1. Executive Summary

In Scotland, domestic transport is the biggest single source of emissions which drive climate change, and are also a source of local air pollution. To help reduce emissions, Scottish Government policy aims for a 56% reduction in transport carbon emissions by 2030 and complete decarbonisation by 2045. Additionally, the new UK Government has committed to bringing forward the ban on sale of new internal combustion engine (i.e. petrol and diesel) cars from 2035 to 2030 and it is estimated that petrol and diesel cars will be almost removed from Scottish roads by 2045 through natural fleet turn over.

Despite these aspirations, as of March 2024, less than 1.4% of all privately registered cars in Scotland were fully electric, although more company-owned EVs are also on the road. The direction of policy, coupled with existing trends, mean that in future years there will be a significant increase in the number of consumers purchasing and thereafter relying on EVs for domestic travel. It is therefore important that EVs, and the infrastructure that supports them, work for all consumers.

Consumer Scotland undertook this research to better understand the current attitudes and experience of electric vehicle drivers in Scotland, as well as the attitudes of those considering an EV in future. In this policy briefing we present our key findings based on mixed method research comprising of an online survey of 463 current EV drivers and 204 drivers in Scotland who would consider purchasing an EV in the future. This was complemented by two text-based online focus groups with 10 EV owners that lived in urban areas of Scotland, and 9 that lived in rural areas.

We found that EV drivers in Scotland are very positive about their vehicles. However, they highlighted a number of issues and concerns with associated costs, and also the support and charging infrastructure currently available to them in Scotland. Our key findings and identified areas for improvement include:

EV drivers’ ability to charge at home is key. Drivers believe the costs of charging using the public network are too high and find the current infrastructure lacking.

There is a distinct difference in experience between those able to charge at home, and those reliant on the public charging network. Three quarters of current EV drivers live in circumstances which allow them to charge at home, and strongly prefer to do so. Charging at home is viewed as essential by many EV drivers, offering lower costs – particularly when time of use tariffs are used – and high convenience. Conversely, the costs of public network charging fees are at best comparable to, and can be more expensive than, fuelling petrol or diesel vehicles. There are also concerns around availability and reliability of the public charging network, with significant anxiety about being able to charge EVs when required.

Around half of all households in Scotland live in circumstances where charging at home is not likely to be an option. These households are concentrated in urban areas where there could be greater local air quality benefits from adoption of EVs. The difference in experience between home and public charging risks producing future inequality as more people who cannot access at home charging transition to EVs.

Area for improvement: improvements to the public charging network in Scotland are needed. There is already evidence of investment in faster chargers, necessary to support longer journeys which is necessary and should continue. Additionally, our research suggests there is a clear need for greater numbers of slower chargers in areas with high concentrations of households not able to charge at home.

EV drivers tend to own newer vehicles and have purchased them new. They are generally satisfied with servicing and repairs, but some indicate capacity concerns which could become more problematic as the current fleet ages and the number of EV drivers increases, putting capacity demands on the system.

The majority of EVs in Scotland were registered from 2021 onwards. Despite this there are early indications of consumer concerns around the vehicle maintenance and repair infrastructure. Around one in five EV drivers report current dissatisfaction with ease of finding a technician and choice of technician for both servicing and repair. This rises to one in three reporting dissatisfaction with the length of time taken for repairs specifically, concerning given the young age of the fleet.

Area for improvement: consideration is needed to the support which will be required for those purchasing and using older EVs. As EVs age, there will likely be a growing need for repairs and maintenance. Access to services is essential, to give consumers confidence in purchasing not only used EVs but also to those purchasing new EVs with the intention to keep them for some time, or concerned about resale value.

The most significant information issue described is the difference between the advertised range of vehicles as opposed to the real world range. This is of much greater concern for those considering an EV in future, with three in four highlighting this.

However, a significant minority of EV drivers also report concerns with either overall battery life (one in four) or battery degradation (one in three). In particular, EV drivers reported specific issues in relation to maximum mileage being overstated at purchase, and dropping in scenarios such as motorway driving or in cold weather.

Area for improvement: more accurate information on real-world range of EVs in a Scottish context is needed. While there is clear evidence that positive experiences in use mean drivers are less concerned about these issues than those considering a purchase, concerns remain for significant minorities of drivers. Consumers need clarity to build confidence.

There are multiple organisations involved in delivering an effective EV sector for consumers in Scotland. It is essential that the whole EV journey works effectively for consumers. It is important for organisations to work collaboratively to achieve this, designing interventions to address our identified areas for improvement. We therefore seek to work with stakeholders to explore how the required improvements can be delivered so that the choice of an EV does not lead to negative consumer outcomes.

2. Introduction

Who we are

Consumer Scotland is the statutory body for consumers in Scotland. Established by the Consumer Scotland Act 2020, we are accountable to the Scottish Parliament. The Act defines consumers as individuals and small businesses that purchase, use or receive in Scotland goods or services supplied by a business, profession, not for profit enterprise, or public body.

Our purpose is to improve outcomes for current and future consumers, and our strategic objectives are:

- To enhance understanding and awareness of consumer issues by strengthening the evidence base

- To serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- To enable the active participation of consumers in a fairer economy by improving access to information and support

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. In conjunction with that evidence base we seek a consumer perspective through the application of the consumer principles of access, choice, safety, information, fairness, representation, sustainability and redress.

The Consumer Scotland Act 2020 states that Consumer Scotland’s functions include promoting environmentally sustainable practices and that we must have regard to the environmental impact of the actions of consumers. Therefore, alongside vulnerability and affordability, our work focuses on consumers and climate change adaptation and mitigation as a key theme.

The Consumer Scotland Strategic Plan[1] sets out the detail of our approach:

“Scotland has an ambitious net zero target and consumers’ choices will be key to achieving it. Our intention is to understand and track consumers’ priorities for, and experience of, the transition to net zero. We want to understand how the transition can be made easier for consumers on lower incomes, or who face other disadvantages, to make sure they are not excluded. We will use our insights to help inform the design of net zero and adaptation policy and practice across the public and private sectors.”

