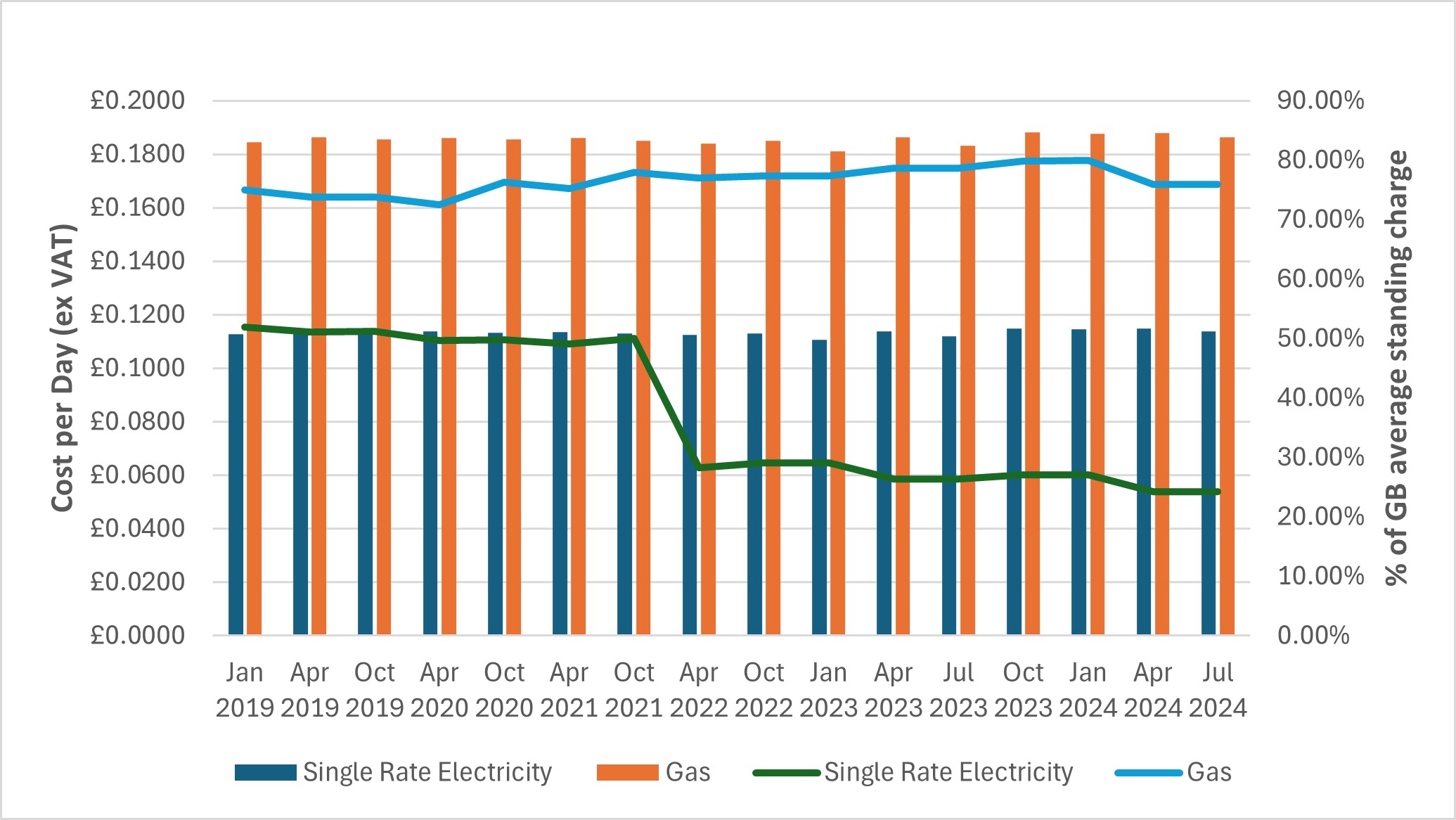

As shown in Figure 1, the standing charge allowance under the default tariff cap for direct debit gas consumers has decreased by 4.7% in real terms throughout Great Britain between January 2019 and September 2024. In contrast, the standing charge allowance for both single rate and Time of Use (“multi-rate”) direct debit electricity consumers has increased by a real terms average of 116.4%. Similar trends are also evident in the prices paid by consumers who pay by standard credit or PPM.

Figure 1: Average default tariff cap standing charges in Great Britain for consumers paying by direct debit, in January 2019 prices [2]

Significant variance is evident in the level of electricity standing charge allowances under the default tariff cap between the 14 electricity distribution network operator (DNO) licence areas in Great Britain (49.3% – 152% for single rate electricity; 48.5% – 150.5% for multi-rate electricity). Table 1 shows this variance for direct debit single rate electricity.

Table 1: Regional comparison of single rate electricity standing charge allowances under the default tariff cap for consumers paying by direct debit, in January 2019 prices [3]

|

Charge restriction period DNO Region |

Jan 2019-Mar 2019 Nil kWh |

Jul 2024-Sep 2024 Nil kWh |

Real terms increase (%) |

|---|---|---|---|

|

N Wales and Mersey |

£75.82 |

£191.06 |

151.99% |

|

Northern |

£82.14 |

£202.93 |

147.06% |

|

Southern |

£73.09 |

£180.53 |

147.00% |

|

Yorkshire |

£81.39 |

£192.20 |

136.14% |

|

Southern Western |

£81.65 |

£191.52 |

134.56% |

|

Midlands |

£78.06 |

£178.79 |

129.04% |

|

South Wales |

£79.14 |

£180.28 |

127.80% |

|

Southern Scotland |

£81.09 |

£180.44 |

122.52% |

|

East Midlands |

£74.39 |

£159.61 |

114.56% |

|

South East |

£78.58 |

£162.21 |

106.43% |

|

North West |

£74.39 |

£145.85 |

96.06% |

|

Northern Scotland |

£92.01 |

£174.15 |

89.27% |

|

Eastern |

£78.58 |

£142.29 |

81.07% |

|

London |

£77.83 |

£116.23 |

49.34% |

|

GB Average |

£79.16 |

£171.29 |

116.40% |

In this context, we consider stakeholder concerns about standing charges to be concerns about electricity standing charges.

