1. Key point summary

Consumer detriment occurs when consumers experience problems or issues with the goods or services that they purchase and use. These problems can cause consumers stress, take time to resolve, or cost money to fix or put right.

Consumer Scotland conducted an analysis across multiple data sources into the level and nature of detriment commonly experienced by consumers, when purchasing goods and services or the use thereof. This briefing looks first at detriment in general, and goes on to examine detriment in three sectors that can be considered essential services in consumer markets, and where the evidence indicates a high prevalence of detriment: housing, telecommunications, and finance.

We gathered the following key insights:

- At a UK-wide level, younger consumers (especially those aged 18-39) were consistently more likely to experience detriment; to not take action to resolve issues; and to suffer the most negative consequences, when compared to other groups. Socio-economic factors also play a role, and it is concerning that those who can least afford to experience detriment appear to be the most at risk of doing so

- Whether and how consumers address detriment varies, depending on their own circumstances and on the type of good or service they are purchasing. The same groups that are more likely to experience detriment are often the same groups that are least likely to take action in response, compounding the initial harm experienced

- The most commonly reported type of detriment across multiple sources related to goods and services that were of poor quality or unable to be used, followed by issues with delivery or complete failure to provide items

- While 8 out of 10 consumers who experienced consumer detriment took action, only half of those who did obtain a satisfactory resolution.

Sectors with high levels of reported detriment across multiple sources were:

- Internet provision

- Electronic devices and software

- Clothing, Footwear and accessories

- Energy provision

- Public transport

At least one in every four purchases in these categories resulted in consumer detriment:

- Some sectors, such as second-hand vehicles, are consistently associated with high levels of detriment. However, detriment levels in other sectors are impacted by wider social, economic and political factors, such as the COVID-19 pandemic and supply issues around rented housing

- The rented housing sector accounted for the highest level of net monetised detriment (£7.4 billion UK-wide), with 17% of rental agreements resulting in some form of consumer detriment

