1. Overview

The current UK traditional telephone network – the Public Switched Telephone Network (PSTN) is reaching the end of its life and needs to be upgraded. Broadly, by the end of 2025, consumers currently using a traditional landline will be migrated over to landline telephones using Voice over Internet Protocol (VoIP) technology.[i] VoIP allows users to make telephone calls over a broadband internet connection instead of a standard telephone line.

Openreach will withdraw its Wholesale Line Rental products that rely on the BT PSTN by 2025. As a result, over 16 million telephone lines that use Openreach’s wholesale call products will be transferred to IP based networks[ii] which support broadband-based call services. Similarly, Virgin Media intends to retire its PSTN over the next few years and currently anticipates completing its switch to IP in line with Openreach’s timescales.[iii]

The change is industry-led and the decisions regarding retirement of the PSTN lie with the telecommunications operating companies. This means that the switch to phone calls over broadband will be undertaken by different companies, at different times, and in different locations depending on their plans.[iv]

For most customers, switching to VoIP should be straightforward and they will continue to receive what they recognise as a traditional phone service. However, unlike traditional corded analogue phones, a digital phone will only work in a power cut if it has a battery back-up. If a consumer is dependent on their landline phone – for example, if they don’t have a mobile phone or don’t have a mobile signal at their home – providers must offer consumers a solution to make sure they can contact the emergency services when a power cut occurs.[v] This could take the form of a mobile phone (if there is a signal), or a battery back-up unit for their landline phone providing a minimum of one hour’s access to emergency services.

There is a risk that some consumers may experience detriment or difficulty in the migration to VoIP, alongside a risk of anxiety or stress as a result of the process. For example, some may be still reliant on PSTN for certain services or additional devices that are linked to their telephone lines, such as care alarms, door entry or CCTV systems or fax machines. Some consumers may lack the right equipment in their home to switch easily, or others may simply not understand what they need to do when the switchover happens.

In order to inform the implementation of the changeover to VoIP, the Communications Consumer Panel (CCP) commissioned a quantitative research survey of 4,612 landline consumers across the UK in 2022.[vi] The research was repeated in 2023[vii] with an increased sample size of 6,117, including a Scottish sample of 808[viii] which was segmented by rurality[ix] for a number of questions. The objectives of the survey were to ascertain:

- What do people need to know to prepare for the switchover to digital telephony?

- What is consumers’ current knowledge and awareness of the switchover?

- How can consumers best be informed, by whom, and what content is required?

- How reliant consumers are on their landline phone – for example, what would they do in an emergency if there was a power cut and they had no access to a landline connection?

- Are there particular concerns, requirements, or communication preferences amongst consumers who may be put in a vulnerable position if their landline service failed?

2. Findings

The 2023 Communications Consumer Panel (CCP) research found that 59% of all respondents and 62% of respondents in Scotland with a landline used it for calls at home.

Reported usage of landlines has decreased, however it is still widely used in some groups, particularly older people and people with low digital literacy. People aged 65 years and over reported a higher level of landline use with 74% of respondents in this age group reporting using their landline to make calls at home compared to 59% of all respondents and 62% of respondents in Scotland. Those aged 65 and over were also more likely to report that the landline was their preferred device with 52% of respondents in this age group stating that it was their preferred device to make calls at home compared to 32% of all respondents and 35% of respondents in Scotland.

Consumers in Scotland had a slightly higher awareness of the upcoming switchover, with 55% of respondents in Scotland vs 51% of all respondents being aware of the switchover. 2022 data showed a similar pattern, with 53% of respondents in Scotland vs 48% of all respondents reporting awareness of the switchover.

40% of respondents in Scotland stated that BT provided their landline service, 18% received landline service from Sky, 14% from Virgin Media and 26% received their landline service from other providers, with the final 2% of respondents not identifying a specific provider.[x] Notably, for respondents in remote rural areas, 64% stated that BT provided their landline services.

The CCP research concluded that any communications campaign should focus on five key target groups who have both high dependence upon their landline and current low levels of awareness of the switchover:

- People who are 65 years and older

- People with low levels of digital literacy

- People with physical or mental conditions or disabilities

- People living in rural locations

- People with an additional device (such as a telecare alarm) connected to their phone line (note, operators may not currently know which of their customers have additional devices)

In relation to the Scottish sample, and particularly people living in rural locations, the issues that emerged as being particularly relevant can be broadly summarised as:

- An increased reliance on landlines

- Lower levels of mobile phone usage and poorer mobile signal

- The impact of power cuts

There were also some top-line differences in preferences for communications and how information should be disseminated during the VoIP switchover.

3. Key finding: Increased reliance on landlines

Households in rural Scotland report higher than average levels of landline usage

There are small (although not statistically significant) differences in landline usage between the Scottish sample and the UK wide sample, with 59% of all respondents with a landline using it to make calls at home compared to 62% of respondents in Scotland. This is fairly consistent with the data from 2022 (62% of all respondents vs 65% of respondents in Scotland). This represents a 3 percentage point decrease in landline usage in both the UK and Scotland.

