1. Delivering household energy bill support this winter

Energy bills are lower than they were this time last year, but they continue to impose substantial affordability challenges on many households, not to mention their negative impacts on health and wellbeing. There is a strong case for providing additional targeted energy bill support this winter to the consumers who need it most. This briefing reviews the options that the Chancellor may be considering as he puts the final touches to next week’s autumn statement. It argues that, whilst the mechanisms still available to the Chancellor for delivering targeted bill support may be imperfect, that does not negate the case for action.

Energy bills are lower than last year, but continue to put a strain on many households

This time last year, policymakers were responding to unprecedented events in the wholesale energy market. Ofgem’s price cap had reached a level of £3,500 for a typical household with further significant increases projected. It was clear that many people would not be able to afford to heat and power their homes through the winter. UK Government intervention in the form of energy bill support (the £400 bill discount via the Energy Bill Support Scheme) and an energy prices subsidy (the Energy Price Guarantee) combined to alleviate the most severe of these concerns, lowering the average annual bill to £2,100 for the typical household. The Alternative Fuel Payment provided some relief to households not connected to the gas grid.

The situation this year is slightly different. Ofgem’s price cap has fallen to £1,923 but acute affordability challenges have become enduring strains on household budgets. Energy prices remain significantly higher than they were in winter 2021/22 (gas and electricity prices in October 2023 are 60% and 40% higher respectively than they were in October 2021, according to ONS figures). Moreover, the legacy of last winter means that an increasing number of households are now repaying energy debt in addition to their ongoing consumption.

These points can be evidenced through the findings from our latest energy tracker survey – which surveyed 1,500 Scottish households during October, more detailed results of which we will publish shortly. This found that 30% of households are finding it difficult to keep up with their energy bills. Strikingly, 43% of respondents are finding it more difficult to keep up with their bills now compared to this time last year (with only 13% saying they found it easier, and the rest saying there was no difference).

More generally, after an extended period of rising prices across many goods and services, the financial resilience of consumers has been placed under very considerable strain during the past 18 months. Our latest energy tracker survey shows that almost one quarter (23%) have borrowed money or missed rent payments to be able to afford energy bills over the six months from April to October.

High bills also continue to have wider repercussions for wellbeing. 41% of respondents to our latest energy tracker say that they cannot heat their home to a comfortable level because of financial concerns. One third of respondents say that their mental health has been negatively affected by energy bills, and one quarter say that their physical health has been negatively affected.

The tracker continues to show that disabled households, those on the lowest incomes, those without access to mains gas and prepayment meter users, are amongst the groups which are most likely to report struggling with their energy costs.

The UK government’s options for providing energy bill support this winter are limited

There is a clear case therefore for the UK government to provide further support for energy bills this winter. The UK government may use the Autumn Statement on 22 November to set out plans for further energy bill support this winter, targeted at those households who are likely to need it most.

However, the Chancellor’s options for providing that support this winter are limited. With winter almost upon us, any support for energy consumers this winter will have to be channelled through existing mechanisms. There is insufficient time to implement new policies, with new eligibility criteria, this winter.

Had the UK government taken action earlier this autumn, the Warm Home Discount (WHD) option may have been its preferred option. From a Scottish perspective however, the scheme has a number of drawbacks.

Primarily, these relate to the way that the 190,000 ‘Broader Group’ customers in Scotland have to apply to their supplier to access support, rather than it being paid automatically, as happens England and Wales. Inconsistencies between energy suppliers in the eligibility criteria and application windows creates confusion and results in a degree of arbitrariness about who does and does not receive the WHD in Scotland. Further information on the operation of the WHD is included in Annex A at the end of this briefing.

In practice however, whilst WHD might have been a workable option a few weeks ago, the window of opportunity may have already closed on that option. Payments to eligible consumers this winter are already being processed, and reopening the scheme may not be pragmatic.

With the window of opportunity to use the WHD to deliver support this winter likely to have passed, the Chancellor will need to consider alternative mechanisms to deliver support. A second potential mechanism that the Chancellor may consider for targeting of energy bill support this winter is to extend the Energy Price Guarantee for prepayment meter customers (‘the PPM-EPG’).

Since July, households without a PPM are no longer covered by the EPG. However, households that pay for their energy with a PPM continue to be covered by the EPG, resulting in lower costs. This is specifically to align costs for comparable PPM and Direct Debit customers, ensuring that PPM users no longer pay a significant premium for their energy – as they did previously.

The PPM-EPG is now delivered as a discount to standing charges, saving a typical PPM customer around £40 per year compared to the position without the EPG. In principle the PPM-EPG could be extended to provide a further bill discount for PPM customers.

One advantage of providing support through the PPM-EPG, compared to the way the WHD works, is that the EPG is applied automatically on your energy bill. There is no requirement on individual customers to apply for the discount, and no ambiguity as to whether or not they will receive it.