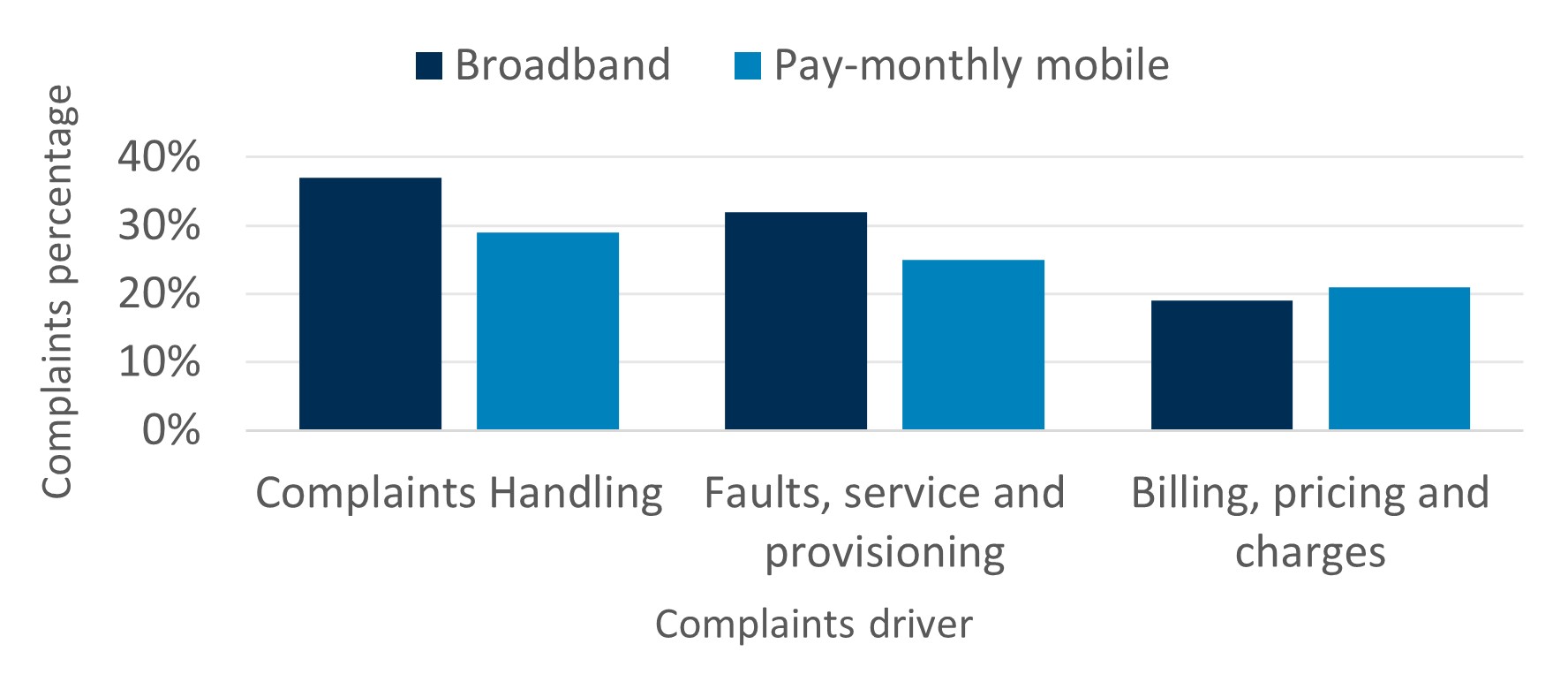

- Multiple data sources illustrate how poor customer service can itself create and exacerbate detriment. Complaints handling is consistently one of the three key drivers of complaints relating to both broadband services and monthly mobile phone contracts. The other two consistent complaints categories are Faults, service and provisioning; and Billing, pricing, and charges, with Complaints handling often coming in at the first place. This is also underlined in the financial sector, where the number one issue relating to detriment amongst adults with financial products was being unable to reach their provider (14%).

- Consumer detriment not only relates to consumers’ finances, but also to their mental and physical health. In sectors covering essential services or personal care, such as renting a home or personal care for an adult or a child, there is a higher likelihood of consumers experiencing a negative impact on their mental health when consumer detriment occurs, than in other sectors.

- Future research activity on these and other matters will be beneficial to further increase our understanding of consumer detriment and how it might be addressed.

2. About Consumer Scotland

Consumer Scotland is the statutory body for consumers in Scotland. Established by the Consumer Scotland Act 2020[1] (“the Act”), we are accountable to the Scottish Parliament. The Act defines consumers as individuals and small businesses that purchase, use or receive products or services.

Our purpose is to improve outcomes for current and future consumers and our strategic objectives are:

- to enhance understanding and awareness of consumer issues by strengthening the evidence base

- to serve the needs and aspirations of current and future consumers by inspiring and influencing the public, private and third sectors

- to enable the active participation of consumers in a fairer economy by improving access to information and support

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. In conjunction with that evidence base we seek a consumer perspective through the application of the consumer principles of access, choice, safety, information, fairness, representation, sustainability and redress.

We work across the private, public and third sectors and have a particular focus on three consumer challenges: affordability, climate change mitigation and adaptation, and consumers in vulnerable circumstances.

We have a statutory requirement to provide consumer advocacy and advice with a view to reducing harm to consumers, increasing consumer confidence and generally promoting fairness, inclusion and wellbeing.

The Act also requires us to produce a Consumer Welfare Report in 2026 (and every three years thereafter). The Consumer Welfare Report will need to set out how well the interests of consumers are being served in Scotland, and the nature and extent of any harm they experience. We interpret ‘consumer welfare’ in its broadest sense. By this we mean that it refers not just to the value that consumers get from consuming particular goods and services, but more generally how well markets work for consumers. More specifically, consumer welfare can be conceptualised as the extent to which markets meet consumers’ needs without causing them harm, or detriment. In this sense, our interpretation of consumer welfare is akin to, and interchangeable with, consumer wellbeing.

Consumer Scotland also has a particular responsibility to consider the welfare of consumers in vulnerable circumstances, since these consumers may be particularly at risk of harm, and have less scope to maximise their well-being. We are interested in understanding whether certain consumers, or groups of consumers, are at particular risk of experiencing detriment, or experience more severe detriment than others.

3. Background

The last few years have been marked by a period of sustained challenge facing consumers in Scotland and across the UK. Consumer Scotland has published research on the affordability of essential goods and services within the energy[2] and postal[3] sectors, and we have been researching the affordability of essential services in other sectors.

Navigating these financial challenges makes it all the more important that when consumers purchase goods or services, they can trust that these meet their needs without any problems. In reality, items may not meet the consumer’s expectations, may be faulty, be over-priced, or be otherwise sub-optimal.

The damage suffered by consumers in the marketplace when they encounter a problem relating to the purchase of an item or service, is defined as consumer detriment.[4] Consumer detriment can lead to consumers losing out financially if they have wasted their money and/or have to pay to get the issue resolved. It can also take up their time, as they try to get their issues resolved. Furthermore, it can impact on a consumer’s health and wellbeing, as a negative experience can cause stress and in some cases, be detrimental to physical health.