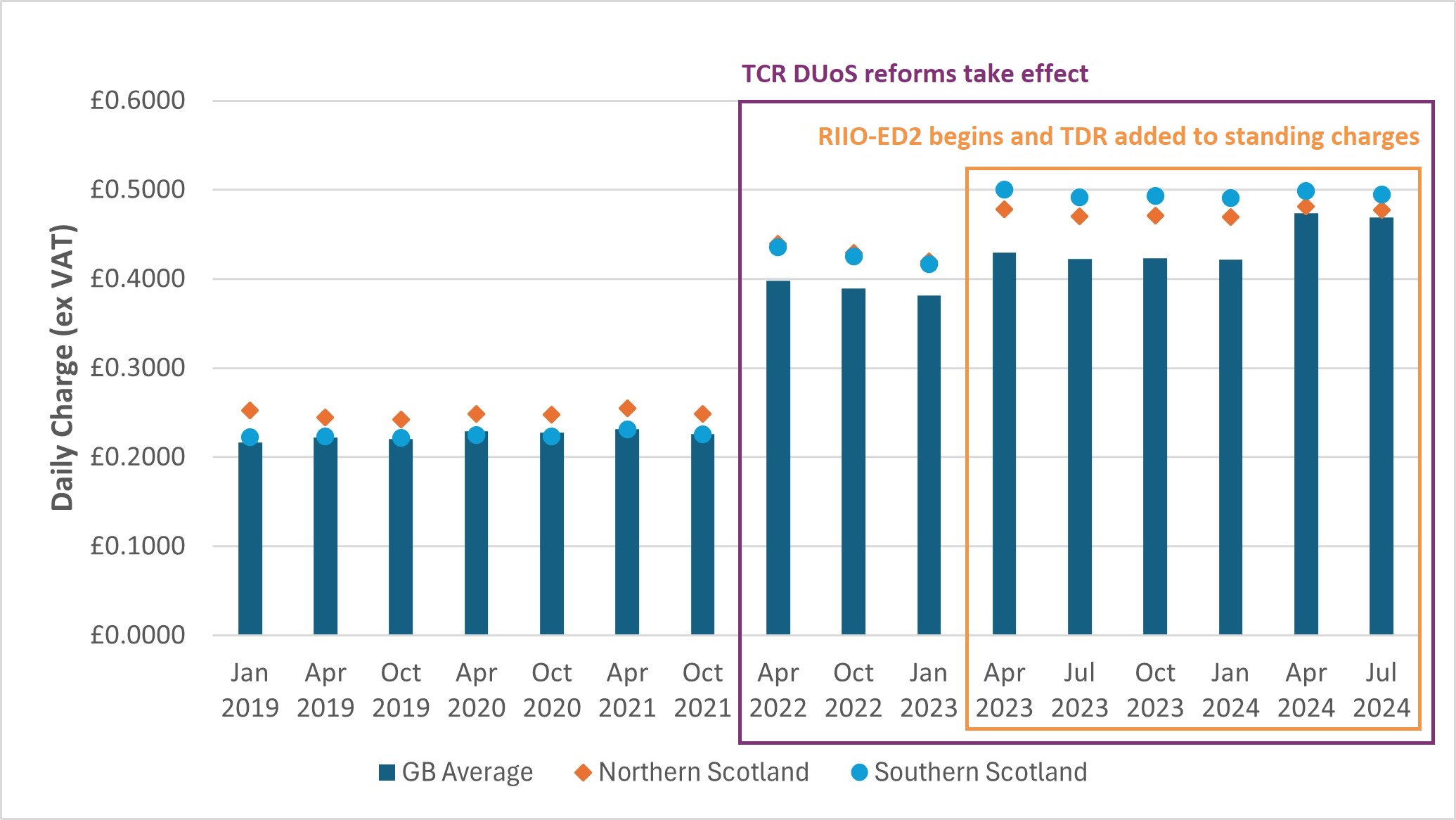

Responses to Ofgem’s Standing Charges Call for Input suggest that the reasons for the divergence in standing charge allowances under the default tariff cap between fuel types and between regions are generally poorly understood.[4] As summarised in the Call for Input and the current options paper, this divergence is largely due to changes which have been made to how electricity network costs are recovered from consumers. These changes have had differing impacts on consumers in different parts of Great Britain, and have evolved over time. Figure 2 summarises these impacts for direct debit single rate electricity consumers in Scotland.

Figure 2: Comparison of default tariff cap standing charges in Great Britain and Scotland for single rate electricity consumers paying by direct debit, in January 2019 prices [5]