This report, on the experience of consumers in Scotland of electric vehicles, is part of a wider series of work on this topic. Other research includes attitudes to net zero and consumer decisions across all goods and services, as well as more specific work on topics such as energy, water and postal services, all of which are available on our website[2].

Background to this Research

In Scotland, domestic transport has consistently been a large part of Scotland’s emissions. As of 2022, the most recent available data, it remains the biggest single source of emissions which both drive climate change and are also a source of local air pollution.[3] To help reduce emissions, Scottish Government policy aims for a 20% reduction in car kilometres travelled by 2030, but also commits to reductions in greenhouse emissions from remaining vehicles, reducing transport carbon emissions by 56% by 2030 and decarbonising completely by 2045.[4] While electrification is not the only way to achieve this reduction in carbon emissions from transport, and there are approaches which can combine these aims (e.g. car clubs which are currently small scale in Scotland[5]), it is by far the most widespread at present.

The new UK Government has committed to bringing forward the ban on sale of new internal combustion engine (i.e. petrol and diesel) cars from 2035 to 2030.[6] The current policy is accompanied by the Zero Emission Vehicle Mandate which sets progressively higher interim targets for new vehicle sales.[7] Taken together, current policy is clearly aimed at increasing the number of electric vehicles (EVs), and phasing out traditional petrol and diesel vehicles. It has been estimated that through natural fleet turn over fossil fuel vehicles will be almost removed from Scottish roads by 2045[8].

Despite strong growth in EVs over the last few years, numbers of privately owned EVs remain limited. Of the around 2.4m private cars in Scotland at the end of March 2024, only 34,254 were fully electric.[9]

This number is expected to increase significantly in the future however, and it is also important to note that the total number of EVs on the road is greater. EV sales currently account for over 16% of all new vehicles sold in the UK in 2023, translating to just over 300,000 new EVs, from an overall total of just over 2 million vehicles.[10] While the majority of these are commercial and business fleet vehicles,[11] many will be sold to private drivers, typically when three years old[12].

The ways in which consumers use and charge EVs also has implications for the extent to which changes are needed to national and local electricity generation and supply. If EV charging were to add to current peak demand, the investment needed would be considerably greater than if the majority of EV charging is carried out overnight, when demand is both lower and also generally has a lower carbon intensity.[13] Consumers charging their EVs off peak and in the medium to longer term taking up vehicle to grid technologies can help reduce both household and grid investment costs.

Further, there is potential for EVs to perform a more active role within the electricity system in the future, by helping smooth demand, through vehicle to grid technologies.

The clear direction of UK government policy is to phase out the sale, and eventually the use, of petrol and diesel cars. This aspiration will only be achieved if consumers have a positive experience of EVs across all aspects of the customer journey, including purchasing, the driving experience, the cost and convenience of charging and servicing, and more. It’s also important that EVs are accessible to and a viable option for all drivers, not just a subset of them.

In this context, Consumer Scotland undertook research with current EV users and potential EV users to understand issues including:

- The profile and circumstances of current EV drivers

- Research and concerns about EVs before and after purchase, and views of the purchase process itself

- How drivers use their EVs – frequency and type of journeys

- How often, when and where they charge, and views of the public charging network

We held early discussions on our initial research findings with a small number of stakeholders with an interest in this work.[14] Their contributions have allowed us to better understand the context of our research and to identify aspects which are most relevant to current policy discussions, and we are grateful for their time and input. It is the output both from our research and our wider understanding that informs this report.

Methodology

In order to explore the experience of purchasing, driving and charging EVs in Scotland, we commissioned YouGov Plc to undertake research. The primary research was an online survey of 463 EV drivers, defined as drivers in Scotland who own a vehicle with an electric engine, either solely or jointly with someone else – the sample does not include drivers whose cars were provided to them by their employer. An additional 204 drivers in Scotland who would consider purchasing an EV in the future were also surveyed. This was defined broadly, based on answers to the question “which type of engine would you consider purchasing in the future for your new or second-hand car”.

In both cases, the samples were recruited by YouGov’s existing panel, and fieldwork was carried out between 20 March and 14 April 2024. In the absence of official data on the demographic makeup of Scottish EV owners, figures were weighted based on the wider YouGov panel. Within the panel, 20,000 residents in Scotland answered standard questions about current and future vehicle type ownership, which were used to evidence the demographic make-up of EV drivers and considerers in Scotland based on gender and age. The findings are considered representative of all EV drivers or of those considering purchasing an electric vehicle in Scotland (age 17+). We are satisfied we can usefully generalise our findings to the wider population of EV drivers in Scotland but note that there is potential for bias in our sample and accept that as with most survey research our analytical findings will include a margin of error. Findings presented here should be viewed in this context.

The survey element of the research, which include both fixed-answer and a small number of free-text questions, was complemented by two text-based online focus groups that took place in April 2024. The groups involved 10 participants that lived in urban areas of Scotland, and 9 that lived in rural areas. The focus groups allowed deeper exploration of the themes identified through the survey research.

A full report covering all the findings from the YouGov research is being published alongside this report along with data tables. While some of the findings have been directly replicated into this report, we have presented some of the data differently to highlight our identified issues more clearly, and also conducted some additional analysis. The aim of this report is to focus specifically on findings that are considered to have particular relevance for policy instead of presenting the totality of the research findings, for which the full YouGov report should be viewed.

3. Key Research Findings for Policy Development

Our research shows that the great majority of EV drivers are very positive about their cars and the overall driving experience. However, EV drivers also identify areas where significant improvements are needed if the transition to electric vehicles is to be successful and inclusive over the coming years. These are primarily but not exclusively related to the public charging network. More detailed discussion of the key points from our research can be found below.