Consumer Scotland seeks to reduce harm to consumers and has through our research sought to clarify the prevalence and impact of consumer detriment in Scotland, so that solutions may be identified. This briefing paper presents our initial analysis of the available data on consumer detriment and sets out the implications of this for future work in this area. It aims to provide a general image of what consumer detriment in Scotland looks like, by bringing together a number of relevant data sets. The briefing considers the sectors in which consumers are most at risk of detriment, which consumers appear to be more likely to experience detriment, and how the experience of consumer detriment impacts on them, both financially and in broader terms.

We have looked in particular detail at three sectors that are important for consumers in different ways. The findings from this analysis are set out in three ‘Spotlights’ in Annex 1-3, focussing on private and social housing; broadband internet; and banking current accounts respectively.

4. Methodology

To improve our understanding of how consumers are most impacted by detriment in key consumer markets, we reviewed quantitative evidence gathered by government and advice bodies.

The objective of this review was to generate insight into how consumers experience detriment across different sectors, and to provide insight into some key similarities and differences between data sets.

An initial review was conducted using four main data sets:

- Consumer Protection Study 2022[5] (covering the 12-month period to April 2021)

- Public Attitudes Tracker Consumer Issues Spring 2023[6] (covering the 12-month period to April 2023)

- Advice Direct Scotland Data Portal (covering the 12-month period to the end of December 2023)

- Citizens Advice Scotland Data Hub (covering the 12-month period to the end of December 2023)

To illustrate the nature and effects of consumer detriment it can be helpful to look at the consumer experience in different sectors of the economy. We have therefore included three case study sections at the end of this briefing. These illustrate what detriment may look like in three differing sectors which relate to important components of consumers’ daily lives, and where the data indicates that levels of detriment can be significant:

- Spotlight 1 - An essential sector with tangible detriment: Private and Social Housing

- Spotlight 2 - An increasingly essential sector: Broadband internet

- Spotlight 3 - An essential sector based on customer service: Banking

Consumer Protection Study 2022 (“CPS22”)

The objective of the Consumer Protection Study was to gather information from consumers about their experiences of detriment. It offers an overview of these findings and highlights which product types and purchase channels are most likely to result in detriment. It also explores whether some groups of consumers are more likely to experience a problem and to then face more negative consequences as a result. It provides estimates of the overall incidence, financial value and impact on wellbeing of consumer detriment.

As the sample size for Scottish participants was small, we have reported Scottish data alongside the UK-wide results where possible. The CPS22 did not find statistically significant sectoral differences between the UK and Scottish samples.

The CPS22 primarily reports detriment incidence within a sector as the percentage of those who had purchased a product that experienced an issue as opposed to the percentage of the wider population that experienced an issue. Unless otherwise stated, percentages quoted within this report follow this definition. The difference between the two can be seen from the following explanation: 19% of consumers in the UK who purchased, or used, new vehicles experienced detriment, but only 1% of UK adults experienced detriment with new vehicles.

Public Attitudes Tracker (“PAT”) Spring 2023

The PAT is a quarterly survey conducted by the UK Government Department for Energy Security and Net Zero (DESNZ) (formerly BEIS). We reviewed the Spring 2023 edition, which covered 4,410 consumers across the UK in the period between 9 March and 6 April 2023 using a push-to-web methodology.

The ‘Consumer Issues’ section of the PAT presents data on the proportion of UK participants who experienced at least one problem with a sectoral purchase in the last 12 months. It does not contain any separate data for Scotland; however, as CPS22 did not find any statistically significant sectoral differences between the UK and Scotland samples, we consider that the PAT data provides relevant insights. We note that the ‘Consumer Issues’ component of this survey has now been discontinued.

When considering these figures, it should be noted that quantitative surveys such as the CPS22 and PAT are limited by their reliance on participants being aware that they have experienced detriment and them being able to accurately recall details such as the costs incurred.

Advice Direct Scotland Data Portal

Consumer Scotland has insight into the advice provided by Advice Direct Scotland (ADS) through their consumeradvice.scot service by means of a portal, which contains sectoral ‘complaints’ data. This database contains over 200 products and services categories, grouped into more than 50 general areas. For the purpose of this review, we analysed data for the 12 months to 31 December 2023.