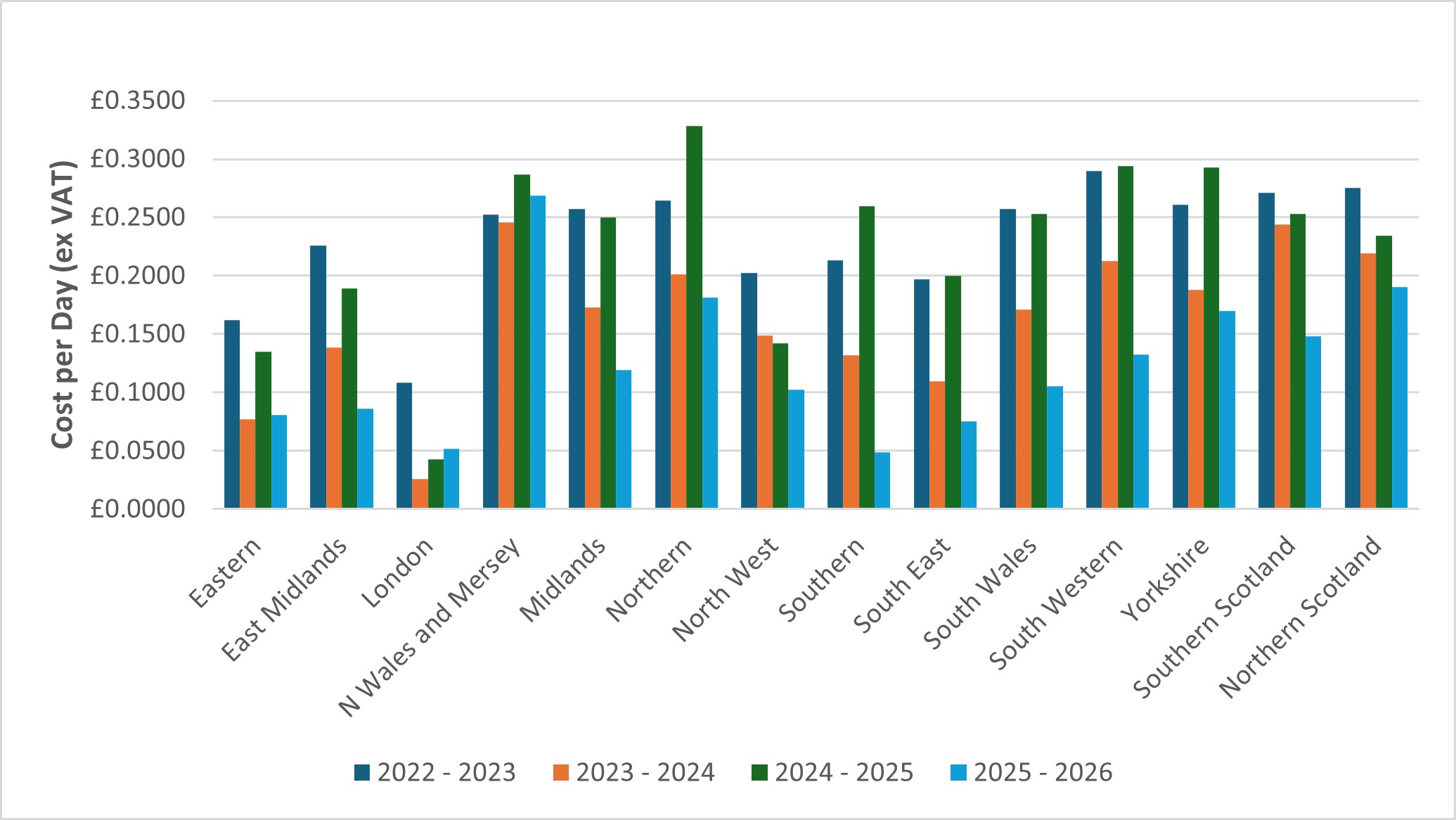

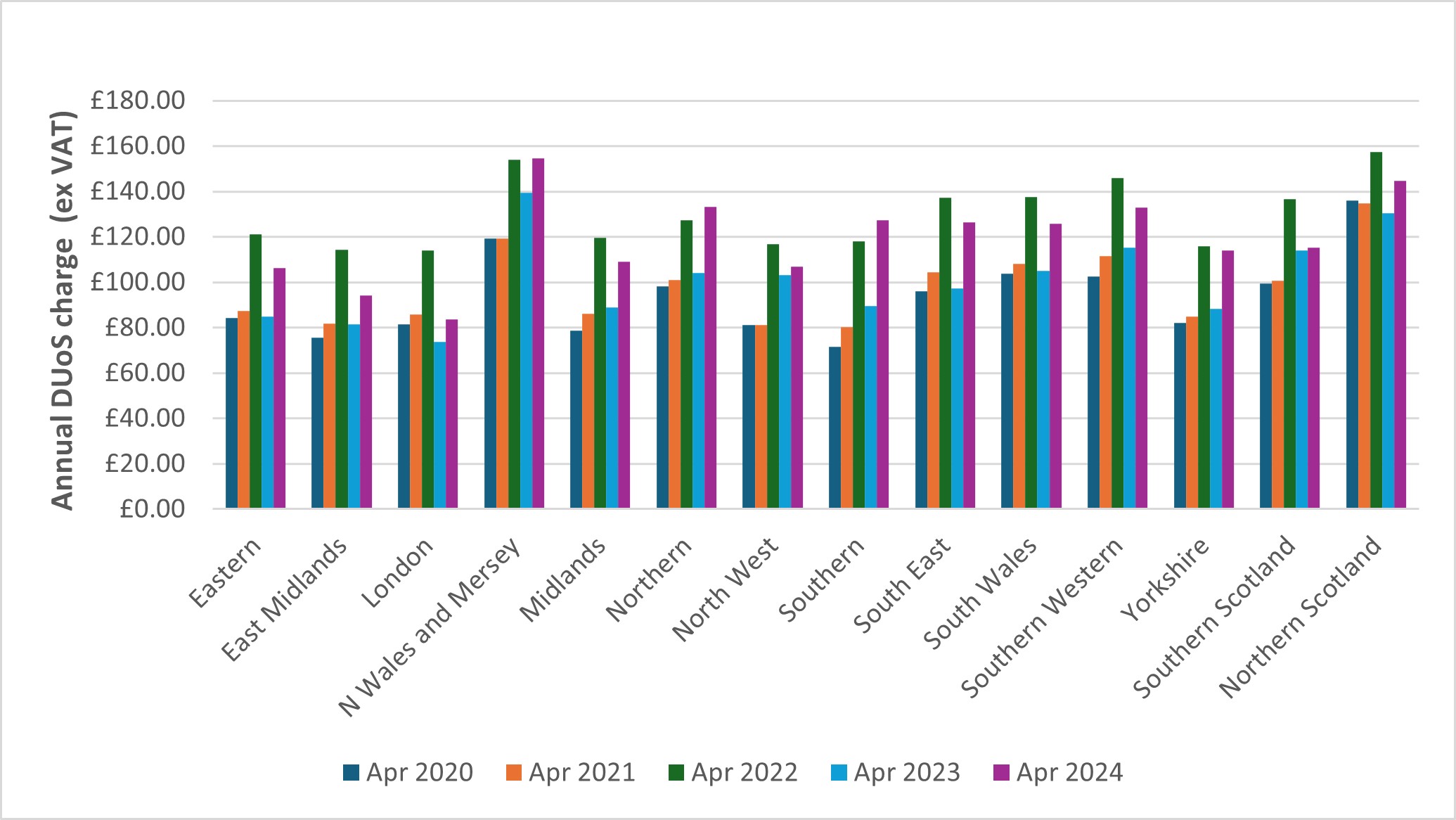

The changes to the recovery of electricity network fixed costs arising from the Targeted Charging Review (TCR) coincided with a period of enhanced volatility in the wholesale gas and electricity markets and high levels of inflation. Combined, these factors have masked the reduction to Distribution Use of System (DUoS) and Transmission Network Use of System (TNUoS) forward looking charges which took effect when the corresponding demand residuals increased. As shown in Figure 3, under-recovery of DUoS charges in the first year of the RIIO-ED2 price control has also added to the volatility of the DUoS residual, with some DNO licence areas seeing DUoS charges increase significantly in 2024-2025 to recover missing revenue from 2023-2024.[6] The recovery of the costs associated with the Supplier of Last Resort (SoLR) process that emanated from the market exit of 25 domestic electricity suppliers in 2021-2022 also added to upwards pressures on electricity standing charges in the period between April 2022 and March 2024.[7]

Figure 3: Volatility in the £nominal DUoS residual since 2022 [8]

Figure 4: Total DUoS charges at benchmark consumption for single rate electricity consumers paying by direct debit, in January 2019 prices [9]

As a consequence of how the standing charge allowance in the default tariff cap is set, suppliers’ fixed operating costs within the default tariff cap for both gas and electricity have remained broadly flat in real terms since January 2019, and are currently apportioned evenly among domestic consumers throughout Great Britain. However, given the overall rise in electricity standing charge allowances, operating costs within the default tariff cap now comprise a lesser proportion of electricity standing charges than was the case when the default tariff cap was first introduced.

Figure 5: Operating cost allowances in the default tariff cap for gas and single rate electricity consumers paying by direct debit, adjusted for CPIH inflation since 2019 [10]

Consumer Scotland recognises the level of concern that has been expressed by consumers and stakeholders in response to the increase in electricity standing charges set out above. The strength of feeling evident among many respondents to the Standing Charges Call for Input indicates that the electricity retail market is not currently providing products which meet the expectations of many consumers. However, we have reservations about the use of the default tariff cap to mitigate this as the distributional impacts appear to be such that many consumers with high essential energy expenditure would face adverse price signals to which many would be unable to respond. We also consider that a redistribution of fixed costs to unit rates would exacerbate winter affordability challenges for many consumers, and could result in a transfer of value from consumers to suppliers in periods of prolonged or exceptionally adverse weather. It may therefore be preferable for suppliers to innovate beyond the restrictions of the default tariff cap, such that products to support consumers seeking a low or zero standing charge tariff can be made more widely available, but where the uptake of such products would always arise from the active choice of the consumer.