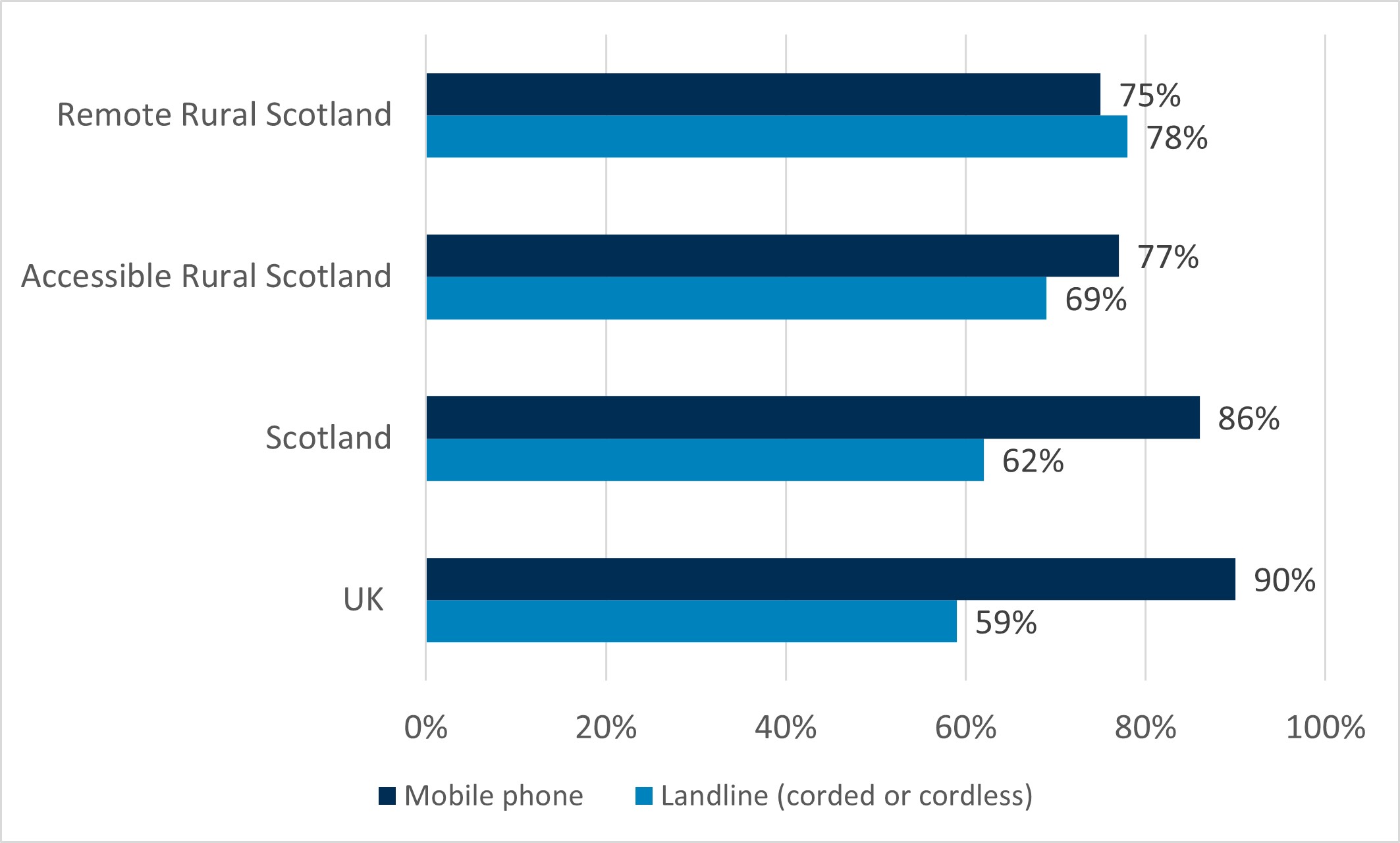

Within the Scottish sample in the 2023 data, differences were observed between participants living in urban and rural areas, with the percentage of respondents using a landline to make calls being highest in accessible rural (69%) and remote rural (78%) areas.

Figure 1: How do you make calls when you are at home?

Unweighted sample size: UK 6,117; Scotland 808; accessible rural Scotland 101 and remote rural Scotland 48

In the 2023 data, respondents in the Scottish sample did not significantly differ to those in the wider sample with regards to reporting that their landline is their preferred device for making calls at home (35% vs 32%). However, there is a larger difference when looking at the urban vs rural segmentation of the Scottish sample, with accessible rural (44%) and remote rural respondents (43%*) both being more likely to state that a landline is their preferred device for making calls at home.

The higher level of landline usage in accessible rural and remote rural Scotland may suggest a greater reliance on the landline and potential higher level of vulnerability of consumers in these areas in the event of a power cut.

Households in rural Scotland are more likely to want to use their landline in an emergency

When asked what device they would use if an emergency happened at home and they needed to make a phone call to someone to help, respondents in Scotland were slightly more likely to state that they would use a landline (37% vs 34%) but this was not a statistically significant difference. Notably, a higher percentage of respondents in accessible rural (44%) and remote rural areas (61%*) reported using a landline to make an emergency call from home.

There was not a substantial difference between all respondents (27%) and respondents in Scotland (26%) who stated that the reason for this preference was poor signal/call quality. However, those living in accessible rural (36%) and remote rural (50%) areas were considerably more likely to give this reason for preferring landline to mobile for making emergency calls at home.

The higher percentage of respondents in accessible rural and remote rural Scotland who want to use their landline in an emergency further highlights the potential vulnerability of consumers living in these areas when considering how they might make emergency phone calls during a power cut.

Additional devices connected to landlines are important to respondents

8% of UK respondents reported having additional devices such as care alarms, door entry or CCTV systems or fax machines connected to their landline compared to 5% of respondents in Scotland, however 11% of respondents in remote rural areas of Scotland reported having additional devices.

When asked about the importance of the additional devices/services they have attached via their landline, 75% of respondents in the UK stated that they were important compared to 88%* of respondents in Scotland, with 100%[xi] of those in accessible and remote rural areas and remote small towns stating that the devices/services attached via landline were important. There was an 8 percentage point* rise in respondents in Scotland stating that the additional devices/services attached to their landline were important (80% in 2022 vs 88% in 2023). Notably, 74% of respondents in Scotland considered their additional devices to be very important, compared to only 44% of the wider UK sample.

Although the sample sizes are small, meaning significance differences between rural Scotland and the wider Scotland sample could not be statistically tested, the high level of importance placed on additional devices by respondents particularly in remote rural Scotland highlights the potential vulnerability of these consumers in the migration to VoIP and the need for providers to consider the impact of the transition on consumers with additional devices.

4. Key finding: mobile phone usage

Mobile phone usage is on the increase, but remains slightly lower in rural areas of Scotland

As with landline usage, there are some small (although not statistically significant) differences between the Scottish and wider sample in relation to levels of mobile usage. In 2023, 90% of all UK respondents reported using a mobile phone to make calls at home compared to 86% of respondents from the Scottish sample.

These numbers are similar to 2022 levels, where 89% of all respondents reported using a mobile phone to make calls at home vs 85% of respondents in Scotland. In 2023, within the Scottish sample, the percentage reporting using a mobile phone to make calls at home falls to 77% for accessible rural and 75% for remote rural.

Respondents in Scotland report similar preference levels for making calls at home via their mobile as the wider UK sample (65% vs 67%). However, when looking within the Scottish sample at rurality, a lower percentage of accessible rural and remote rural respondents report a mobile phone being their preferred device (both 56%). The Communications Consumer Panel has recently published research on the experience of consumers, citizens and micro-businesses in remote and rural locations in the UK.[xii] The research found that the consumer experience of communication services amongst people living in rural and remote communities was, at best, functional for the majority, and at worst very poor. The research noted that for many, the infrastructure was not in place to enable households and microbusinesses to manage effectively in a digital society[xiii].