Citizens Advice Scotland Data Hub

Consumer Scotland gains insight into advice provided by Citizens Advice Scotland (CAS) through dashboards containing high-level data on selected categories of consumer advice given by the network. This data draws on the experience of the hundreds of thousands of people who access advice from the Citizens Advice network in Scotland every year. The data dashboards do not include information from Citizens Advice Scotland’s Extra Help Unit, which provides second tier advice on complex and urgent issues – primarily related to energy, but also a relatively small number of postal issues. Additionally, we also gather insight from CAS publications such as monthly data reports that offer a summary of national trends in advice provided through the Citizens Advice network in Scotland and the CAS online advice site.

5. Findings

General

CPS22 found that overall, many purchases did not result in problems. On most occasions where there were problems, these were resolved to the satisfaction of consumers. It also found that most detriment incidents resulted in a relatively small cost to the consumer. At the same time however, it is clear from the research that detriment is pervasive.

CPS22 estimates that 69% of consumers across the UK (36 million) experienced at least one incidence of detriment over a 12-month period, causing consumers stress, and costing them money or time. Of the 229.6 million detriment incidents in the UK that year, 18.6 million were incurred in Scotland. This resulted in a net monetised detriment to consumers in Scotland of £4.7 billion, which represented around 2.5% of total Scottish Gross Domestic Product (GDP).[7] While consumers in Scotland and England (72% and 70%) reported a higher incidence of detriment than those in Wales and Northern Ireland (69% and 56%), the median ‘net monetised detriment’ per individual incident of detriment was £28 in Scotland, which was broadly similar to other parts of the UK.

While CPS22 showed that across the UK, Airline (36%) and Package holidays and tours (35%) were the two sectors with the highest incidence of detriment per active consumer, it is important to note the impact of wider factors. Participants suggested that the high prevalence of detriment in the first two categories was heavily influenced by the COVID-19 pandemic, with 13% of incidents mostly or fully caused by the pandemic and 30% of incidents made worse by it. These sectors have therefore been excluded from further analysis.