Q2. What are your views on the range (£20 – £100) of operating costs we are considering shifting from standing charges to unit rates? Should it be higher? Within this range, is there a value you would favour and why?

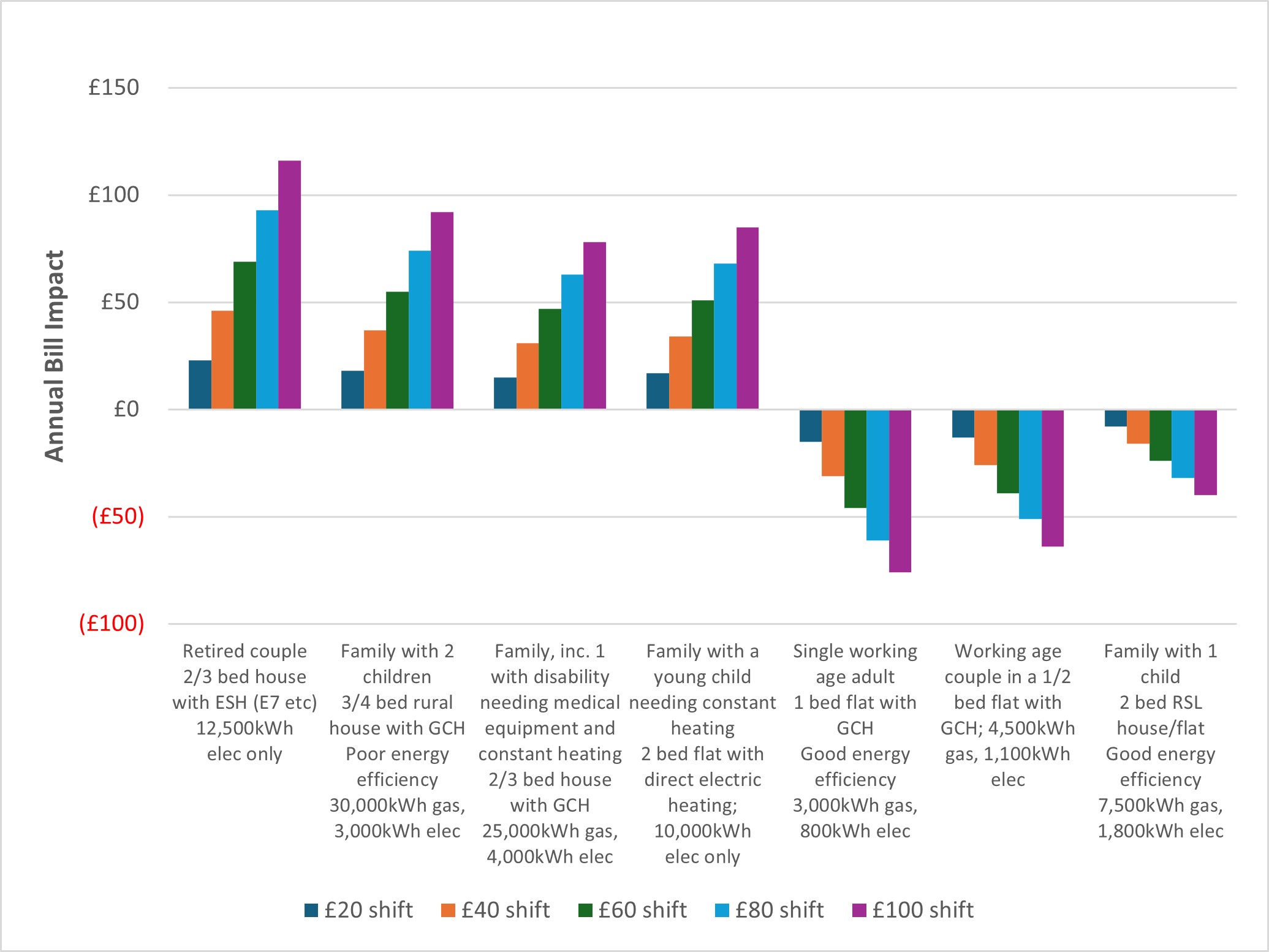

The distributional analysis included in Appendix 1 to the options paper and summarised in Figure 6 shows that any redistribution of fixed costs from standing charges to unit rates results in consumers with higher than average energy consumption facing an increase in overall costs. This includes consumers with more complex energy needs, such as households with an enhanced heating need and consumers reliant on electrically powered medical equipment. The options paper describes these consumers as having “inflexible high demand”, in that while the demand associated with additional energy needs might be flexible in time it cannot reasonably be reduced through efficiency or self-rationing.

Figure 6: Distributional analysis of the impact of fixed costs redistribution on different consumer archetypes

Settlement data from Elexon that was published by Ofgem as part of the 2023 review of Typical Domestic Consumption Values also suggests that many consumers who use traditional forms of electric heating would be disadvantaged by any redistribution of fixed costs from standing charges to unit rates.[11] Although benchmark consumption for multi-rate electricity consumers is set 35% higher than for single rate electricity, Grid Edge Policy has highlighted that many consumers with legacy multi-rate electricity metering infrastructure no longer use electricity for space or hot water heating.[12] This results in a reduction to the average consumption registered through such meters and distorts the average peak and off peak consumption split in favour of peak. Each of these features influences aspects of how the default tariff cap methodology is set for consumers with multi-rate electricity meters, in that they influence the level at which benchmark consumption is set and the allocation of benchmark consumption between the peak and off-peak charging periods, respectively.

Although a lack of reliable data on the consumption of consumers who use Dynamically Teleswitched (DTS) electricity meters clouds this issue, Table 2 suggests that consumers with some legacy multi-rate meter types are more likely than others to use significantly higher than the multi-rate meter benchmark of 4,200 kWh per annum.

Table 2: Comparison of annual mean consumption in Great Britain by electricity meter type [13]

|

Meter type |

Annual mean consumption (kWh) as of Nov 2022 |

|

Single Rate |

3245 |

|

Economy 7 / White Meter |

4748 |

|

Economy 10 |

6083 |

Table 3 shows that in some regions of Great Britain the average proportion of consumption that occurs off-peak in households with a multi-rate electricity meter is now less than 40%, and that in no region does average off-peak consumption through multi-rate electricity meters comprise more than 50% of total energy use. This suggests that a significant proportion of multi-rate electricity meters in all regions of Great Britain are located in properties which no longer use electricity for space or hot water heating.