A risk of delivering support through PPM-EPG is that it may incentivise some customers to switch to a PPM. However, this risk could be substantially mitigated by signalling very clearly that the policy would apply only to those households that were already paying by PPM, or had already requested a PPM by a certain date and those who were later involuntarily moved to PPM after that date. This intervention could run until an enduring solution is brought forward by Ofgem.

How well targeted is support aimed at PPM customers? Data from Ofgem indicates that almost 500,000 households in Scotland pay for their electricity with a PPM; and over 300,000 pay for their gas with a PPM (the vast majority of customers on a PPM for gas will also be on a PPM for electricity).

PPM customers are more likely to be struggling with their energy bills. In our latest tracker survey, half of PPM customers in Scotland say they are struggling with their bills (compared to 30% of the population generally), and 63% say that they cannot heat their home to a comfortable level (compared to 41% of the population generally).

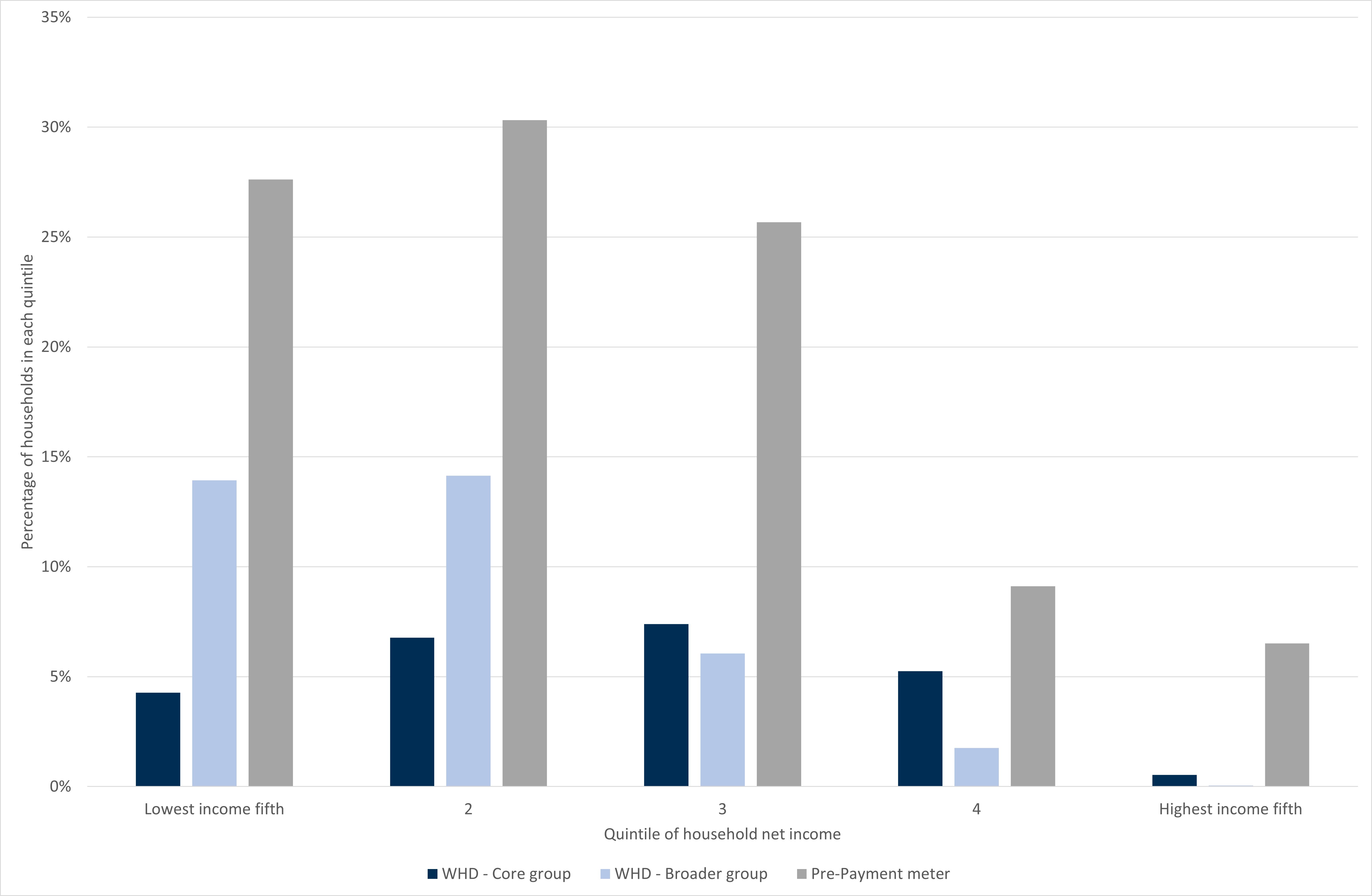

WHD and PPM customers are more likely to have a low income, but many low income customers would not be eligible for support targeted through WHD or a PPM scheme

Percentage of households in Scotland eligible for the Core or Broader Groups of the Warm Home Discount; and percentage of households paying for their energy by PPM, by quintile of income

Source: Consumer Scotland analysis of the Scottish Household Survey, Family Resources Survey and IPPR Tax-Benefit model

PPM customers are also more likely to have a low income. Chart 1 shows that around 25% - 30% of households in the lower half of the income distribution pay for their energy with a PPM, compared to fewer than ten percent of households in the top two quintiles of the income distribution. But clearly, not all low income customers pay for their energy via PPM.