The lower level of mobile phone use in accessible rural and remote rural Scotland, highlights a resilience concern for those consumers who do not or cannot use a mobile phone if their landline access is interrupted as a result of a power cut.

Mobile phone signal strength may be poorer in rural Scotland

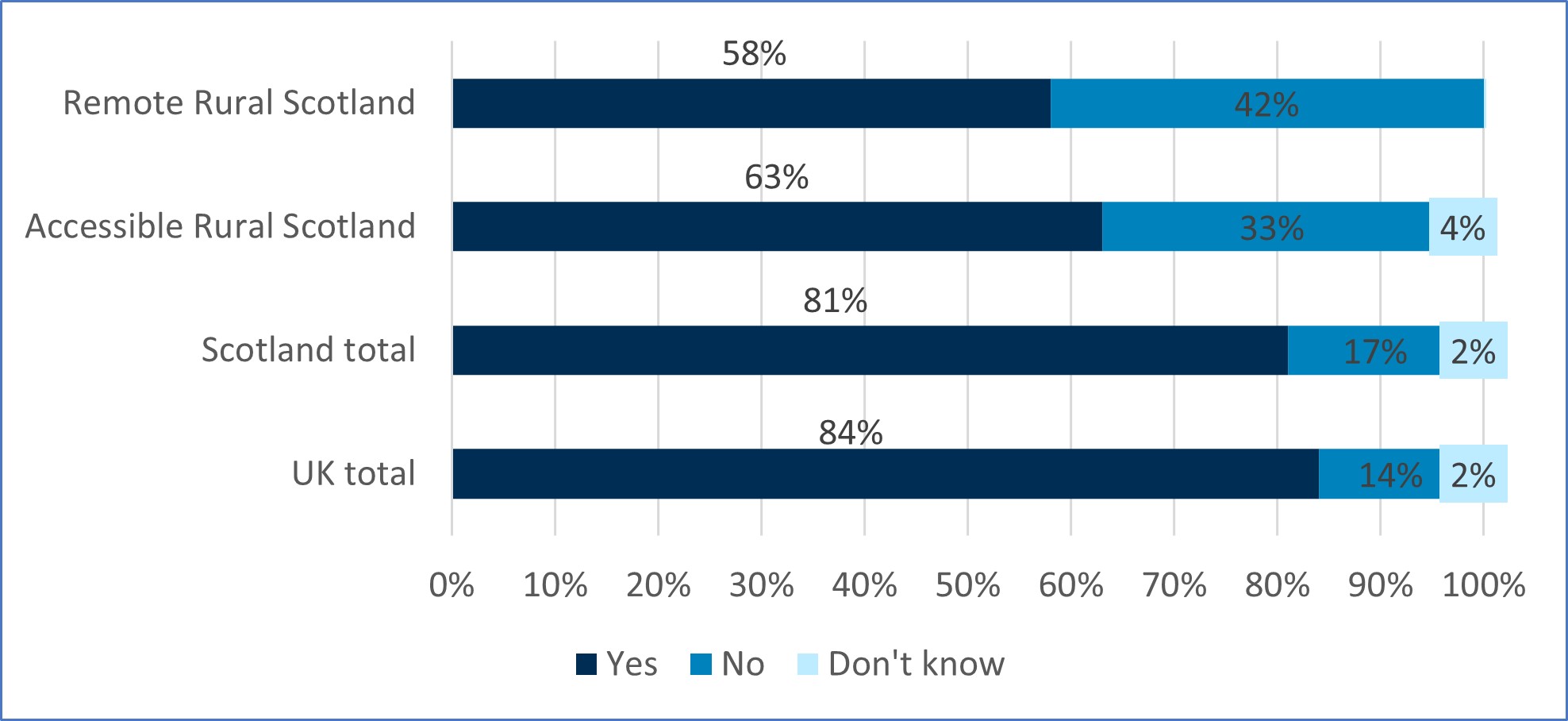

When asked if mobile signal was strong enough to allow them to make a call from anywhere in their house, 84% of respondents to the 2023 survey stated that it was, compared to 81% of respondents in Scotland. This figure falls to 63% of respondents in accessible rural and 58% of respondents in remote rural locations in Scotland.

Figure 2: Is your mobile signal strong enough to make a call anywhere indoors?

Unweighted sample size: UK 5,969; Scotland 786; accessible rural Scotland 99 and remote rural Scotland 45

There was not a significant difference between respondents in Scotland and respondents in the UK’s likelihood to report that they would use a mobile to make emergency calls at home (62% vs 65%). While sample sizes were small, the percentage of people who said that they would expect to use a mobile phone to call for emergency help was lower for those living in accessible rural (55%) and remote rural (39%) locations.

Evidence from this survey suggests that people in more rural areas of Scotland are less likely than people in more urban areas to use their mobile phones for emergency calls. This appears to be mainly due to mobile signal strength being unreliable or call quality being poor.

There remain areas in the UK where there are ‘mobile not-spots’, where people cannot access mobile services. These can include total not-spots, operator specific not-spots, areas with no mobile broadband coverage, or areas where there is no indoor coverage. Ofcom research has shown that Scotland has a higher level of both 4G total ‘not-spots’[xiv] (17% for Scotland compared to 8% for the UK[xv]) and voice and text total ‘not-spots’ (10% for Scotland compared to 4% for the UK).[xvi]

The Ofcom Connected Nations 2022 report shows that those premises categorised as being in a rural area in Scotland have 89% geographic coverage for voice mobile coverage from at least one operator compared to 95% for the UK. [xvii] The 11% of premises in rural areas in Scotland vs 5% in the UK that do not have voice coverage from at least one operator shows a greater reliance on landlines by these premises and leads to a higher risk should they need to make an emergency call during a power cut.

Consumer Scotland acknowledges that there has been a steady improvement in mobile coverage across Scotland in recent years. For example, the Shared Rural Network programme will ultimately ensure geographic coverage from at least one operator across 91% of Scotland. There are also significant predicted increases in the areas served by all four operators, with this improving from 44% to 74%.[xviii] The Scottish Government’s Scottish 4G Infill Programme will also deliver 4G infrastructure and services in up to 55 mobile ‘not-spots’ in rural and remote parts of Scotland.[xix]

However, not all of these improvements will be in place at the time of the predicted switchover. The currently poorer mobile signal strength in Scotland, particularly in accessible rural and remote rural Scotland, and the higher level of ‘not-spots’ highlights the potential vulnerability for consumers living in areas that do not have strong mobile signal strength. Consumers living in areas with a poorer mobile signal have a higher level of reliance on a landline to make calls, including emergency calls, and without adequate back-up provision could find themselves at risk in the event of a power cut.