Table 3: Comparison of average peak:off peak consumption ratios for domestic multi-rate electricity consumers in different regions of Great Britain [14]

|

DNO region |

Consumption split based on 2017 data |

2023 proposed consumption split |

||

|

Peak |

Off peak |

Peak |

Off peak |

|

|

Eastern |

62% |

38% |

64% |

36% |

|

East Midlands |

67% |

33% |

68% |

32% |

|

London |

48% |

52% |

50% |

50% |

|

N Wales and Mersey |

57% |

43% |

60% |

40% |

|

Midlands |

47% |

53% |

53% |

47% |

|

Northern |

55% |

45% |

58% |

42% |

|

North West |

49% |

51% |

53% |

47% |

|

Southern |

49% |

51% |

54% |

46% |

|

South East |

62% |

38% |

63% |

37% |

|

South Wales |

49% |

51% |

54% |

46% |

|

Southern Western |

53% |

47% |

57% |

43% |

|

Yorkshire |

47% |

53% |

53% |

47% |

|

Southern Scotland |

46% |

54% |

53% |

47% |

|

Northern Scotland |

51% |

49% |

56% |

44% |

|

GB Average |

58% |

42% |

60% |

40% |

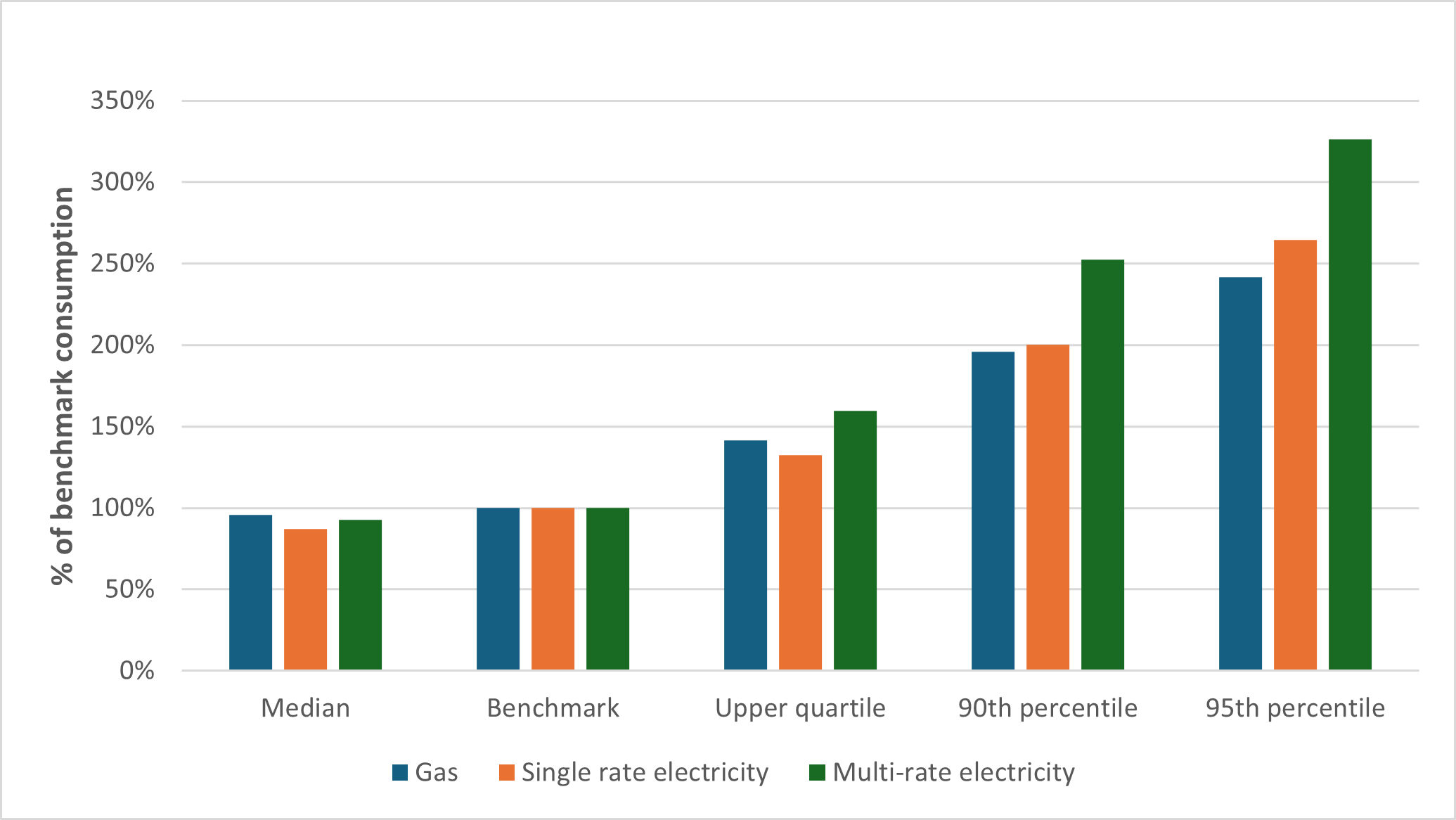

Figure 7, which compares above-average consumption at the 75th, 90th and 95th percentiles for gas and electricity as a proportion of benchmark consumption, suggests that above-average consumption households with electric heating would be particularly disadvantaged by the changes explored in the options paper.

Figure 7: Comparison of above-average consumption at the 75th, 90th and 95th percentiles for gas and electricity, as a proportion of benchmark annual consumption under the default tariff cap (15)

These things considered, moving any proportion of suppliers’ fixed costs from standing charges to unit rates would appear to disadvantage households with complex energy needs, and many households with electric heating. Consequently, we would caution against any redistribution of suppliers’ fixed costs from standing charges to unit rates.

Q3. What are your views on the trade-offs and impacts we have identified for consumers and suppliers? Should any of these take more or less significance in our assessment, and are there any important impacts we have not considered?

The options paper highlights a series of risks to the reallocation of fixed costs to unit rates. From a consumer perspective, these include second order risks arising from a possible weakening of competition for consumers with low consumption, and potential risks to suppliers’ financial resilience.

As a zero sum change, the options paper recognises that moving a proportion of suppliers’ fixed costs from standing charges to unit rates under the default tariff cap methodology would mean that any consumer with gas or electricity consumption higher than the median for all consumers in Great Britain would face higher costs for the relevant fuel than under the status quo. For higher consumption legacy PPM households (i.e. higher consumption PPM households without a smart meter) this appears to represent a particular risk due to technical constraints within the legacy PPM infrastructure which limit the number of tariff slots available to suppliers.[16],[17] Although the wholesale market volatility referred to above has resulted in significant consolidation in the retail energy market since the default tariff cap was first introduced, it is not immediately apparent how this has affected the distribution and use of available PPM tariff slots by and among suppliers.

PPM consumers typically use less energy than the average consumer in Great Britain, but absent self-rationing the evidence that PPM consumers use less energy than an equivalent non-PPM consumer is weak. With the smart meter rollout still incomplete, the extent to which suppliers could offer a comprehensive range of legacy PPM tariffs to ensure that higher consumption legacy PPM households are provided with sufficient choice to allow them to respond to an unfavourable change to the default tariff cap methodology is uncertain. Consequently, the interests of all PPM consumers may be better served if this narrative is reversed, such that the market is encouraged to provide innovative solutions to support legacy PPM consumers seeking a low or zero standing charge option, but where the uptake of that option would always arise from the active choice of the consumer.