EV fleet and owner demographics

It is clear from our research that the current fleet of EVs is very new.[15] The majority of vehicles owned by our respondents were registered during 2021 or later (70%). This is likely to be significantly younger than for petrol and diesel vehicles, for which the average age at scrappage was 13.9 years.[16]

Chart 1 - The current EV fleet is mostly newer vehicles, 70% registered after 2020

Proportion of vehicles for each year of registration as provided by EV drivers (2011 – 2024)

Source: Consumer Scotland EV Experience Survey: In what year was the electric vehicle you own manufactured? If you are unsure please provide your best estimate. Base = 454

Our research also found that only 26% of EVs had been bought used or pre-owned, albeit a slightly higher proportion of considerers (31%) intend to buy a used or pre-owned vehicle. The age of fleet and purchase method will impact the experience of owning and operating an EV.

In relation to purchase, there is less consumer detriment associated with new vehicles than with second-hand; the 2022 Consumer Protection Study found that 30% of UK adults that used or purchased second hand vehicles experienced detriment (a problem or issue that caused stress, took time to resolve or cost money to fix or put right) compared with 19% who used or purchased new vehicles. Older vehicles are also more likely to require maintenance and repair services; the same study found that 17% of UK adults who used these services experienced detriment (9% of the UK population).[17]

A second significant demographic point from the research is that current EV owners have far higher household incomes than the Scottish median household income of £35,048.[18] Household income was not a sampling quota for our research, instead allowed to fall out naturally in the sample, and 60% of drivers had household incomes of over £60,000. By comparison, our own analysis of Households Below Average Income (HBAI) data finds just 25% of Scottish households have household incomes over £60,000. [19] There was more variability in income for those considering owning an EV In the future, but the majority of this sample also had an income over the Scottish household median.

Chart 2 - Current EV owners and considerers generally have higher household incomes than the Scottish population

Proportion of survey respondents within each income category

Source: Consumer Scotland EV Experience Survey: household income question. Base = 410 (Drivers), Base = 171 (Considerers). Excludes 53 Drivers and 34 considerers who Preferred not to answer the income question. Data for All Scottish Households from Consumer Scotland’s analysis of HBAI 2022/23.

EV owners are also more likely than average to live in circumstances which allow them to charge their vehicles at home. As will be discussed later in this report, this is important as being able to home charge materially impacts the charging experience.

Within our sample, 80% of EV drivers tend to charge at home via their retail energy supply, with around three quarters of drivers using a charging point attached outside their house (73%) as opposed to a three point socket inside their house (8%). This tends to indicate that just under three quarters of EV drivers have access to space for domestic charging, such as a driveway. As a point of comparison, the 2021 Scottish Household Condition Survey identified that 37% of Scotland’s households lived in flats,[20] the majority of which would not be expected to have access to such space. Additionally, not all houses will have access to this space either, which will increase the percentage of households unable to charge at home.

Purchase process and concerns

Despite a range of financial incentives having been available, the majority of consumers (55% of our sample) did not access any public funding support either to buy their cars or to install a charge point at home.

Although it might have been expected that financial assistance would have been more attractive to those on lower incomes, it was actually those with household incomes of more than £60,000 that were more likely to report having used at least one scheme (46% as opposed to 33% for those on lower incomes). Further analysis shows this difference was driven by higher likelihood of those with higher incomes to have used employer-led schemes such as salary sacrifice[21], private company schemes or benefits in kind such as company cars.

Some of those who did use help to buy schemes reported finding the process lengthy and difficult, for example because of dealerships or installers being reluctant to engage with these schemes. This experience is anecdotal and limited to a small number of research participants, but does suggest a potential opportunity for improvement.

“Most of the electrical installers I contacted said that getting the grant was more hassle than it was worth to them, so they could install it only without a grant application (installer had to apply for the grant).” (Group 1 – urban)

“Tried Govt loan to purchase, but it's difficult to use - had a loan set up that I was told was suited to the vendor I had found then at the last minute I was told by a different person it wouldn't be accepted in that circumstance. Very frustrating.” (Survey response)

Overall, our research shows that current EV drivers are motivated and capable of undertaking their own research about EVs. The vast majority, 91% of EV drivers in our survey, reported they had done this. The top information sources were Online Reviews (62%), EV manufacturers (38%) and local dealerships (36%).

Drivers are satisfied overall with the information they accessed in advance of purchasing their EVs: 90% of our sample described themselves as satisfied including 42% who stated they were very satisfied. However, there is also evidence of information gaps and concerns, particularly in relation to information obtained from mainstream dealerships which was found by some to be lacking:

“The dealer didn’t know much about the car and definitely about charging. He said I will pick it up as I go along.” (Group 2 – rural)

The most significant information issue for EV drivers is the difference between the advertised range of vehicles as opposed to the real world range. When asked specifically about range, over one third (34%) of EV drivers surveyed said that it was less than they had expected, and a quarter (25%) that maximum mileage had been overstated at purchase.

A number of different driving scenarios were offered in which real life range was found to be lower than expected. Around four in ten drivers surveyed (43%) said the battery went down too quickly in cold weather, and other factors identified by a number of participants included faster driving such as on a motorway.

“Range is poor, advised 220 miles, <200 miles at best and that is without Motorway or dual carriageway driving. Motorway driving has to be under 60mph or battery depreciates very quickly.” (Survey response)

“My true range in the winter is about 120 miles. In the summer its longer - I notice a difference when the temperature goes up to about 12 deg C” – (Group 2 – rural)

More positively, the research found that many concerns around owning and using an EV lessened with real world experience. Concerns about costs and driving fell at each stage of the consumer journey, identifying that experience is possibly generally better than had been expected.

Chart 3 - Driving and cost concerns generally reduce with experience of driving an EV

Proportion of survey respondents reporting that they had any cost or driving concerns at different stages of the consumer journey (considering, pre purchase and post purchase)

Source: Consumer Scotland EV Experience Survey: What, if any, concerns do you have about [driving; the costs of] your electric vehicle [PRIOR to; SINCE] purchasing it? Please select all that apply. Base = 463 (Drivers), Base = 204 (Considerers)

Servicing and repairs

Once an EV has been purchased, drivers are generally satisfied with both servicing and repairs. As might be expected given the age of the fleet, more drivers in our sample have had their vehicles serviced (57%) than repaired (28%), with the proportions being higher for drivers with cars registered in or before 2020 – 87% of whom have had their vehicle serviced, and 36% repaired. The available experience is, therefore, limited, given the young age of the fleet.