There is a need for longer term reform of energy affordability policies, but this should not detract from the necessity of providing additional bill support this winter

Energy bills remain much higher than they were before 2022. They are imposing substantial financial burden on lower income households – particular those with high energy needs.

The rationing of energy use and cutting back on essentials that is the result has real impacts on health and wellbeing.

There is therefore a strong case for providing further targeted energy bill support this winter.

But with winter almost upon us, the government has few options available to it for providing this support. Any additional scope will have to be channelled through existing policy mechanisms.

It may already be too late to consider WHD as a mechanism this winter. But support could be channelled to PPM customers – who are disproportionately more likely to be struggling with their energy bills – via the PPM-EPG that is already in place.

Both the WHD and PPM-EPG have limitations in terms of how efficiently and effectively they provide support to those who most need it. This is especially true of the operation of WHD in a Scottish context.

These limitations strongly reiterate the need for a more comprehensive and better targeted approach to energy affordability in the longer term. In future commentary we will consider options for such policy.

But the absence of a more effective approach to energy affordability does not negate the need to provide support this winter. The options available for delivering that support may not be ideal, but second best policy is vastly preferable to inaction.

2. Annex A

Warm Home Discount in Scotland

The Warm Home Discount (WHD) is an unusual policy. It is a UK government scheme, but one which operates differently in Scotland from England and Wales.

The WHD provides an energy bill discount of £150 (‘the rebate’) for eligible households. There are two groups of eligible households. The first group (known as ‘Core Group’) are low income pensioner households in receipt of the guarantee element of pension credit. For this group, WHD in Scotland operates the same as it does in England and Wales. Recipient households receive their discount automatically. There are around 90,000 ‘Gore Group’ WHD recipients in Scotland.

Arrangements for the second group differ in Scotland from those in England and Wales (‘Broader Group’ in Scotland and ‘Core Group 2’ in England and Wales). Core Group 2 recipients receive their £150 rebate automatically if they meet the eligibility criteria. To be eligible, a household has to be in receipt of a means tested benefit and be living in a property identified as having high energy need. ‘Energy need’ is identified using data from the Valuations Office Agency (VOA) covering the age, size and type of the property. This data on the physical characteristics of properties in England and Wales is matched to Department for Work and Pensions (DWP) data on benefit receipt and made available to energy suppliers so that the discount can be applied automatically.

In Scotland there is no equivalent to the VOA data that can be used to identify the energy needs of properties. Therefore, eligibility for WHD is based purely on whether households meet various socioeconomic criteria – notably being in receipt of a means tested benefit and having young children or a disability.

The socioeconomic criteria for eligibility are narrower in Scotland than in England and Wales. In England and Wales, data on energy need acts to narrow eligibility; but without comparable Scottish data, narrower socioeconomic eligibility criteria are needed to prevent people missing out when the number of eligible applicants in Scotland is greater than the number of rebates available.

But the big difference with the Broader Group in Scotland is that, unlike Core Group 2 in England and Wales, it is not paid automatically. It is up to individual households in Scotland to apply to their energy suppliers for the WHD rebate, if they think they meet the qualifying eligibility criteria.

The inevitable risk of a ‘by application’ scheme is that some customers may not realise that they might be eligible – a risk which is heightened for consumers in vulnerable circumstances. This uncertainty is magnified by the fact that energy suppliers have scope to vary the specific eligibility criteria for their Scottish schemes; and because different suppliers invite applications during different time periods in any given year (with some having very limited application windows). Furthermore, suppliers operate the schemes on a first come, first served basis, as a result of which some households who might technically be eligible find that their applications have been unsuccessful.

Around 190,000 households in Scotland currently receive the WHD under the ‘Broader Group’.

If the UK government was to increase the WHD payment above £150 – as some campaign groups have called for – this would go some way to providing additional bill support to some low-income households in Scotland. But it would also serve to accentuate the sense of arbitrariness between households that do and don’t receive the payment. An alternative way of enhancing the scheme’s impact this winter would be to increase the number of households receiving it. But in Scotland this would mean reopening the scheme with broader eligibility criteria and inviting further applications – a process which is likely at odds with the quick turnaround that is required.