From a distributional perspective, the UK Government’s National Energy Efficiency Data-Framework (NEED) shows that median domestic gas consumption in Scotland is c. 6% higher than the median gas consumption for all domestic consumers in Great Britain.[18] This suggests that a typical domestic gas consumer in Scotland would be more likely to face higher costs as a result of the proposals explored in the options paper than an equivalent consumer in England or Wales. Taken as a proxy for all heating fuels, this would also suggest that electrically heated households in Scotland would be similarly disadvantaged with respect to equivalent consumers in England and Wales.

Households that use electric heating in Scotland are already more likely to be in fuel poverty than households that use any other primary heating fuel.[19] In addition, electrically heated households in Scotland are significantly more likely than other households to be fuel poor but not in relative poverty.[20] In common with many consumers with high essential energy expenditure, this makes their identification challenging using current methods, and many would seem destined to fall beyond the scope of existing schemes of assistance despite affordability being worsened by the changes to the allocation of fixed costs that are currently being considered.

The Fuel Poverty (Targets, Definition and Strategy) (Scotland) Act 2019 defines a household in Scotland as being in fuel poverty if:

- the total fuel costs necessary to maintain a satisfactory heating regime are more than 10% of the household's adjusted net income (i.e. its income after housing costs); and

- after deducting the sum of the household’s fuel costs as defined in (i), any benefits received for a care need or disability, and any relevant childcare costs, the household's remaining adjusted net income is less than 90% of the relevant UK Minimum Income Standard (MIS).

When calculating the applicable MIS for a household in Scotland, the Act also requires a premium to be added to the relevant MIS for households in remote rural, remote small town, and island (RRRSTI) communities, to account for the higher cost of living in these areas. Table 4 sets out the most recent RRRSTI MIS values.

Table 4: Minimum Income Standard for remote rural, remote small town, and island areas by household type, in 2022 prices [21]

|

Household type |

Base MIS |

Mainland uplift |

Island uplift |

90% of mainland RRRSTI MIS |

90% of island RRRSTI MIS |

|

Couple with two children |

£21,380 - £44,000 |

15% |

14% |

£22,128.30 - £45,540 |

£21,935.88 - £45,144 |

|

Single working age |

£11,950 |

27% |

31% |

£13,658.85 |

£14,089.05 |

|

Working age couple |

£20,100 |

28% |

33% |

£23,155.20 |

£24,059.70 |

|

Single pensioner |

£10,240 |

26% |

26% |

£11,612.16 |

£11,612.16 |

|

Pensioner couple |

£16,150 |

19% |

24% |

£17,296.65 |

£18,023.40 |

Additionally, the Fuel Poverty (Enhanced Heating) (Scotland) Regulations 2020 set out categories of person who in Scotland are deemed to require an “enhanced heating regime” of enhanced heating hours, enhanced heating temperatures, or both.[22] Such persons include:

- consumers with a physical or mental health condition or illness which has lasted or is expected to last for a minimum of 12 months;

- consumers in receipt of benefits for a care need or disability;

- consumers aged 75 or over; and

- children under the age of six.

All of the above might reasonably be considered to have high essential energy expenditure. This is the energy cost which is necessary to meet higher energy needs that are essential to the health and wellbeing of the individual. Such needs may arise due to one or more of a range of factors, including the presence of young children, traditional forms of electric heating, or a disability or health condition within the household. The term focuses on energy expenditure rather than energy demand because while demand may stay constant, changes to the price of energy may materially impact on the cost of meeting the consumer’s essential energy needs. For example, in the case of the proposals set out in the discussion paper, the introduction of lower standing charges at the expense of higher unit rates is likely to adversely impact the energy expenditure of consumers with higher than average essential energy requirements.

For consumers with a disability, these requirements may encompass costs beyond those incurred by non-disabled people, including (but not limited to):

- Medical equipment (e.g. oxygen concentrators, at home dialysis, hoists, hospice beds)

- Mobility equipment (e.g. electric wheelchairs, scooters)

- Essential care needs (e.g. increased washing needs, increased bathing needs, cost of carers in home – such as additional heating requirements)

- Safe heating regimes (e.g. an enhanced heating regime or more) which includes the need for heat to manage medical conditions including pain, respiratory risk, fatigue.

Preliminary analysis of the Scottish Household Survey data by Consumer Scotland has found that households where someone was limited a lot by disability faced an additional energy expenditure of £124 a year, when compared to an equivalent household without someone with a disability.[23]

Q4. What are the changes required, if any, to the price cap to facilitate a reduction in the level of the operating costs charged through the standing charge?

No answer provided.

Q5. Could mandating suppliers to have at least one low or no standing charge tariff available to customers help promote competition in this area of the market?

In their response to the Standing Charges Call for Input, suppliers stated that low or zero standing charge tariffs were financially unsustainable under the default tariff cap, due to the risk of under-recovery of fixed costs.[24] In part, this is because compliance with the default tariff cap is assessed at all levels of consumption (cf. only nil and benchmark consumption), and thus it is not possible for suppliers to cross subsidise between consumers with higher-than-average consumption and consumers with lower-than-average consumption. With the majority of the market currently subject to a default tariff, the extent to which suppliers might be able to cross-subsidise between consumers on a non-default tariff and consumers under the cap would also currently appear to be limited.

The above having been said, the market for low and zero standing charge tariffs was also poorly served before the default tariff cap and the prepayment meter charge restriction came into effect. In this context, the options paper discusses whether a mandate on suppliers to include at least one low or zero standing charge tariff within their product range may be required to stimulate competition in this sector of the market, with the implication that suppliers would be provided with the flexibility to choose whether this tariff was a default tariff or not.

In principle and in theory, we consider there may be merit in exploring this proposal further. The options paper discusses the possibility that, outside the protections of the default tariff cap, the commercial interests inherent in the design of a low or zero standing charge product are likely to result in a tariff that was structured in such a way as to favour suppliers not consumers. However, in circumstances where the tariff is not the default tariff, consumers’ exposure to the costs and benefits of such a tariff would always result from the active choice of the consumer. Consequently, the existing protections of the default tariff would remain for consumers who prefer the status quo.

However, with the smart meter rollout still incomplete we note that limits on PPM tariff slots may prevent non-default tariff options becoming widely available for legacy PPM consumers. If it is these consumers for whom the issue of standing charges has become most acute, then further work would be required to assess the potential for these proposals to increase choice in the legacy PPM market.

For the reasons set out in the rest of this response, we would caution against a low or zero standing charge option inadvertently becoming the default tariff.

Q6. How could we create flexibility in how costs are recovered between the unit rate and standing charge without reducing the protection provided by the cap?