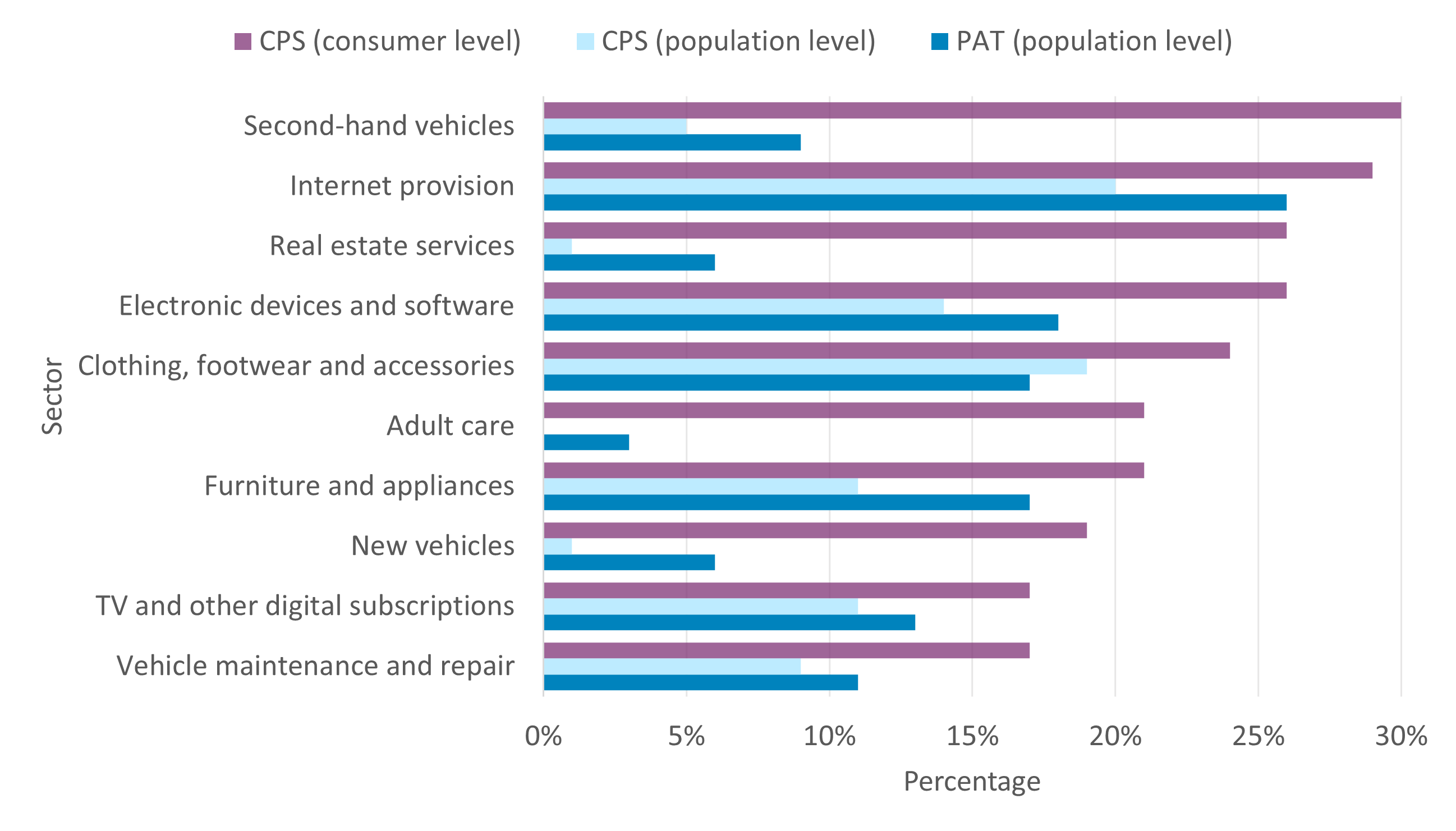

The variation in results depicted in Chart 1 below highlights that the experience of consumer detriment is affected by external factors more often than for once in a lifetime events such as COVID-19. In all sectors, the percentage point differences are statistically significant from each other despite the two studies using comparable methodology and definitions. This tends to suggest that consumer experience of detriment is not consistent.

The chart also illustrates the difference between the detriment rate per consumer active in the sector, and the detriment rate applied to population level. This presents challenges when trying to define detriment – is the more significant problem the sector that has a higher rate per active consumer, e.g. second hand vehicles? Or the sector in which more of the population are active, leading to higher detriment rates at the population level, e.g. internet provision?

Chart 1: Detriment occurs in a variety of different sectors and varies over time and between different surveys

The 10 leading detriment sectors in terms of the proportion of CPS participants who purchased goods or services/subscriptions in certain sectors and experienced detriment, compared with results from the PAT.

Sources: Department for Business, Energy & Industrial Strategy – Consumer Protection Study 2022; Department for Energy Security & Net Zero - Public Attitudes Tracker: Consumer Issues - Spring 2023. Note - chart strips out sectors from the CPS (e.g. ‘airline services’, ‘package holidays/tours’) in which detriment incidents were thought to be significantly skewed by COVID lockdowns/restrictions.

Similar contextual issues influence data from other sources too. CAS data shows a 128% increase in requests for advice relating to the Housing and Property First Tier Tribunal between December 2022 and December 2023, which may result from the impact of the eviction ban and rent cap in Scotland in place at the time, leading to more tenants seeking advice on exercising their rights.[8]

Caveats aside, in terms of problematic sectors, both CPS22 and PAT demonstrate relatively high levels of reported detriment in relation to internet provision. Just under a third (29%) of active consumers surveyed in the CPS22 reported detriment in this sector, while the rate at population level was 20% for CPS22 and 26% for PAT. Electronic devices and software (26%), Clothing, Footwear and accessories (24%), and Furniture and appliances (21%) also featured heavily in CPS22. PAT reported higher levels of detriment at population level than CPS22 in every sector other than clothing, footwear and accessories. As the PAT survey fieldwork took place later than the CPS22 survey, these findings may be linked to cost of living pressures and changes to expenditure patterns. However, further analysis to establish whether this is the case fell outwith the scope of our initial research.

Other measures of assessing detriment, include considering net monetised detriment. According to CPS22, the Second-hand vehicles sector, the sector with the highest incidence of detriment per active consumer, also accounted for the highest level of net monetised detriment, with a median net monetised detriment of £463 per incident UK-wide (£7.4 billion in total). In Scotland, 40% of purchases in this sector were associated with detriment, albeit this was from a small sample of active consumers.

Who is likely to experience detriment

CPS22 found that across the UK, younger consumers (aged 18-39 in particular) were consistently more likely to experience detriment, to not take action to resolve issues, and to suffer higher levels of negative impact on their physical or mental health or household finances, when compared to other groups. Similarly, PAT identified that for both products and services and subscriptions, consumers aged under 45 were more prone to detriment, particularly when compared to those over 65.