5. Key finding: The impact of power cuts

Households in rural parts of Scotland experience a higher level of power cuts

Respondents in Scotland reported a similar likelihood of experiencing power cuts, with 64% of UK wide respondents stating that they had experienced a power cut in the last 2 years vs 67% of respondents in Scotland. However, those in accessible rural (87%) and remote rural areas of Scotland (96%*) were more likely to have experienced power cuts in the past two years, highlighting the differences experienced by consumers across Scotland.

The percentage of respondents who reported experiencing power cuts in the 2022 survey was static for respondents across the UK but increased for respondents in Scotland (from 59% in 2022 to 67% in 2023).

Respondents in Scotland were similarly likely to report a higher number of power cuts in the previous two years, with 12% (up from 11% in 2022) of all respondents reporting having more than 4 power cuts compared with 15% (up from 11% in 2022) of respondents in Scotland. However, the 2023 data indicated that the proportion of respondents in Scotland reporting over 4 power cuts rose significantly to 29% of respondents in accessible rural Scotland and 55%* in remote rural Scotland.

Although the sample sizes are small, the higher number of reported power cuts in accessible rural and remote rural Scotland, combined with the poorer mobile phone signal and greater reliance on landlines in some areas highlights potentially higher levels of vulnerability that consumers living in these areas face without adequate back-up provision.

Power cuts in Scotland last longer than the UK average, particularly in remote rural Scotland

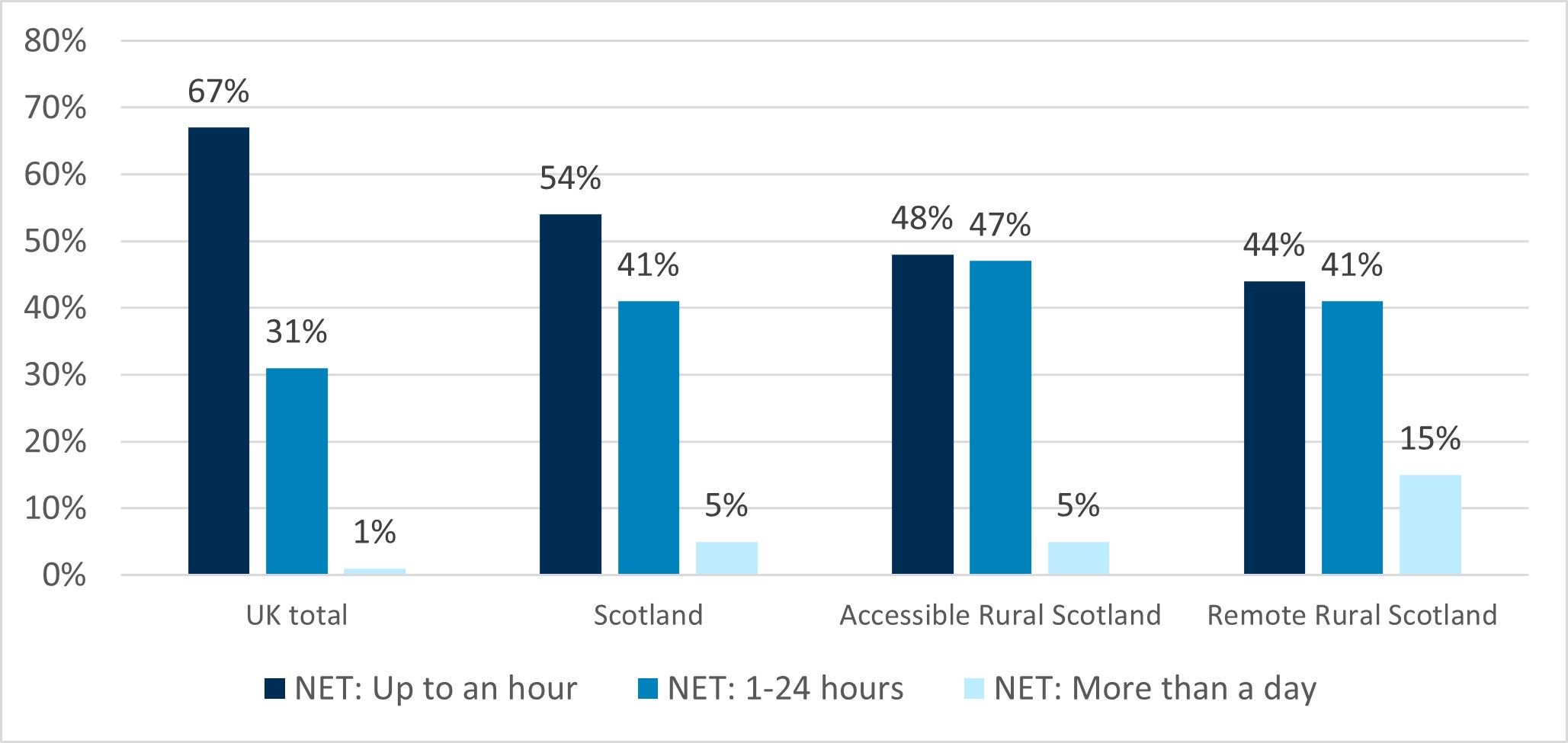

With regards to average length of power cuts, respondents in Scotland were significantly more likely to report power cuts lasting between 1-24 hours (41% of respondents in Scotland vs 31% of all respondents) and power cuts lasting over one day (5% of respondents in Scotland vs 1% of all respondents).

There was some variation across different areas in Scotland, with 44% of those in accessible small towns and 47% of respondents in accessible rural locations reporting average lengths of power cuts of between 1-24 hours (compared to 41% of all respondents in Scotland and 31% of all respondents). However, 15% of respondents in remote rural areas of Scotland reported average lengths of power cuts of over one day (compared to 5% of all respondents in Scotland and 1% of all respondents).

Figure 3: On average, how long do any power cuts you experience last for?

Unweighted sample size: UK 3,842; Scotland 474; accessible rural Scotland 80 and remote rural Scotland 44

There were also increases from the 2022 survey, with the number of respondents in Scotland reporting average power cuts of between 1-24 hours rising from 37% in 2022 to 41% in 2023 and those reporting average power cuts of over one day rising from 4% in 2022 to 5% in 2023.

