1. Who we are

Consumer Scotland is the statutory body for consumers in Scotland. Established on 1 April 2022 under the Consumer Scotland Act 2020, we are independent of government and accountable to the Scottish Parliament.

Consumer Scotland’s purpose is to improve outcomes for current and future consumers and our strategic objectives are:

- to enhance understanding and awareness of consumer issues by strengthening the evidence base

- to serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- to enable the active participation of consumers in a fairer economy by improving access to information and support

2. Summary results

- One-third of consumers continue to report that they are not managing well financially

- The proportion of consumers who said it was easy, or difficult, to keep up with their energy bills remained relatively consistent over the Autumn 2022 and Winter and Spring of 2023

- Half of all consumers said they were using less energy in Spring 2023 compared with the same period last year. This is an increase from Spring 2022, but had fallen from the Winter peak

- Just over six in ten consumers reported rationing of energy in Spring 2023

- Previous waves saw an increase in the already significant proportion of consumers reporting that financial concerns meant it was difficult to heat their home to a comfortable level. This is now declining but remains above the level of Spring 2022

- Overall perceptions of customer service standards of energy suppliers declined between Spring 2022 and Autumn 2022 but have remained constant since

- Previous waves saw an increase in the already significant proportion of consumers reporting that financial concerns meant it was difficult to heat their home to a comfortable level. This is now declining but remains above the level of Spring 2022

- Individuals with incomes lower than £20,000 or with disabilities find it more difficult to keep up with their energy bills

3. Overview

The Spring 2023 Energy Affordability Tracker was carried out by YouGov on behalf of Consumer Scotland. This briefing summarises the findings of the Tracker by highlighting headline statistics and drawing comparison to the data from Spring, Autumn and Winter 2022. The Spring 2023 Tracker found that a third of domestic energy consumers continue to report that they are not managing well financially (33%). Whilst there were small improvements in the affordability of energy bills from the Winter wave (27% in Spring 2023 compared to 24% in Winter 2022-23), fewer consumers reported that it was easy to keep up with their energy bills than in Spring 2022 (31%).[1]

The fieldwork for the Spring Tracker took place from 2 – 23 March 2023. At this time, domestic energy bills were being subsidised by the Energy Price Guarantee,[2] and this was also the last month in which households received support under the Energy Bill Support Scheme.[3]Our Winter update[4] highlighted that these interventions had mitigated greater affordability challenges. The same can be said for consumers in the Spring wave, with the reported small improvements in affordability likely reflecting the reduced need for heat due to the warmer weather.

Energy prices have fallen[5] since the Spring 2023 wave of the Tracker, and the new energy price cap level for October – December 2023 will drop further to £1,923 per annum for the average household in Great Britain.[6] However, this is still significantly higher than in the October 2021 – March 2022 period, when the price cap stood at £1,277.[7] Without further intervention certain groups of consumers are likely to continue to experience severe energy affordability challenges this winter. There is also a growing need to sustainably address levels of domestic energy debt and arrears, which Ofgem figures show have increased from £1.55bn in Q1 2021 to £2.25bn in Q1 2023 – an increase of £700m in two years.[8]

Similarly to previous waves, the Spring 2023 Tracker found that certain groups of consumers in Scotland are struggling more than others. These include:

- Younger people

- Individuals earning under £20,000 per annum

- Disabled people

- Electric heating users

Recent developments in the regulatory landscape are welcome, such as the proposed consumer standards framework[9] and restrictions on the restart of involuntary prepayment meter installations by suppliers[10]. Nevertheless, further supply and demand side reforms are required to make energy affordable for all households. This includes a long-term solution that delivers energy affordability for groups that are disproportionately affected by high prices, and a renewed impetus on improving the energy efficiency of Scotland’s housing stock. Consumer Scotland will be undertaking further work on each of these issues.