CPS22 findings also associated having a limited disposable income with a higher likelihood of experiencing detriment. Those who self-assessed as ‘finding it very difficult’ to get by were the most at risk of detriment, with 86% of this category reporting they had experienced detriment. It is possible that having less disposable income means having less choice, or compromising quality for price. However, further research would be required to establish whether and to what extent this is the case.

The nature of detriment

Available survey data suggests that detriment varies by sector, changes over time and is shaped by the wider economic and social context. Further research would be required to establish exactly why certain sectors are more strongly associated with detriment at certain points in time.

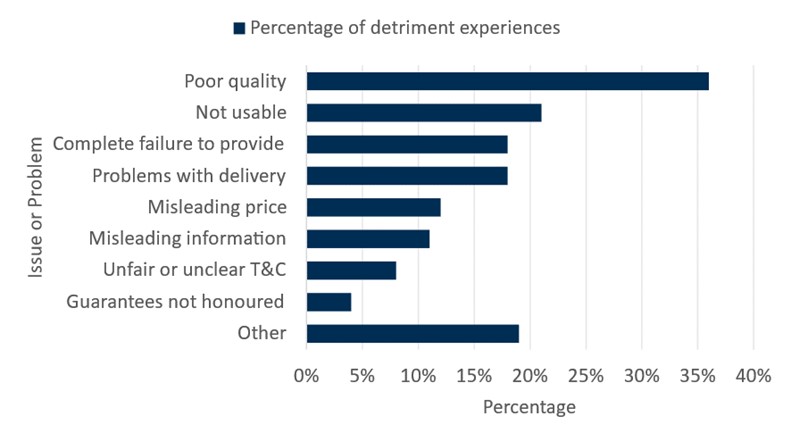

The most commonly reported type of detriment in CPS22 was ‘poor quality goods and services’ (36%) , as set out in Chart 2 below. ‘Not usable’ (21%), ‘problems with delivery’ (18%) and ‘complete failure to provide’ (18%) also featured prominently.

The category ‘other’ (19%) included ‘issues with returns/returns being difficult or not an option’; ‘difficulties leaving a service or cancelling’; ‘difficulties altering or changing a service’; and ‘fraud/account was hacked’.

Chart 2. Poor Quality Goods and Services is the most commonly experienced cause of detriment across the UK

The proportion of detriment experiences CPS22 participants attributed to different causes.

Source: Department for Business, Energy & Industrial Strategy – Consumer Protection Study 2022: All detriment experiences in the UK in the 12 months to April 2021. Unweighted base: 9,416.