On that basis, there is little evidence of significant issues around servicing and repair from the survey element of the research; Satisfaction levels are generally higher than dissatisfaction levels for all aspects for both service and repair.

Chart 4 - Proportion of EV drivers reporting satisfaction or dissatisfaction with a range of metrics associated with servicing and repairing their vehicles

Source: Consumer Scotland EV Experience Survey: When you had your electric vehicle [SERVICED; REPAIRED] how satisfied were you with each of the following? Base = 263 (Service), Base = 125 (Repair)

There are, however, some indications of concerns around the limited capacity of repair services resulting in lengthy waits for work to be completed, particularly for repairs. This could become more problematic both as the current fleet ages and as the number of EVs on the road increases, putting further demands on the system. The survey results found that EV drivers were split between those who were satisfied and those who were dissatisfied with the length of time a repair took, with 44% identifying they were satisfied, and 35% identifying they were dissatisfied. This was significantly different for the same metric for service where seven in ten (71%) of our sample reported being satisfied. For all other metrics for both service and repair, significantly more EV drivers reported being satisfied than dissatisfied further indicating long repair times is a particular problem. This may be explained due to services being comparatively straightforward and easy access in comparison to repairs, which may require specialist knowledge and skills that are still not widespread.

“Manufacturers don't seem to have provided the where with all for garages to fix battery problems – mine went from Edinburgh to Newcastle and took 5 weeks.” (Survey response – typing errors amended)

“I have an ongoing issue with my van. The dealer is beyond hopeless. I have resorted to fixing it myself and talking to a HEVRA garage [in a different part of Scotland] … that is an EV genius.” – (Group 2 – rural)

How EV owners use their vehicles

Our research found that while driving patterns vary considerably, the vast majority of drivers in our survey describe their EV as their primary vehicle (93%). For six in ten (61%), the only type of engine in the vehicle(s) they own is electric.

What is meant by “primary vehicle” may vary between consumers, however our research suggests that drivers mean the vehicle they use most regularly. Almost all respondents (97%) drive their EV at least weekly, and 83% on at least three days per week. The majority of trips, however, appear to be short and local with only 36% describing taking “longer trips outside of the local area” at least weekly, and 45% reporting driving on motorways at least weekly.

While the survey did not examine whether or not the smaller number of longer journeys simply reflects typical habits, some focus group members reported consciously choosing not to take longer journeys in their EVs, turning instead to a petrol or diesel vehicle, or another mode of transport entirely. This also came across in survey responses to open-ended questions asking about reasons NOT to purchase an electric vehicle and whether respondents would like to add anything further about how their EV experience had or hadn’t met expectations.

“Avoiding longer journeys. We're mainly city drivers but would normally do a few longer journeys per year. We've used the train instead so far other than one trip to Newcastle.” (Group 1 – urban)

“The battery range means we also have a petrol car for longer journeys” (Group 2 – rural)

When asked to define a “long” journey, all focus group participants generally agreed this was a return journey that would require at least one charge to complete. It seems possible therefore that one reason for limiting use of EVs to shorter journeys is linked to a combination of range anxiety (perceptions of the distance the car can travel in the real world) and a linked but distinct concern about the ability to charge away from home.

The existence of concerns about EV range / battery degradation and battery life are well reported.[22] As such, it is not surprising that sizeable majorities of those considering purchasing an EV reported such concerns, with 73% identifying range / battery degradation and 74% citing battery life as an area of concern, with 89% reporting at least one of these issues.

It is positive that the proportion of consumers holding these concerns declines at each stage of the consumer journey. However even after purchase, four in ten (42%) drivers are still concerned about at least one of aspect of their vehicle’s battery; one in three reported specific concerns about range / battery degradation (35%) and one in four about battery life (26%).

Chart 5 - A significant minority of EV drivers retain concerns over range / battery degradation and battery life

Proportion of EV drivers or considerers responding that they have specific concerns about their electric vehicles at each stage of the journey (considering, prior to purchase, since purchase)

Source: Consumer Scotland EV Experience Survey: What, if any, concerns did/ do you have about driving your electric vehicle [PRIOR to; SINCE] purchasing it? Base = 263 (Considerers), Base = 125 (Drivers)

Battery concerns are also reflected in the answers to questions about whether EV drivers were concerned about having capacity to complete journeys and the ability to charge their car when out and about.

The opinion of drivers in our survey was divided on whether they worry that their EV will have capacity for journeys (44% agree they worry and 43% disagree). However, more EV drivers agree than disagree that they worry they will not be able to charge their EV when out and about (51% compared to 36%). This rises to 61% when only women are considered.

The strong emotions associated with range and charging anxiety are evident when EV drivers were asked if there was anything else they would like to add about how driving their EV has or hasn’t matched up to expectations:

“I hate the range anxiety and difficulty finding reliable fast chargers” (Survey response)

“I like how smooth it is when driving it but range anxiety takes away any benefits of its use” (Survey response)

Similarly, while our research finds only a small minority of EV drivers would not purchase an EV in the future (13% of our sample), analysis suggests that for this group, range and battery life may be key factors in this decision as higher proportions reported holding these concerns.

Charging

Our research found that charging was the primary cause of complaint for EV drivers, with a stark difference between the experience of domestic charging versus public charging.