Respondents in Scotland were more likely to state that they had to call to check on anyone or call for help during any recent power cuts, compared to the wider UK sample (17% vs 13%). However, this was not a statistically significant difference. This figure rose to 29% of respondents in remote rural Scotland.

The longer lasting power cuts in Scotland, particularly in remote rural Scotland, further highlights the potential vulnerability that consumers living in these areas face without adequate back-up provision in the transition to VoIP.

In general, climate change projections suggest observed climate trends will continue to intensify in the future, including an increased risk of flood, drought, and extreme weather events.[xx] The Scottish Climate Change Adaptation Programme 2019-2024: strategic environmental assessment[xxi] notes that infrastructure in Scotland is exposed to a range of climatic hazards, including these extreme weather events.

More winter storms, including disproportionately more severe storms, and smaller scale convective summer storm activity is also projected to increase over the UK in the future. [xxii] The increase in these extreme weather events and the impact that they can have on infrastructure means that power cuts and disruption to communications could become more commonplace.

We acknowledge that following severe storms in recent years, work has begun to improve infrastructure resilience. For example, Ofcom is engaged in the work of the Electronic Communications Resilience & Response Group (EC-RRG), a cross government and telecoms industry forum whose aim is to ensure the telecoms sector remains resilient to threats and risks to services.[xxiii] This work includes developing best practice, sharing knowledge, and providing resilience guidelines to providers.[xxiv] There remain significant challenges in developing and maintaining our infrastructure resilience, given the nature of Scotland’s geography and the predicted increase in the volume and impact of severe weather events.

6. Key finding: VOIP switchover communication priorities

Those who have already made the transition to VoIP were often not asked about potential vulnerabilities by providers

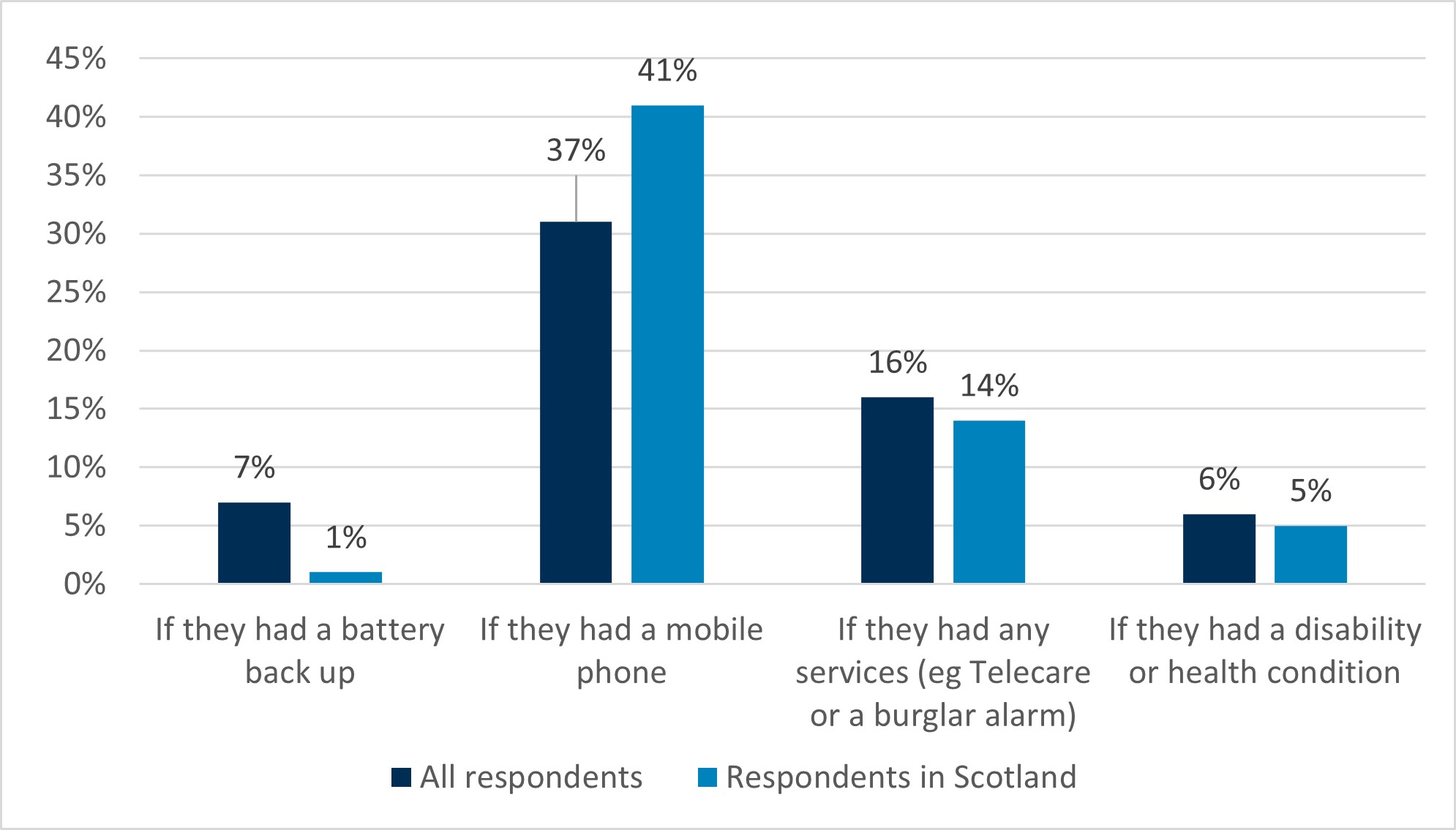

The CCP asked respondents who had already changed to a digital phone service if their provider had asked them if they had a battery backup, a mobile phone, any additional connected services (eg telecare or a burglar alarm) and if they had any disabilities or health conditions. 52% of respondents and 51% of respondents in Scotland stated that they had been asked none of the above questions. The breakdown for those who said they had been asked each of the individual questions is as follows:

- 7% of all respondents and 1% of respondents in Scotland said they were asked if they had a battery back up

- 37% of all respondents and 41% of respondents in Scotland said they were asked if they had a mobile phone

- 16%* of all respondents and 14% of respondents in Scotland said they were asked if they had any additional connected services, eg telecare or a burglar alarm

- 6%* of all respondents and 5% of respondents in Scotland said they were asked if they had a disability or health condition.