The options paper highlights that as the default tariff cap applies at all levels of consumption, this may prevent suppliers from deviating significantly from the allocation of costs set out in the default tariff cap methodology. The paper notes that relaxing the rules such that compliance with the default tariff cap is only assessed against nil and benchmark consumption levels could encourage suppliers to innovate in respect of their default tariffs. However, it suggests that the commercial incentive to do so would essentially be predicated on expectations of a transfer of value from consumers to suppliers. We broadly agree with this reasoning. If implemented as part of reforms to the default tariff methodology, there is therefore a risk that a relaxation of the rules around compliance with the cap would result in a one-sided commercial bet being made by suppliers, with many consumers facing an increase in overall costs that some are likely to find difficult to mitigate or avoid. For this reason, it may be preferable for suppliers to innovate beyond the restrictions of the default tariff cap, such that products to support consumers seeking a low or zero standing charge tariff can be made more widely available, but where the uptake of such products would always arise from the active choice of the consumer. This would represent a two-way bet between suppliers and consumers, with both parties consenting to carry a share of pricing risk, while avoiding the distributional disadvantages of a solution to the issue of high standing charges being brought forward under the default tariff cap.

Q7. In enabling greater diversity in standing charges on default tariffs, what, if any, safeguards would be needed to protect vulnerable consumers?

The distributional impacts associated with the proposals set out in the options paper are such that any consumer with gas or electricity consumption higher than the median for all consumers in Great Britain would face higher costs for the relevant fuel than under the status quo. As discussed above, this appears to place the typical consumer in Scotland at financial disadvantage and holds particular risks for consumers with high essential energy expenditure and some PPM consumers. In contrast, the largest beneficiaries of any change along the lines proposed in the paper are low consumption small households.

Accepting that any change necessarily creates ‘winners’ and ‘losers’ due to the inherent transfer of value from one party to another, there are currently significant challenges to data-matching for the groups which are likely to be most severely impacted by any redistribution of suppliers’ fixed costs to unit rates. This makes it difficult to mitigate the adverse impacts of the proposals for consumers with high essential energy expenditure, and consumers who are fuel poor but not in relative poverty. For example, the development of the universal Priority Services Register has already encountered barriers to the sharing of data on Adult Disability Payment / Personal Independence Payment for consumers with high essential energy expenditure due to disability or health. There are also outstanding challenges arising from the devolution of certain benefits, which makes replicating any mitigation across nations more difficult. In addition:

- for NHS data matching, there are gaps in access to data which is not held centrally. Data-sharing agreements also require to be in place, and these do not cover equipment that has been paid for by the consumer.

- regarding income, household level income data is held by HMRC but is not currently used to support the efficient design and delivery of financial assistance for consumers. In addition, consumers’ energy affordability challenges may be driven by higher than average essential expenditure which may mean that means-tested benefits are insufficient proxies of income adequacy.

The impact of these difficulties is that many households with high essential energy expenditure are harder to identify and match to available support than households whose affordability concerns are primarily driven by low income. These things considered, we think there are alternative ways to provide support to low income low consumption households which do not disadvantage consumers who are already harder to reach and vulnerable. Consequently, while we would support a greater variety of tariff offerings from suppliers, we would caution against a low or zero standing charge tariff becoming the default tariff under the cap.

Q8. What are the key considerations we should take into account in developing options for smoothing spend for prepayment meter customers?

The allocation of fixed costs to the standing charge allowances in the default tariff cap methodology currently acts to smooth a proportion of default tariff PPM consumers’ costs throughout the year. Any move to redistribute some or all of these fixed costs onto unit rates would erode this benefit, and would result in greater seasonal volatility in PPM consumers’ energy expenditure (unless the falling block tariff model already employed by suppliers such as Utilita is replicated by default). Consumers who pay by standard credit would similarly be faced with higher overall winter energy bills.

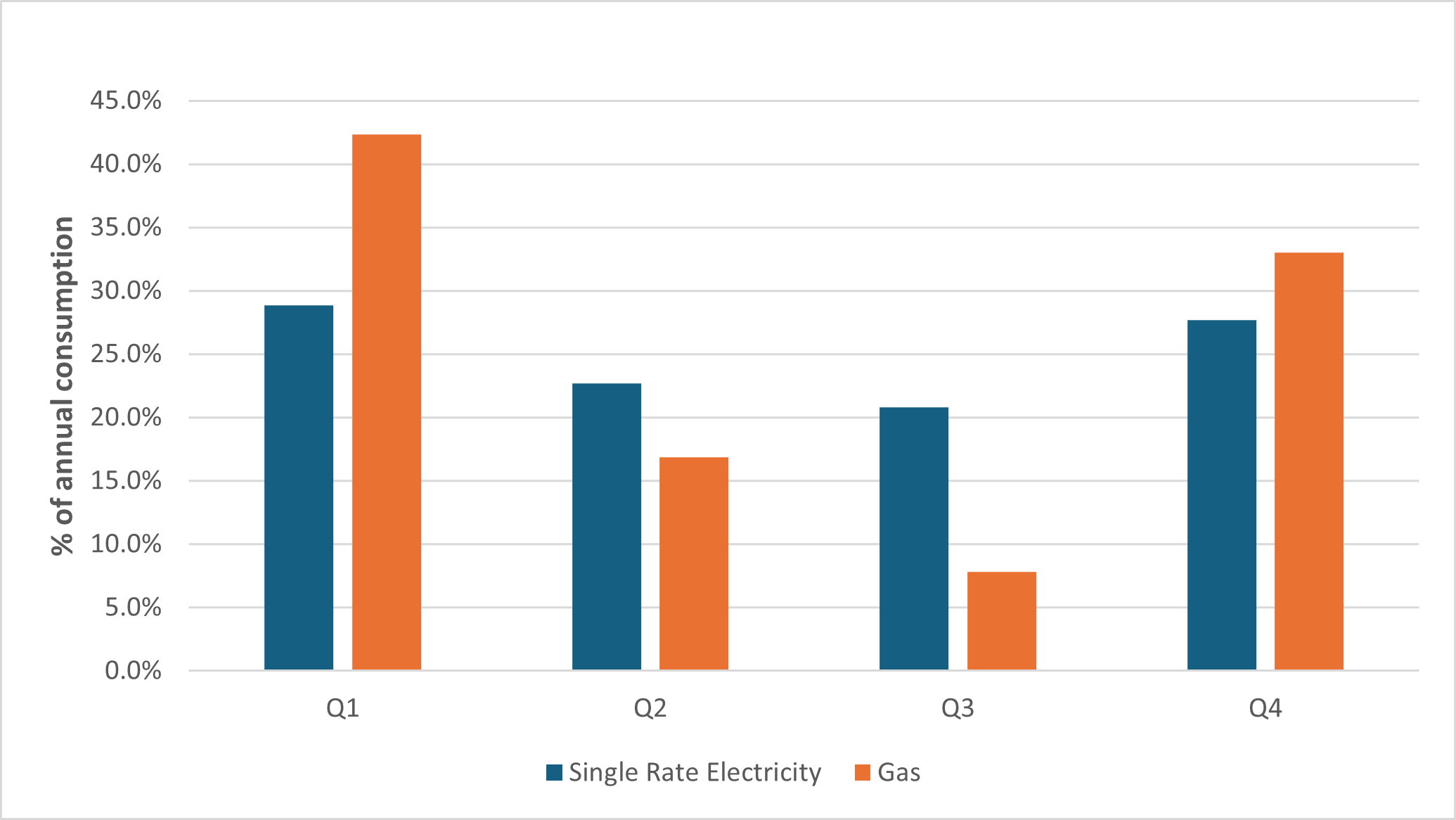

Figure 8 sets out the seasonal distribution of gas and single rate electricity consumption of a typical dual fuel consumer in Great Britain. With 75% of annual gas demand occurring during the winter and shoulder months, the proposals set out in the options paper seem likely to result in more acute seasonal affordability challenges for many PPM consumers. This is likely to result in an increase in harmful self-rationing and an uptick in demand for additional support credit and other forms of emergency financial assistance.