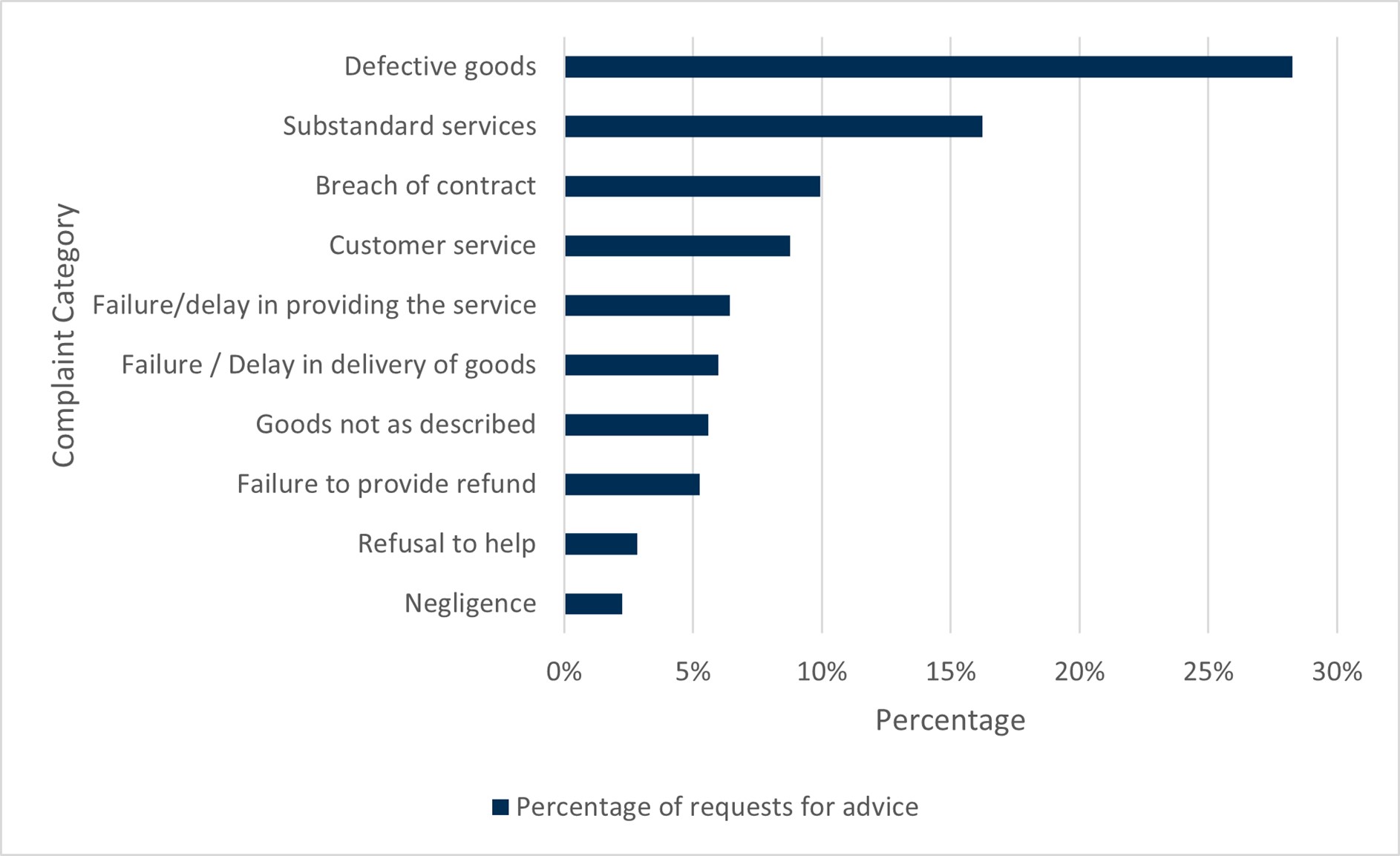

The data available from the ADS consumer service makes a useful point of comparison to the CPS22, and identifies similar issues. Within the ADS consumer service, the most prevalent complaint category was “defective goods” which accounted for 28% of all requests for advice, a similar category for services – “substandard services” – was the second most prevalent, accounting for a further 16% of requests.

Chart 3. Poor quality goods and services feature prominently within requests for advice to the ADS Consumer Service

The proportion of requests for advice relating to the top ten complaint categories.

Source: ADS Consumer Service advice portal.

As highlighted within the ADS data, poor customer service can itself be a source of detriment and can make it harder for consumers to take action to resolve detriment. Within the ADS dataset, “customer service” was listed as the complaint category for 9% of requests for advice, and is also implied in other complaint categories such as failure to provide refund (5%), refusal to help (3%), and unclear billing / charging (1%). In relation to telecoms services, Ofcom reported in April 2024 that the three key drivers of complaints relating to both broadband services and monthly mobile phone contracts were Complaints handling; Faults, service and provisioning; and Billing, pricing, and charges.[9]

The impact of detriment on consumers’ health and wellbeing

Consumer research published by the Joseph Rowntree Foundation[10] and the Resolution Foundation[11] found that mental health and wellbeing are increasingly prominent areas of focus in consumer surveys. However, the true health impacts of consumer detriment are difficult to assess in the absence of more detailed research.

The impact of detriment on consumers’ health, wellbeing, and time was examined in CPS22. In addition to costing consumers money and time, the findings suggest that detriment incidents often had a negative impact on wellbeing. Across the UK, 50% of incidents had a negative impact on the consumer’s mental health, and 28% on physical health. Across all sectors, over half of the detriment incidents were associated with respondents feeling either anxious, helpless, misled or upset. The most commonly reported feeling/emotion was ‘upset’ (66% of incidents). As noted by Which?, issues relating to essential services such as housing or personal services such as childcare or social care generally resulted in more negative impacts on consumers’ mental health.[12]

CPS22 finds that detriment incidents broadly have a negative impact on consumers’ mental, physical, and financial health. However, there is little detail on the knock on impact of detriment, for example, whether detriment resulted in consumers being off work with stress, going without services or incurring debt to cover monetary loss. Further research would be required to gain greater insight into the cumulative impacts of detriment on consumers.

Wider research shows the impact of poor quality goods and services on a consumer. For example, The Resolution Foundation conducted research examining the impact of poor quality housing on consumers’ mental and physical health. This found that, even after controlling for demographic and income-related factors, people in poor quality housing were more likely to be in poor general and mental health. [13]

The study, which had 10,122 participants aged 18+, found that across the UK, 10% of adults live in poor quality housing (such as that in a poor state of repair, damp, or without working heating). It indicated that 30% of private sector tenants lived in a property with damp, while 29% of social housing tenants lived in a property in a poor state of repair. Those aged 18-34 (18%); those with incomes in the lowest quintile; disabled people; single people; and those of Pakistani, Bangladeshi, or Black backgrounds were the most likely to be exposed to such detriment.