Figure 4: Before you changed to an internet phone were you asked if you....?

Unweighted sample size: UK 323; Scotland 47

These questions would give providers useful insight into potential vulnerabilities that consumers may have and what support they might need during the transition. The low levels of consumers reporting that they have been asked questions relating to potential vulnerabilities suggests that there are improvements that could be made to providers understanding of consumers needs and the ways that the transition may impact on them or present risks to their safety.

We are aware that in December 2020, Openreach started to trial moving customers to full-fibre and VoIP services in Salisbury and Mildenhall. Following this, Ofcom commissioned qualitative research in order to understand how customers experienced the trial.[xxv] This broadly demonstrated a low awareness of the migration to VoIP, with many consumers having limited understanding of what was happening, or the implications of the migration. This in turn affected their expectations and experiences of the migration. This trial also found that some participants did not recall receiving information about the changes to their voice service or the level of work that would be required for the full-fibre installation. Consumer Scotland recognises that the sample size for this study comprised only 24 participants and that this study took place at a much earlier point in the migration process. However, taken together with the CCP research, it does raise concerns regarding consumer awareness and understanding of the implications of this change.

There is a gap between the way in which consumers expect to hear about the transition and how they are finding out about it

For respondents who had heard about the switchover, the survey asked how they had heard about it. The results were as follows:

- From my provider - 26% of all respondents vs 30% of respondents in Scotland

- A family member or friend told me - 16% of all respondents vs 10% of respondents in Scotland

- Read about it online - 34% of all respondents vs 30% of respondents in Scotland

- Read about it in the newspaper – 15% of all respondents vs 13% of respondents in Scotland

- Watched something about it on TV – 12% of all respondents vs 7% of respondents in Scotland

- Can’t remember - 15% of all respondents vs 18% of respondents in Scotland.

- Other – 4% of all respondents vs 4% of respondents in Scotland

When asked who they would expect to inform them about changes to the way that changes to the way that telephone services are provided, the responses were as follows:

- My provider – 93% of all respondents vs 94% of respondents in Scotland

- The Government – 34% of all respondents vs 36% of respondents in Scotland

- Ofcom – 18% of all respondents vs 21% of respondents in Scotland

- A consumer organisation[xxvi] – 9% for both all respondents and respondents in Scotland.

For those who had transitioned to VoIP, more than half had not been asked any risk related questions prior to the switchover. When asked how they would like to be informed about the switchover, 67% of all respondents reported wanting to be informed by email. 54% of all respondents and 57% of respondents in Scotland wanted to hear by letter. For those in remote rural Scotland, 73% stated that they wanted to hear by email vs 65% wanting to hear by letter.

While 93% of all respondents and 94% of respondents in Scotland would expect to hear about upcoming changes from their provider, less than a third (30% for both UK and Scotland) report that they first heard about the transition to VoIP in this way. This suggests that there is more that could be done by providers to provide consumers with information about the transition.

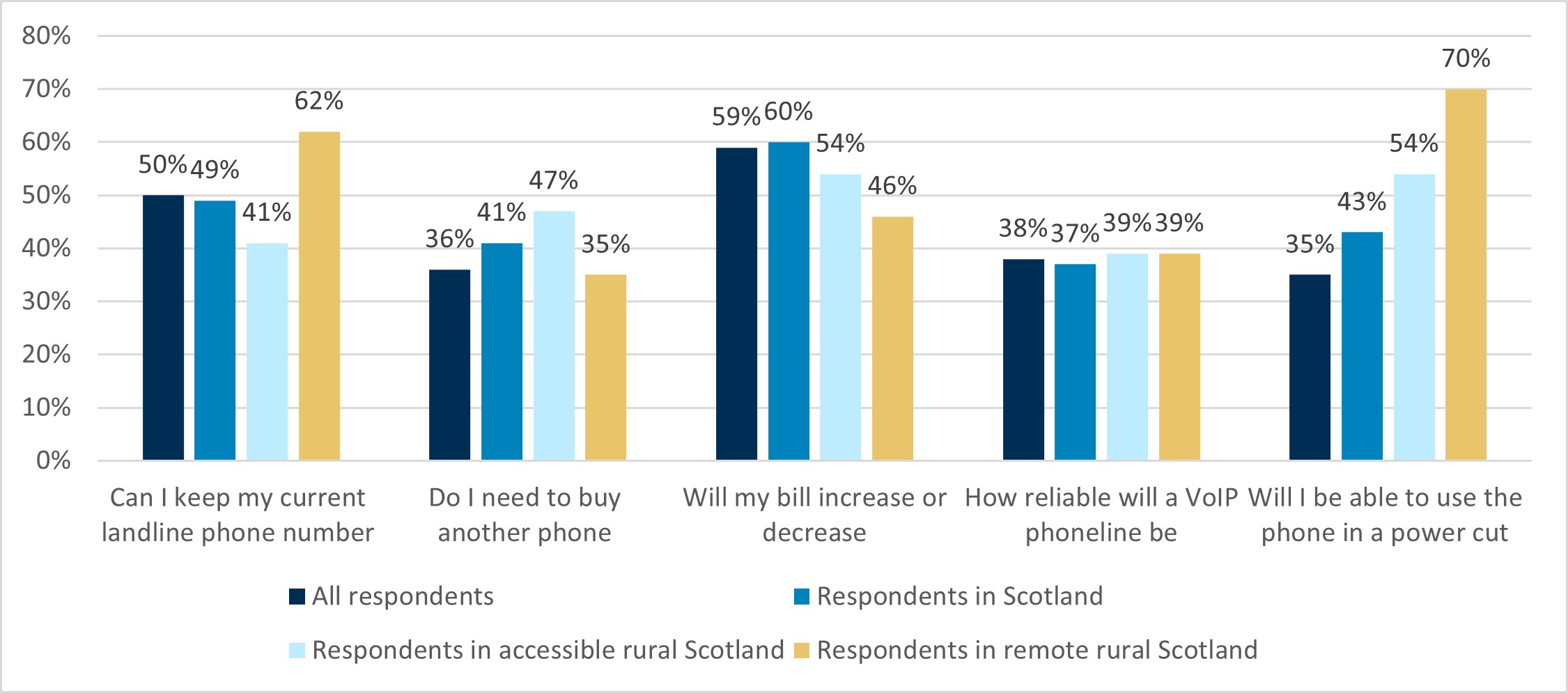

Consumers are concerned about whether they can keep their existing phone number, whether they need to buy new equipment and changes to bills