“It is so easy and I love not having to visit petrol stations. You just plug in at home and the car is fully charged each time you leave the house.” (Survey response)

“Charging is the big negative. We've had a full electric car for 5.5 years and it is still very difficult and inconvenient to take it on long journeys. We thought the amount of chargers and reliability would have improved much more in this time.” (Survey response)

As noted above, a strong majority of participants in our survey (80%) tend to charge their cars at home, at least some times. The proportion of EV drivers saying they charge at home “the most” (i.e. more than at other locations) is only slightly lower than this figure – three quarters (74%) of drivers charge mostly at home, generally by using a charging point attached to the house (68% of all drivers). Amongst considerers there is a smaller, but still strong tendency towards home charging. Of this group, 63% intend to charge at home.

These preferences are even stronger in rural areas, with nine in ten drivers in our survey in rural areas (90%) tending to charge at home, and eight in ten (83%) mostly tending to charge at home (comparative figures for urban areas are 74% and 69%). This urban /rural split is also seen with considerers, with 87% of rural considerers intending to charge at home, compared to 57% in urban areas.

The clear preference for home charging is again seen in frequency of use of the public charging system, with more than half of EV drivers in our survey (54%) using this less than once a fortnight and an additional one in ten (11%) saying they never use it. This shows that it is not just that EV drivers “mostly” charge at home, in reality they use home solutions for the vast majority of their charging needs.

Chart 6 - Almost two thirds of EV drivers use public charging points less than once a fortnight

Proportion of EV drivers using public charging points with particular frequency

Source: On average how often do you use/ do you think you will use public charging points to charge your electric vehicle? This is a charging point that is in a public space and may or may not charge a fee for its use. Base = 463

It is clear from comments obtained both via the survey and in focus groups that drivers view charging at home as a central part of the attraction of EV ownership:

“[No at-home charging is] a total deal breaker. No home charging and we would not have our EVs.” (Survey response)

“I love driving my electric car. It’s much easier and a better experience than ICE vehicles. I love the fact the car is charged up and ready to go every day so I never have to worry about going to a petrol station.” (Survey response)

Furthermore, although the vast majority of EV drivers would purchase an electric vehicle in the future, for the small minority that would not, the availability of home charging does appear to factor into this decision – 89% of drivers in our survey who tend to charge at home would purchase an EV in the future, dropping to 78% for those do not.

There are two main reasons for home charging being viewed as the “gold standard”: low cost and increased convenience, both of which contrast sharply with the reported experience of public charging for which EV drivers raise concerns about reliability, accessibility and costs. The situation is such that EV drivers in our focus groups view a consistent, reliable and affordable public charging network as critical to the widespread adoption of EVs across Scotland.

“I would prefer [an EV world], where there are no polluting vehicles! However the infrastructure is completely incapable of supporting anywhere near this world.” (Group 1 – urban)

“I think things are improving but slowly. Scotland used to be a leader but the existing chargers aren't fit for purpose anymore. Even fitting so called fast 50kWh ones don’t even scratch the surface as car technology is getting better, the requirement for more output is needed.’ (Group 2 – rural)

In relation to convenience, issues were raised by significant minorities of drivers about both availability but particularly reliability of public chargepoints. Around four in ten surveyed (39%) disagree that there are typically enough charging points for them to use. A higher proportion, just under half, disagree that public charging points are typically in good working order (46%) and notably this is higher than those who agree with the statement (37%). Both are likely reasons for why three in ten of our respondents (31%) disagree that they find it easy to charge their vehicle as and when they needed to do this.

Issues around reliability of public charging infrastructure are evident. For example, EV drivers often have to choose a different charging point than the one they had originally intended to use. For three quarters of EV drivers surveyed (75%) this happened at least once in the past 12 months, and for one in ten (12%) it happened at least ten times.

Chart 7 - Three quarters of EV drivers have had to choose a different charging point at least once in the past 12 months

Proportion of EV drivers reporting they have had to choose a different charging point than the one they had originally intended to use in the past 12 months

Consumer Scotland EV Experience Survey: In the past twelve months how many times, if at all, have you had to choose a different charging point than the one you had originally intended to use? If you are unsure please provide your best estimate. Base = 408

By far and away the most common reason for having to choose an alternative public charging point was the intended point being out of order - around three quarters (73%) of surveyed EV drivers who’d had to choose a different charging point cited this. Other commonly raised reasons indicate too much demand for available infrastructure (43% reported queuing), technical issues (42% could not connect, while 33% could not easily activate the charger), and charge points being inaccessible, for example blocked (39%).

“I … used the Leaf Satnav to find a charger. It sent me to Newbridge [public site], but I couldn't find it, then Edinburgh airport, but I couldn't find that one either, then the [commercial location], I found the charger, it seemed to be working but wouldn't charger my car. Eventually I crossed the bridge and went to Halbeath [park and ride] and found a working charger!” (Group 1 – urban)

Cost of Charging

In relation to costs, concerns are evident about both the higher cost of public charging and also the variability in charging prices. The higher overall cost of public charging is seen in the difference in responses to questions around running costs and concerns between those who tend to charge at home compared to those who do not:

- 30% of those surveyed who tend to charge at home report running costs being lower than expected compared to 16% of those who do not

- Conversely, 38% of those surveyed who do not tend to charge at home report running costs higher than expected, compared to 14% who do

- 11% of those who tend to charge at home report concerns over running costs compared to 33% of those who do not

Chart 8 - EV drivers who tend to charge at home report better experiences in relation to running costs

Proportion of EV drivers reporting current concerns over running costs or that costs are higher than expected

Source: Consumer Scotland EV Experience Survey: To what extent, if at all, has your electric vehicle matched your expectations in each of the following ways? (Running Costs); What, if any, concerns do you have about the costs of your electric vehicle SINCE purchasing it. Base = 93 (tends not to charge at home), Base = 370 (tends to charge at home)

The sentiment was also a topic of discussion for focus groups and in open-ended responses to survey questions.

“If I had to rely on public charging I’d sell the car and get something else. Public charging is out of control for cost. It takes too long and is very inconvenient.” (Group 2 – rural)

Emphasising the already positive perceptions of at home charging costs, four in ten (42%) of EV drivers in our survey use a Time of Use energy tariff, with a further 35% interested in using one in the next twelve months. The benefits of being able to charge cheaply at home is evident from responses to questions about what EV drivers like most about EV ownership.