4. Key findings

One-third of consumers continue to report they are not managing well financially

- In both Winter 2022 and Spring 2023, 33% of consumers reported that they were not managing well financially

- This compared with 36% of consumers who reported that they were not managing well financially in Autumn 2022

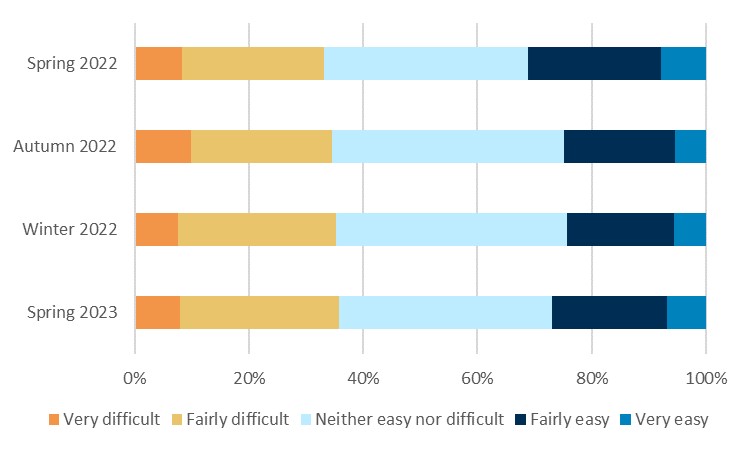

- The proportion of consumers who said it was easy or difficult to keep up with their energy bills remained consistent

- In Spring 2023, 27% of consumers said that they found it easy to keep up with their energy bills compared with 31% in Spring 2022, 25% in Autumn 2022 and 24% in Winter 2022-2023

- 36% of consumers reported that they find it difficult to keep up with their energy bills, and this has remained relatively consistent over previous waves: 33% in Spring 2022 and 35% in the Autumn and Winter waves

Percentage of respondents answering how difficult or easy they find it to keep up with energy bills in Spring 2022, Autumn 2022, Winter 2022 and Spring 2023

Survey Question: How easy or difficult is it for your household to keep up with your energy bills nowadays?

Base: Spring 2022 – 2,012 adults; Autumn 2022 – 1,586 adults; Winter 2022 – 1,621 adults; Spring 2023 – 1,579 adults. Samples weighted to be representative of all Scottish adults (16+)

Half of all consumers said they were using less energy in Spring 2023 compared with the same period last year. This is an increase from Spring 2022, but had fallen from the Winter peak

- In Spring 2023, 50% said they were using less energy compared with the same period last year. This compares with 35% who reported in Spring 2022 that they were using less energy compared with the previous year

- Since Winter, there has been a decline in people who are reporting using less energy compared with the same period in the previous year. In Autumn 2022 61% of consumers reported being in this position, while in Winter 2022 56% gave this response

- The percentage of consumer reporting that they were using more energy compared with the previous year dropped to 9% in Autumn 2022, but in Spring 2023 was back in line with the Spring 2022 and Winter 2022-23 waves, at 17%

Nearly two thirds of consumers reported rationing of energy, a slight decline from autumn and winter, but higher than the previous spring

- In Spring 2023, 62% of all consumers reported that their household is rationing their energy use because of financial concerns. This is significantly higher than the 52% of households who reported rationing their energy in Spring 2022

- The Spring 2023 figure represents a slight decline from Autumn and Winter 2022, when 68% of consumers reported rationing their energy use

Previous waves saw an increase in the already significant proportion of consumers reporting that financial concerns meant it was difficult to heat their home to a comfortable level. This is now declining but remains above the level of Spring 2022

- In Spring 2023 38% of consumers reported that they could not heat their home to a comfortable level because of financial concern, a reduction from a height of 43% of consumers who reported being in that position in Autumn 2022

- However, the Spring 2023 numbers are still significantly higher than Spring 2022, when 31% of consumers reported that they were struggling to heat their homes comfortably

Overall, perceptions of customer service standards of energy suppliers declined between Spring 2022 and Autumn 2022 but have remained constant since

- There has been a decrease during the past year in the percentage of consumers who think that their energy supplier makes it easy to contact them, with 51% agreeing with this statement in Spring 2022 compared with 46% in Spring 2023

- The change in perception about ease of contact occurred between Spring 2022 and Autumn 2022 and has remained relatively constant since, at 45% in both Autumn and Winter 2022

- Fewer consumers thought their supplier treated them fairly in Spring 2023 (42%) as opposed to Spring 2022 (47%)

- Less than a quarter of consumers thought that their supplier offered a good price for energy in Spring 2023 (22%), a fall from 33% in Spring 2022. The change in sentiment occurred between Spring 2022 and Autumn 2022 (23%), and has remained consistent since.