When asked what the top 3 most important things they would like to know about the new VoIP service, the most frequently selected options were:

- Can I keep my current landline phone number - 50% of all respondents, 49% of respondents in Scotland, 41% of respondents in accessible rural Scotland and 62% of respondents in remote rural Scotland

- Do I need to buy another phone - 36% of all respondents, 41% of respondents in Scotland, 47% of respondents in accessible rural Scotland and 35% of remote rural Scotland

- Will my bill increase or decrease - 59% of all respondents, 60% of respondents in Scotland, 54% of respondents in accessible rural Scotland and 46% of respondents in remote rural Scotland

- How reliable will a VoIP phoneline be - 38% of all respondents, 37% of respondents in Scotland, 39% of respondents in accessible rural Scotland and 39% of respondents in remote rural Scotland

- Will I be able to use the phone in a power cut - 35% of all respondents, 43% of respondents in Scotland, 54% of respondents in accessible rural Scotland and 70% of respondents in remote rural Scotland

Figure 5: What are the top 3 most important things you would like to know about the new voice over internet protocol (VOIP) service?

Unweighted sample size: UK 5,794; Scotland 761; accessible rural Scotland 96 and remote rural Scotland 47

When asked what the top 3 most important things they would like to know about the new VoIP service, the most frequently selected options were:

- Can I keep my current landline phone number - 50% of all respondents, 49% of respondents in Scotland, 41% of respondents in accessible rural Scotland and 62% of respondents in remote rural Scotland.

- Do I need to buy another phone - 36% of all respondents, 41% of respondents in Scotland, 47% of respondents in accessible rural Scotland and 35% of remote rural Scotland.

- Will my bill increase or decrease - 59% of all respondents, 60% of respondents in Scotland, 54% of respondents in accessible rural Scotland and 46% of respondents in remote rural Scotland.

- How reliable will a VoIP phoneline be - 38% of all respondents, 37% of respondents in Scotland, 39% of respondents in accessible rural Scotland and 39% of respondents in remote rural Scotland.

- Will I be able to use the phone in a power cut - 35% of all respondents, 43% of respondents in Scotland, 54% of respondents in accessible rural Scotland and 70% of respondents in remote rural Scotland.

These key concerns noted by consumers about the transition to VoIP are useful for informing providers, and others who may be required to give advice to consumers, about what any future communications campaign should cover to provide consumers with the information and support they need. Notably, a significantly higher percentage of consumers in Scotland, particularly those in accessible and remote rural areas, consider it important to be informed about whether they can use their phone in power cuts. Therefore, this information could be particularly important for communication campaigns to cover.

7. Summary

Our findings show that there are broad similarities between respondents at a UK and a Scottish level, with the most notable differences being in accessible and remote rural Scotland when compared to both the UK and Scottish data. While small sample sizes meant that significance testing was not always possible, the following findings suggest some key differences between rural and non-rural parts of Scotland:

- Percentages indicate higher landline usage in rural areas of Scotland as well as a stronger preference for using a landline to make emergency calls at home.

- A slightly lower than average use of mobile phone and poorer than average signal strength in rural Scotland.

- Longer power cuts in Scotland compared to the wider UK sample, and both longer and more frequent power cuts in rural areas of Scotland.

- There appears to be a high level of importance given to additional devices attached to the landline by respondents in remote rural areas.

We welcome recent indications that some providers are taking a more granular approach to assessing the risk for consumers. For example, BT have stated that they will not initially proactively swich consumers where they are aware that they are over 70, have a healthcare pendant, only use a landline, have no mobile signal or have disclosed any additional needs.

In addition, BT will install new equipment in the local telephone exchange that will allow customers to use their phone in the same way as they do today. This temporary solution, referred to as a pre-digital phone line, will keep customers connected until they are able to make the switch. This solution may also be made available to other providers as a wholesale product. We welcome these developments by BT and urge other providers to consider adopting similar approaches.

8. Recommendations

Recommendation one

Consumer Scotland agrees with the assessment of the Communications Consumer Panel that the migration to VoIP must be handled carefully to protect the safety of consumers in the event of power cuts. This should include ensuring that the migration takes into account the needs of consumers who live in areas where they cannot rely on a strong, reliable mobile signal and those with additional telephony devices or systems.[xxvii]

Recommendation two

Consumer Scotland concurs with the Communications Consumer Panel’s that a wide-ranging communications campaign focussing on five key target groups who have both high dependency on their landline and current low levels of awareness of the switchover is needed:

- people who are 65 years and older

- people with low levels of digital literacy

- people living in rural locations and

- people with an additional device connected to their phone line.[xxviii]

Recommendation three

Providers should redouble efforts to communicate information about the change to VOIP services to consumers. The evidence indicates that consumers expect to hear about the change from providers, but that despite the provider-led nature of this change, this may not currently be happening. Providers should consider collaborating to ensure that consumers receive consistent messaging. The evidence shows a mix of consumer preferences about how people wish to hear about the switchover. It would be beneficial for providers to use more than one communication method to allow the message to get through to all consumers. We note, for example, recent advertisement campaigns by providers in Northern Ireland and recommend consideration be given to rolling these communication programmes out across the rest of the UK in accordance with the migration timetable. Migration in Scotland is currently scheduled for Summer 2024.[xxix]

Recommendation four

Providers should also consider how they can best work in partnership with relevant advice bodies that provide support to the above groups. Alongside this, providers should also consider working with community-based organisations such as local libraries, post offices and health centres who may be well-placed to communicate with consumers about the switch taking place in their area.

Recommendation five

Ofcom should work with communications providers to ensure that providers have sufficient awareness and understanding of any potential vulnerabilities that consumers have and are taking sufficient steps to adequately assess the risks that consumers face during the transition. In particular, providers need to be aware of issues around additional connected devices (especially where these are health related) or consumers being landline only. In addition, we recommend that providers consider the geographic profile of the areas consumers live in and assess any additional risks posed due to poor indoor or outdoor mobile coverage or patterns of power outages. Ofcom and communication providers should work together to ensure that providers are actively identifying those consumers at greater risk of harm and are ensuring that consumers are offered solutions that take into account their individual needs and circumstances.