“The cost of running the car is amazing. I know I am paying for the Electricity but as it is spread over a bill I already pay I barely notice it.” (Survey response)

“I switched … just for the [Time of Use] tariff, it's brilliant. I average 1000 miles per month at a cost of under £20.” (Group 2 – rural)

A small number of respondents also mentioned that they combine different low carbon technologies, allowing them to charge very cheaply from solar panels. Some of these respondents were also in favour of being able to use their EVs as batteries in the future to support the wider electricity network.

“It's wonderful. Combining with solar PV at home makes loads of sense. Looking forward to when cars will be able to serve as energy storage/ batteries for the house - 2 way charging.” (Survey response)

In contrast, and in addition to public charging being perceived as more expensive generally, a key concern raised by EV drivers , particularly in the focus groups, was the variability in charging across Scotland. Some also raised concerns about other fees.

“... I needed a few Kw to get home. The satnav sent me to a car park which only had 7Kw chargers, I waited 20 minutes for 2.2 Kw and was charged £5. Nowhere on the charger was there a sign stating a £5 minimum charge.” (Group 1 – Urban)

“The price of 20Kw varies hugely. At the Halbeath park & ride in Fife, 20 Kw costs me £4.50 (1.50 to connect and 15p/Kw). At [another] charging station..., it costs 55p/Kw, so £11.00.

[When describing a journey of 130 miles] … If I charge at [a location that would mean needing to charge three times on the trip] …, it costs 35p/kw… . At [a location] which is more convenient and means I only have to charge twice, it costs 70p/Kw.

At home, I pay about 28p/Kw. I can accept a margin for the provision and maintenance of chargers. I think 35p-40p is reasonable, but 70p is robbery!” (Survey response)

In terms of where responsibility lies for improving the public charging network, focus group participants were in agreement that the government has an important role to play in not only providing the infrastructure, but also in removing the current variability around tariffs, availability and reliability (this question was not asked in the survey).

“The Scottish Government has outsourced the provision of chargers to local councils which is why there's so much discrepancy in tariffs, availability, reliability and so on.” (Group 1 – urban)

The Scottish Government has stated in order to grow Scotland’s public charging network at the necessary scale and pace significant private investment is needed, complemented by public funding only where private investment alone is unviable,[23] and is providing finance to Local Authorities and other organisations through the Electric Vehicle Infrastructure Fund towards this aim[24]. In practice, our research highlights that consideration must be given to the variability this introduces across Scotland and what can be done to mitigate the concerns of consumers.

4. Interpretation and emerging policy concerns

Our research shows that while EVs are attractive due to the environmental benefits, this being cited by respondents as a reason for EV ownership, they can also offer significant benefits around convenience and cheaper running costs. The importance of these factors in encouraging consumers to choose sustainable options is consistent with findings from Consumer Scotland’s wider portfolio of research on consumer behaviour and climate change.

However, it is also clear from our research that the financial and convenience incentives on EV ownership are far from uniform for different groups of consumers in Scotland.

For those who can charge at home, EV running costs are significantly cheaper than for comparable petrol and diesel vehicles, and charging is straightforward. There is clear evidence that this group both strongly prefers charging at home, and avoids or minimises use of the public charging network if possible. There is also limited evidence of grouping of low carbon technologies among this group – a small number of our respondents spontaneously mentioned charging their vehicles from electricity generated from solar panels, for example. This is consistent with previous EU wide research, which found a higher concentration of take up of other low carbon technologies among EV owners.[25]

In contrast, those unable to charge at home and reliant on the public charging network have a worse experience for both cost and convenience.

Our findings on higher costs for those reliant on public charging network is consistent with previous findings from a House of Lord’s Environment and Climate Change Committee’s inquiry that public charging costs are at best similar to running a comparable petrol and diesel vehicle, and depending on the relative costs of fuel and charging, can be significantly more expensive.[26]

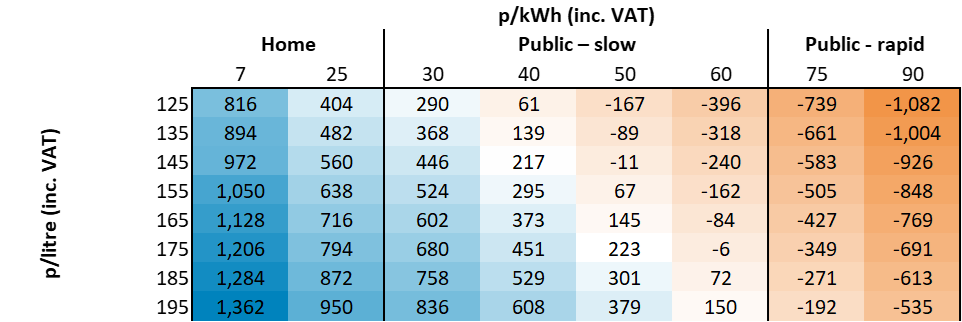

Table 1 - EV charging is generally cheaper than petrol refuelling

Relative prices (in £) of charging versus petrol at a range of indicative prices for an 8,000 mile driver. Negative numbers indicate where EV is more expensive.

Source: Analysis by Zouk Capital LLP as presented to the House of Lords Environment and Climate Change Committee. The analysis includes assumptions of a fuel efficiency of 46 miles per gallon (published assumption 36 miles per gallon) and 3.5 miles per kWh.[27]

The above table suggests that an EV driver charging at 7p per kWh at home, saves £816 per year on annual refuelling costs compared to a petrol car driver who pays 125p per litre, based on an annual mileage of 8,000 miles. Conversely, a driver who relies on public charging at a rate of 60p per kWh, pays £396 more than the petrol car driver refuelling at 125p per litre.

The difference is not limited to costs, however, with our research also showing that drivers find the process of using the public charging network much less convenient, with significant concerns about availability and reliability of public chargers leading to anxiety over whether it will be possible to charge when required.