5. How are different groups of consumers reporting affordability?

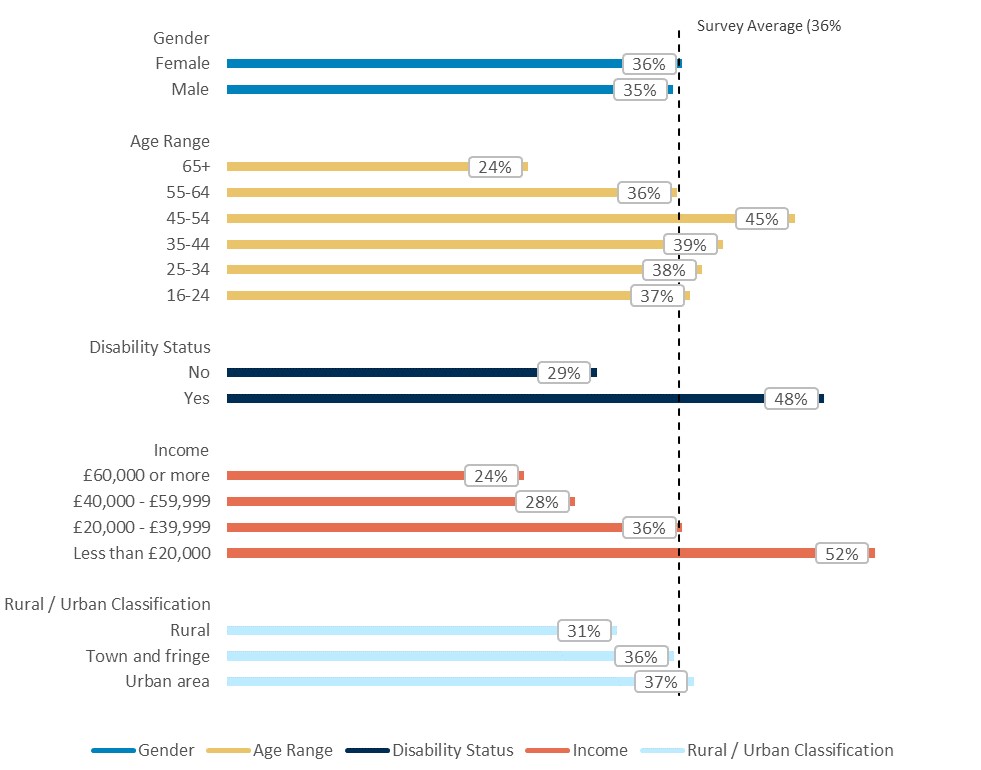

Individuals with incomes lower than £20,000 or with disabilities find it more difficult to keep up with their energy bills

Percentage of respondents answering that they find it very or fairly difficult to keep up with energy bills in Spring 2023

Survey Question: How easy or difficult is it for your household to keep up with your energy bills nowadays?

Base: 1,579 adults, weighted to be representative of all Scottish adults (16+), sub-categories with less than 50 respondents removed from analysis

Gender

- In Spring 2023 there was no difference between men and women reporting that it was difficult to keep up with their energy bills. This is in contrast to the previous waves where there was a slight difference

Age

- Younger consumers are more likely to report that they are struggling with energy bills and energy affordability issues have increased amongst those under 55

- In Spring 2023, those over 55 were least likely to report that they found it difficult to afford their energy bills, with 29% of those over 55 reporting that it was difficult compared with 38% of those aged 16-34 and 42% of those aged 35-54

- The proportion of consumers over 55 reporting difficulty affording their bills has stayed consistent, with 28% reporting difficulty in Spring 2022, 27% in Autumn and 27% in Winter

- Among 16-35 year olds there has been a slight increase in reporting difficulty keeping up with bills, from 35% and 36% in Spring and Autumn to 41% in Winter and 39% in Spring 2023

- Among 35-54 year olds, there has been a similar slight increase in reporting difficulty, with 38% in Spring 2022 rising to 42% in Autumn 2022 and 41% in Winter 2022

Disability

- Forty-eight per cent of disabled people in Spring 2023 said it was difficult to keep up with their energy bills compared with 29% of non-disabled people

- The proportion of disabled people and non-disabled people saying that they found it difficult to keep up with their energy bills has remained consistent since Winter 2022 (47% of disabled people and 29% of non-disabled people)

Income

- Those living in households with the lowest incomes were most likely to say in Spring 2023 that they were struggling with their energy bills, with:

- 52% of those earning under £20,000 reporting that it was difficult to keep up with their energy bills