Figure 8: Typical seasonal distribution of gas and single rate electricity consumption in Great Britain [25]

The options paper also explores the possibility of increasing standing charges for PPM consumers during the summer months and reducing them during winter, in an effort to reduce overall PPM winter costs. However, in addition to the gaming risk identified in the paper and the second order impacts this may have on both suppliers and consumers, moving to such a model would be likely to increase the frequency with which issues which arise, when a PPM consumer chooses not to top up over the summer months and instead accrues standing charge debt heading into the winter heating season. This deferral of costs often interferes with landlords’ statutory gas safety checks as, without available gas to vend, these checks cannot take place and the supply must be temporarily capped for safety. Resolving this often places a burden on landlords, consumers, suppliers, and advice agencies: supplies require to be uncapped and any accrued standing charge debt managed effectively before the gas safety check can be completed, and some PPM consumers require assistance to co-ordinate all of this.

As noted above, wholesale market volatility has resulted in significant consolidation in the retail energy market over the past three years, but it is not immediately apparent how this has affected the distribution and use of available PPM tariff slots by and among suppliers. In a properly functioning market defined by healthy competition and an absence of technical barriers, we would expect suppliers to trial innovative approaches to encourage more PPM consumers to avoid cost deferral and increase their financial resilience ahead of the winter heating season – particularly where there is a history of self-rationing and/or self-disconnection, and/or use of additional support credit.

Q9. Do you have any views on our considerations for the allocation of network and policy costs?

The options paper highlights that the DUoS and TNUoS demand residuals will continue to play a significant role in setting the level of the electricity standing charge in future years. For example, as set out in Figure 3, the DUoS tariffs for 2025-2026 will result in an overall reduction of between 6.28% and 81.24% in the level of the DUoS residual for all direct debit single electricity consumers in Great Britain, excepting consumers in UKPN’s London licence area; similar trends are also evident for multi-rate electricity consumers, and for consumers who pay by PPM or standard credit. Although the TDR is forecast to increase with respect to 2024-2025, the net result of these changes is anticipated to exert a negative pressure on electricity standing charges in 2025, in 12 of the 14 DNO licence areas in Great Britain.

3. Endnotes

[1] Citizens Advice Scotland (2018) Leading by Example: A principled journey through regulation

[2] Ofgem (2024) Levelisation allowance methodology and levelized cap levels v1.3, table 1b. Prices are deflated to January 2019 prices using the ONS CPIH monthly rate price index

[3] Ofgem (2024) Levelisation allowance methodology and levelized cap levels v1.3, table 2a. Prices are deflated to January 2019 prices using the ONS CPIH monthly rate price index

[4] Ofgem (2023) Standing Charges Call for Input

[5] Ofgem (2024) Levelisation allowance methodology and levelized cap levels v1.3, table 2a. Prices are deflated to January 2019 prices using the ONS CPIH monthly rate price index

[6] DUoS tariffs for 2023-2024 required to be set in December 2021, before DNOs’ allowed revenues for the first year of the RIIO-ED2 price control were confirmed at Final Determinations.

[7] SoLR costs are recovered through unit rates for gas.

[8] DNOs’ Use of System Charging Statements, 2022 - 2025

[9] Ofgem (2024) Network cost allowance methodology: electricity v1.19, table 2b. Prices are deflated to January 2019 prices using the ONS CPIH monthly rate price index

[10] Ofgem (2024) Levelisation allowance methodology and levelized cap levels v1.3, table 1b. Prices are deflated to January 2019 prices using the ONS CPIH monthly rate price index

[11] Ofgem (2023) Typical Domestic Consumption Values Call for Input

[12] Frerk, M (2023) It’s a Lottery: how Ofgem’s price cap fails Economy 7 customers

[13] Ofgem (2023) Typical Domestic Consumption Values Call for Input

[14] Ofgem (2023) Typical Domestic Consumption Values Call for Input

[15] Ofgem (2023) Typical Domestic Consumption Values Call for Input

[16] The CMA’s 2016 Energy Market Investigation Final Report noted that legacy PPM infrastructure limits PPM gas suppliers to an industry-wide aggregate of 1,133 unique tariffs. Assuming each supplier charges different prices in each of the 14 DNO regions in Great Britain, this places an upper limit of 80 legacy PPM gas tariffs that are able to serve consumers at any given time. This figure must include provision for any “dead tariffs” which are no longer for sale, but which still form the basis of an ongoing supply contract to one or more consumers.

[17] The CMA’s 2016 Energy Market Investigation Final Report noted that every domestic electricity Market Participant ID (MPID) is allocated 249 PPM retail tariff slots by Itron, with a unique slot required for each regional pricing variation within a tariff and for each regional multi-rate pricing structure. Following mergers and acquisitions, suppliers may hold more than one MPID, but no more than 99 MPIDs can be supported by the legacy PPM infrastructure.

[18] UK Government (2024) National Energy Efficiency Data-Framework (NEED): consumption data tables 2024

[19] Scottish Government (2024) Scottish House Condition Survey 2022: Fuel Poverty tables and figures, table FP9

[20] Scottish Government (2024) Scottish House Condition Survey 2022: Fuel Poverty tables and figures, tables FP14a and FP14b

[21] Bryan, A et al (2024) The Cost of Remoteness

[22] Enhanced heating temperatures are specified as 23°C in the living room and 20°C in other rooms, both of which represent an increase of 2°C on the standard heating temperatures on which the Scottish fuel poverty assessment is based. Enhanced heating hours are specified as 16 hours a day on weekdays and at weekends, which represents an increase of 7 heating hours on weekdays when compared to the standard model.

[23] Consumer Scotland (2024) Disabled consumers and energy costs - interim findings

[24] Ofgem (2023) Standing charges Call for Input: Summary of responses

[25] Ofgem (2024) Wholesale cost allowance methodology v1.22, table 3b

[26] 2022 forecast: ESO (2021) April 2022 Forecast TNUoS Tariffs – Five-Year View (2023/24 to 2027/28) – Report – Updated 16/06/2022, table 15; 2023 forecast: ESO (2022) April 2023 Forecast TNUoS Tariffs – Five-Year View (2024/25 to 2028/29) – Report, table 15; 2024 forecast: ESO (2023) April 2024 Forecast TNUoS Tariffs – Five-Year View (2025/26 to 2029/30) – Report V3, table 15; Actual prices: Ofgem (2024) Network cost allowance methodology: electricity v1.19, table 2a