Currently there is not robust data on how many homes in Scotland could access at home charging. As an indicative proxy we know around 37% of the Scottish population lives in flats and a further 21% in terraced houses.[28] For the majority of these consumers, charging at home via a domestic energy tariff is not currently a practical option, meaning that EV ownership at present not likely to be an attractive proposition for them.

While concerns around battery life and range anxiety are much less evident among EV drivers than those considering one, these remain concerns for significant minorities of drivers. Our research also shows that the difference between expected mileage and real world range is the biggest “surprise” experienced by EV drivers.

Although this is not a new finding,[29] it is clear that accessible information on real world range in a Scottish context is currently lacking. Such information would have been useful to current drivers in advance of purchase, and it is important to address this issue as part of the package to give confidence to those considering an EV in future.

In addition, our research found early signs of potential issues, particularly around repair. While satisfaction was higher than dissatisfaction with service and repair, these findings must be viewed in the context of a very young fleet of vehicles, most of which are still within warranty. Moreover, in the case of the length of time for repairs to be completed, drivers were split between satisfied and dissatisfied indicating this is already somewhat problematic.

As the EV fleet grows and ages, the service and repair infrastructure needed will also expand. As with charging, cost and capacity issues around maintenance and repairs, may constrain EV take up – for example, the membership of the network of independent EV garages is currently very limited in Scotland.[30] It may be necessary for the industry to consider workforce capacity, recruitment and training to ensure the necessary infrastructure grows in parallel with the EV fleet.

The central point from our research, however, is that improvements to the accessibility, availability and reliability of public charging infrastructure are clearly viewed as essential by drivers to support the large-scale adoption of EVs.

There is already both political recognition and action from both the Scottish[31] and UK Governments[32] in this area. However, our research shows that the financial costs of charging must also be considered, and there appears less emphasis on this at present.

5. Areas for Improvement

Consumer Scotland recognises that policy and practice around EVs adoption is both a new area of work for us, and also one which is evolving quickly. We also recognise that the EV market as a whole is at a reasonably early stage. Rather than making detailed recommendations, therefore, we identify below aspects of the EV customer experience against which our research shows improvements are needed.

There are a number of different organisations with a role to play in delivering an effective EV sector for consumers in Scotland. We believe it is important that all organisations work collaboratively to achieve this, as this will ensure a comprehensive set of interventions that address the whole EV journey in a way that works effectively for consumers. Given current policy targets for both the EV sector and the overall journey to Net Zero, it is necessary that this work takes place in a timely manner. Consumer Scotland therefore intends to engage with stakeholders to explore how best to deliver these improvements, with the aim of improving the consumer experience so that the choice of an EV does not lead to negative consumer outcomes.

Improving Information and Access to EVs in advance of purchase

Clearer, more accurate and easily accessible information is needed on the real world performance of EVs in Scotland in advance of purchase. This should include seasonal variations in battery range and typical degradation in battery life for older EVs.

While this is not a Scottish-specific issue – winter temperatures are much lower in Scandinavia, for example – the combination with other concerns about access to home and public charging at present is clearly contributing to a Scottish-specific information need.

This type of information is not currently provided through the Worldwide Harmonised Light Vehicle Test Procedure (WLTP),[33] but is available, at least in part, on third party sites.[34]

In order that those considering an EV purchase can make informed choices, information of this type needs to be easily available to consumers in Scotland, and ideally, linked as directly as possible to existing information, support and advice provision. Alongside this, more consistent advice from dealerships is also needed.

Further consideration should be given to approaches which enable more drivers to experience EVs, such as car clubs.

Car clubs are at present concentrated in urban areas, where the local environmental benefits of EVs are more immediate. Although relatively small in scale at present, there is some evidence that car clubs provide opportunities for drivers to experience EVs first hand,[35] without having to make the significant commitment to purchase or dealing with the fixed costs of car ownership.

Increasing capacity of servicing and repair as the second hand EV market develops

Increased capacity of both dealerships and independent garages to respond to servicing and repair demand will be needed.

The UK-wide 2022 Consumer Protection Study[36] found that 17% of UK adults that used a vehicle maintenance or repair service experienced detriment, i.e. experienced a problem or issue that caused stress, took time to resolve or cost money to fix or put right.

The majority of EVs in Scotland were registered from 2021 onwards. Consequently, the market for used vehicles is less well developed and a proportion will still covered by manufacturer’s warranties. Taken together, this suggests that, as these vehicles age, access to repair services at costs proportionate to the value of older vehicles will increasingly be needed. As above, knowing these services are available, affordable and reliable will help provide confidence to buyers of used EVs.

Significantly improving the public charging network

Support for accessible and affordable public charging infrastructure is especially needed in areas where housing type means consumers are unlikely to be able to charge at home.

There is wide recognition that by far the biggest single issue determining EV adoption in the longer term is the performance of the public charging network. Drivers in our survey were concerned about the ability of the public charging network, especially the availability of very fast chargers, to support longer journeys. Positively, there is evidence that commercial charging station operators are increasingly investing in fast chargers at strategic locations,[37] which will help address these concerns - although intervention may be needed in circumstances where competition may be lacking, as previously identified by the CMA.[38]

Our research and subsequent analysis suggests, however, that a more significant gap is in relation to the lack of availability of slower (7kW+) kerbside chargers in urban areas, at locations easily accessible to residents without charging facilities at home. The concentration of current EV drivers among those who can charge at home emphasises this gap.

In the absence of significant improvements to the network, there is a risk that EV adoption will remain disproportionately concentrated amongst those who can charge from home, leaving those who cannot charge at home (estimated at around half of all Scottish households) facing significant barriers to adoption.

Better access to lower cost charging for consumers unable to charge at home

The unit cost of charging is already a negative factor for consumers unable to charge at home. This is likely to become more pronounced if the second-hand market develops as anticipated, and as more lower-income drivers adopt EVs.