- 36% of those earning £20,000 - £39,999

- 28% of those earning £40,000 - £59,999

- 24% of those earning over £60,000

- Please note that previous waves of this research did not include data on income differentials

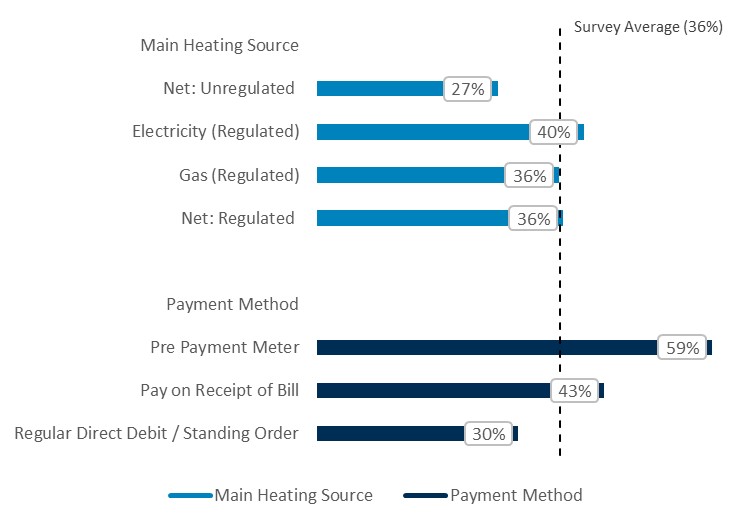

Payment type

Users of prepayment meters continue to find it more difficult to keep up with energy bills

- Thirty percent of those on direct debit said it was difficult to keep up with their energy bills compared with 43% of those on standard credit/pay on receipt of bill and 59% of those on prepayment meters

- Difficulty in keeping up with energy bills stayed consistent with previous waves for those on direct debit, with 30% reporting difficulty keeping up with bills in Autumn 2022 and 29% in Winter 2022

- By contrast, there was an increase in prepayment meter users reporting difficulties in keeping up with their energy bills, with 55% reporting difficulties in Autumn 2022 and 61% in Winter 2022

- Those paying by standard credit have stayed consistent with previous waves, with 41% reporting difficulties in Autumn 2022 and 43% in Winter 2022

Percentage of respondents answering that they find it very or fairly difficult to keep up with energy bills in Spring 2023

Survey Question: How easy or difficult is it for your household to keep up with your energy bills nowadays?

Base: 1,579 adults, weighted to be representative of all Scottish adults (16+), sub-categories with less than 50 respondents removed from analysis

Heating type

- Electric heating users (encompassing both traditional and low-carbon heating systems) were most likely to report affordability challenges in Spring 2023, with 40% reporting that they were struggling to keep up with their energy bills

- Those using unregulated fuels were least likely to report difficulties keeping up with their energy bills with 27% reporting they were finding it difficult

- Over a third of those on mains gas reported difficulties in keeping up with energy bills (36%)

- For those on mains gas, there has been an increase in reporting difficulty keeping up with energy bills, from 31% in Spring 2022 to 35% in Autumn and Winter 2022

- For electric heating users, there have been some fluctuations in reporting difficulty keeping up with energy bills, with 44% reporting affordability challenges in Spring 2022 dropping to 37% in Autumn 2022. This rose slightly to 40% in Winter 2022

- However, there is a slight decline in electric heating users reporting difficulties keeping up with bills from Spring 2022 (44%) to Spring 2023 (40%)

Geographic breakdown

- Consumers living in urban areas are more likely to report not managing well financially than those in rural areas (34% compared with 27%) in Spring 2023

- Consumers in urban areas (37%) are more likely to report that it is difficult to keep up with their energy bills compared with those in rural areas (31%)

6. Endnotes

[1] Consumer Spotlight on Energy 1 | Consumer Scotland

[2] The EPG held costs at £2,500 for the average household in Great Britain; the price cap became the default price when it dropped below this level on 1 July 2023

[3] £66/67 per month paid to all consumers in the regulated market between October 2022 and March 2023

[4] Consumer Spotlight on Energy 2 | Consumer Scotland

[5] Default tariff cap level: 1 July 2023 to 30 September 2023 | Ofgem

[6] Mixed outlook for energy bills as new cap announcement looms - Cornwall Insight (cornwall-insight.com)

[7] Default tariff cap update from 1 October 2021 (ofgem.gov.uk)

[8] Debt and Arrears Indicators | Ofgem