Recommendation six

Ofcom should continue to closely monitor the plans put in place by communications providers. We would welcome a particular focus on reviewing how providers assess and manage the risk to consumers posed by the migration to ensure that consumers, particularly those with additional support needs or who are in vulnerable circumstances, are provided with the information and support they need during the transition to VoIP. We would also welcome thought being given to how regulators can best be assured that providers are asking consumers the required questions regarding their circumstances before migration takes place.

Recommendation seven

Ofcom should continue its engagement with communications providers and other stakeholders such as energy networks, regional resilience partnerships and infrastructure providers to consider resilience risks. It is vital that the communication network is as robust as possible to withstand future weather and climate events and the potential power and communications infrastructure outages that may occur as a result.

Recommendation eight

Ofcom should continue to work together with communications providers and wider forums such as the Electronic Communications Resilience and Response Group to improve monitoring and reporting regarding the resilience of communications networks. Current incident reporting thresholds which are based on the minimum number of end customers affected may disadvantage remote rural communities who are considerably less likely to meet these reporting thresholds. These communities may be more dependent on these services and at greater risk of isolation. Consideration should be given to creating a reporting threshold based on duration of the outage in addition to the number of end consumers affected, in order to capture the impact of outages on these consumers.

Recommendation nine

As the migration process continues, Ofcom should consider conducting further follow up research where managed migration to VoIP has taken place to better understand the experiences of consumers, particularly consumers identified as having both high dependency on their landline and current low levels of awareness of the switchover.

9. Endnotes

[i] Communication Consumer Panel (2023) Migration to VoIP: listening to the needs of landline consumers. Available at: https://www.communicationsconsumerpanel.org.uk/downloads/ccp-acod-migration-to-voip-consumer-research-report-may-2023-text-only-version.pdf

[ii] Internet protocol (IP) based networks which can support both broadband and landline telephone services.

[iii] Ofcom (2019) The future of fixed telephone services available at: https://www.ofcom.org.uk/__data/assets/pdf_file/0032/137966/future-fixed-telephone-services.pdf

[iv] Ofcom (2019) The future of fixed telephone services available at: https://www.ofcom.org.uk/__data/assets/pdf_file/0032/137966/future-fixed-telephone-services.pdf

[v] Guidance: Protecting access to emergency organisations when there is a power cut at the customer’s premises (ofcom.org.uk)

[vi] Switching from analogue to telephony: Listening to the needs of landline consumers (2022) - Communications Consumer Panel

[vii] Switching from analogue to telephony: Listening to the needs of landline consumers (2023) - Communications Consumer Panel

[viii] Data was weighted to the known profile of the UK using the same weights as in 2022, based on age, gender, government office region, social grade, ethnicity, urban/rural, literacy, and condition/disability. The sample was significantly upweighted from 2022 in order to deliver larger sample sizes across the devolved nations of the UK and a larger representation of people who self-identified as having a ‘longstanding physical or mental condition or disability’.

[ix] * Once segmented for rurality, some sample sizes are categorised by the Communications Consumer Panel as a ‘very small base – unsuitable for significance testing’ (under 30). Where this occurs in the results highlighted below, it will be marked with a (*) next to the relevant statistic.

[x] Consumer Scotland does not currently have a list of who is covered under ‘other providers’.

[xi] The small sample size should be noted here, the sample size for remote rural respondents in Scotland with additional devices on landline was 5.

[xii] communicationsconsumerpanel.org.uk/downloads/ccp-acod-the-struggle-for-fairness---rural-and-remote-communities-research-report-(july-2023).pdf

[xiii] ccp-acod-the-struggle-for-fairness---rural-and-remote-communities-research-report-(july-2023).pdf (communicationsconsumerpanel.org.uk)

[xiv] Areas where people cannot access mobile services due to lack of coverage

[xv] Ofcom Connected Nations 2022: Interactive report (updated September 2023), available at: https://app.powerbi.com/view?r=eyJrIjoiZGIzYmY0ZWYtMjg1My00ZTZmLWEzZTUtNzFlZTA5NjVhZmUxIiwidCI6IjBhZjY0OGRlLTMxMGMtNDA2OC04YWU0LWY5NDE4YmFlMjRjYyIsImMiOjh9 (mobile coverage)

[xvi] Ofcom Connected Nations 2022: Interactive report (updated September 2023), available at: https://app.powerbi.com/view?r=eyJrIjoiZGIzYmY0ZWYtMjg1My00ZTZmLWEzZTUtNzFlZTA5NjVhZmUxIiwidCI6IjBhZjY0OGRlLTMxMGMtNDA2OC04YWU0LWY5NDE4YmFlMjRjYyIsImMiOjh9 (mobile coverage)

[xvii] Ofcom Connected Nations 2022: Interactive report (updated September 2023), available at: https://app.powerbi.com/view?r=eyJrIjoiZGIzYmY0ZWYtMjg1My00ZTZmLWEzZTUtNzFlZTA5NjVhZmUxIiwidCI6IjBhZjY0OGRlLTMxMGMtNDA2OC04YWU0LWY5NDE4YmFlMjRjYyIsImMiOjh9 (mobile coverage)

[xviii] Forecast coverage improvements - Shared Rural Network (srn.org.uk)

[xix] Scottish 4G infill programme: progress update - gov.scot (www.gov.scot)

[xx] Appendix B: Environmental Baseline - Scottish climate change adaptation programme 2019-2024: strategic environmental assessment - gov.scot (www.gov.scot)

[xxi] Appendix B: Environmental Baseline - Scottish climate change adaptation programme 2019-2024: strategic environmental assessment - gov.scot (www.gov.scot)

[xxii] Recent trends and future projections of UK storm activity - Met Office

[xxiii] Electronic Communications Resilience & Response Group (EC-RRG) - GOV.UK (www.gov.uk)

[xxiv] EC-RRG resilience guidelines for providers of critical national-telecommunications infrastructure - GOV.UK (www.gov.uk)

[xxv] Migration to digital landlines: Consumer attitudes and experiences of migration to Voice over Internet Protocol (VoIP) services in the Salisbury and Mildenhall Openreach trial areas (ofcom.org.uk)

[xxvi] The wording in the Communications Consumer Panel research was “A consumer organisation (eg Citizens Advice)”

[xxvii] Switching from analogue to telephony: Listening to the needs of landline consumers (2023) - Communications Consumer Panel

[xxviii] ccp-acod-migration-to-voip-consumer-research-report-may-2023-text-only-version.pdf (communicationsconsumerpanel.org.uk)

[xxix] BT announces regional rollout schedule for Digital Voice