Current ChargeplaceScotland unit charging rates vary depend on the host organisation, but are typically around 40p and upwards.[39] This compares to a standard home electricity rate of just over 22p.[40]

Further, 50% of drivers in our research who can charge at home reported that they use a Time of Use tariff to charge their EVs, and an additional 33% of those who charge at home are interested in changing to such a tariff. Others reporting charging their cars at times which maximised the benefits of electricity generated from domestic solar PV.

Positively, this pattern of charging may help address concerns about the need to reinforce the national electricity grid capacity, given that Time of Use tariffs are designed to encourage charging at off peak times.

However, it also emphasises both the considerable difference in experience of drivers unable to charge at home, and the need to identify suitably attractive solutions for them.

Taken together, our research and wider discussions suggest there are significant risks should charging provision for consumers unable to charge at home not be improved:

- There will be increasing financial divisions between the experience of different groups of consumers, in contrast to the Scottish Government’s Just Transition aims[41]

- Local environmental benefits, notably cleaner air in urban areas, will be less likely to be delivered

- Longer term climate change emission reduction targets will be undermined

Overall, however, the vast majority drivers who contributed to our research were strongly positive about their EV experience. We will seek to build on the positive aspects of their experiences so that these become increasingly available to more drivers in Scotland in future.

6. Endnotes

[1] Strategic Plan 2023-2027 (HTML) | Consumer Scotland

[2] Publications | Consumer Scotland

[3] Section B. Results - Scottish Greenhouse Gas Statistics 2022 - gov.scot (www.gov.scot)

[4] Mission Zero for transport | Transport Scotland

[5] 6645d8ccf0f74f6e2b38382e_CoMoUK Car Club Annual Report UK 2023.pdf (website-files.com)

[6] Labour manifesto 2024: 12 key policies analysed - BBC News

[7] Pathway for zero emission vehicle transition by 2035 becomes law - GOV.UK (www.gov.uk)

[8] Decarbonising the Scottish Transport Sector

[9] Vehicle licensing statistics: January to March 2024 - GOV.UK (www.gov.uk)

[10] New car market hits ‘million motors’ milestone at half year - SMMT

[11] The uncertainty around these numbers is a result of EV sales being currently driven more by commercial and business fleet purchases than by individual consumers - UK reaches million EV milestone as new car market grows - SMMT. A significant proportion of commercial and business cars are registered at the headquarter addresses of business, or at the address of a leasing company, which may not be in Scotland. This issue has been considered by the Scottish Futures Trust - review-of-plug-in-vehicle-uptake (scottishfuturestrust.org.uk)

[12] General facts and figures about roads and road use (racfoundation.org)

[13] nationalgrideso.com/document/283101/download; GB Fuel type power generation production (gridwatch.co.uk)

[14] Consumer Council for Northern Ireland, Energy Saving Trust, Transport Scotland, Scottish Futures Trust

[15] This is consistent with SPICE findings Electric vehicle charging – background and FAQs – updated 2023 – SPICe Spotlight | Solas air SPICe (spice-spotlight.scot)

[16] Average Vehicle Age - SMMT

[17] Consumer protection study 2022: understanding the impacts and resolution of consumer problems (publishing.service.gov.uk) – Table 30

[18] Consumer Scotland analysis of Department for Work and Pensions. (2024). Households Below Average Income, 2022/23. 18th Edition. UK Data Service. SN: 5828. Median weekly Gross, SPI'd income for the household before housing costs in Scotland is £674 per week, equating to £35,048 p.a.

[19] Department for Work and Pensions. (2024). Households Below Average Income, 2022/23. 18th Edition. UK Data Service. SN: 5828

[20]Scottish House Condition Survey: 2021 Key Findings Chapter 01 Key Attributes of the Scottish Housing Stock - tables and figures

[21] There can be significant tax benefits to consumers from salary sacrifice Salary sacrifice schemes: How can electric car drivers benefit? | RAC Drive

[22] Is it right to be worried about getting stranded in an electric car? | Business | The Guardian

What is EV charging anxiety? | Is EV range anxiety a thing of the past? | National Grid Group

[23] Decarbonising the Scottish Transport Sector

[24] evinfrastructurefundfaqpublished18may2023.pdf (scottishfuturestrust.org.uk)

[25] A4-EuropeanElectricCarMarket-09-2020.pdf (inquirymarketresearch.pl)

[26] House of Lords - EV strategy: rapid recharge needed - Environment and Climate Change Committee (parliament.uk)

[27] EV strategy: rapid recharge needed (parliament.uk) – Figure 7; the evidence states an assumption of 36 miles per gallon, however our assessment of the analysis indicates an assumption of 46 miles per gallon, so we have amended this. committees.parliament.uk/writtenevidence/124656/html/

[28] Scottish House Condition Survey: 2021 Key Findings Chapter 01 Key Attributes of the Scottish Housing Stock - tables and figures

[29] Revealed: the truth about electric car range - Which? News

[31] Vision for world class public electric vehicle charging network | Transport Scotland; Written question and answer: S6W-26942 | Scottish Parliament Website

[32] UK electric vehicle infrastructure strategy - GOV.UK (www.gov.uk)

[33] Worldwide Harmonised Light Vehicle Test Procedure | VCA (vehicle-certification-agency.gov.uk)

[34] Compare electric vehicles - EV Database UK (ev-database.org); ClearWatt - The second-hand electric revolution

[35] 6645d8ccf0f74f6e2b38382e_CoMoUK Car Club Annual Report UK 2023.pdf (website-files.com)

[36] Consumer protection study 2022 - GOV.UK (www.gov.uk)

[37] For example: Osprey to build largest EV charging hub in Scotland - transportandenergy; Electric Vehicles: Scotland’s most powerful hub opens in Dundee - BBC News

[38] CMA - Electric Vehicle Charging market study - Final report

[40] Domestic GB price cap rate, July-September 2024 Changes to energy price cap between 1 July to 30 September 2024 | Ofgem

[41] Draft Energy Strategy and Just Transition Plan - gov.scot (www.gov.scot)