Actioning and resolution of detriment

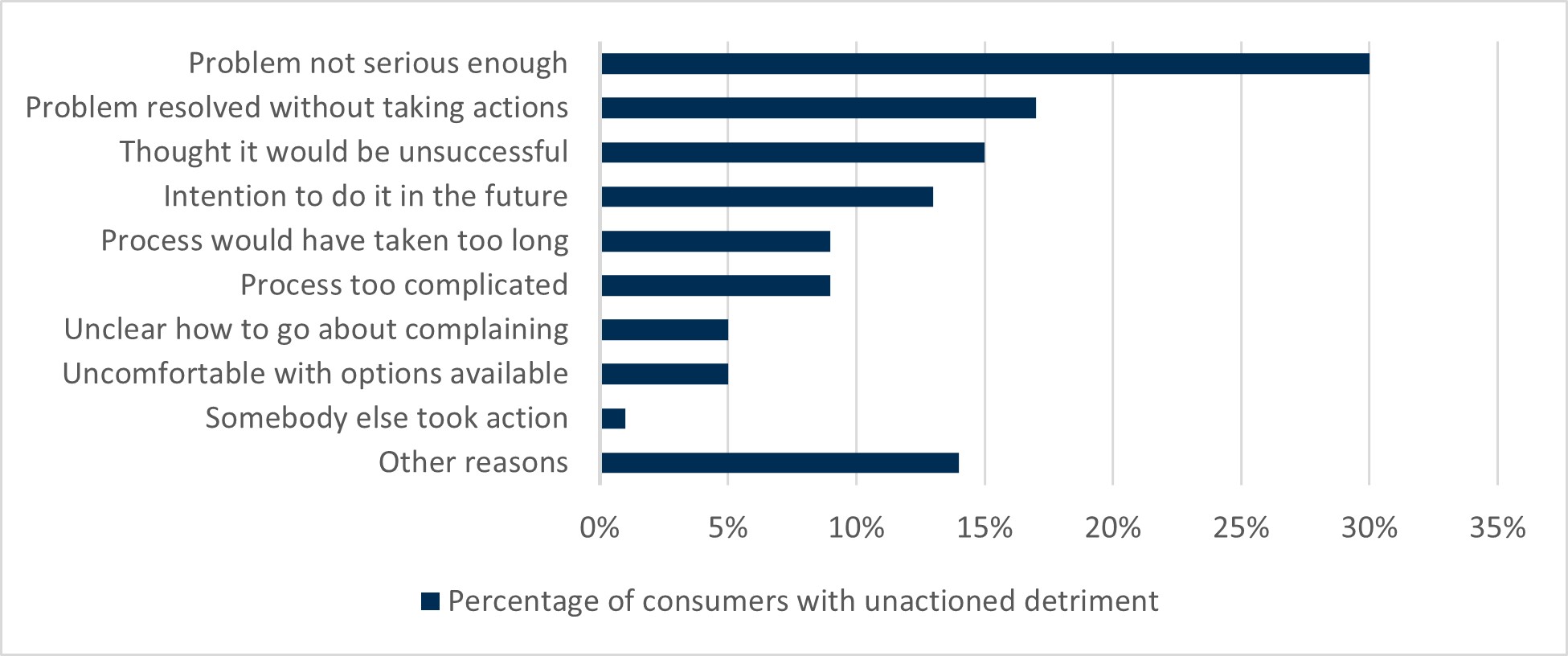

Unaddressed consumer detriment is a known barrier to improving consumer outcomes. The same groups who are more likely to experience detriment are often the same groups that are least likely to take action in response, compounding the initial harm experienced. According to CPS22, 18% of participants who had experienced consumer detriment did not take action.

Consumers make use of different pathways to obtain redress. CPS22 found that in 81% of cases, the consumer contacted the seller, service provider, or producer directly. Consumer rights and advice bodies were contacted in 4% of cases, and dispute resolution services or Ombudsmen in 3% of cases. In the case of Ombudsmen, this is likely because consumers must generally exhaust complaints procedures with their providers before contacting an Ombudsman. However, to establish the reasons for these patterns, further research would be required.

Chart 4. The most common reason for taking no action in relation to a detriment incident was due to the problem not being considered serious enough

Reasons why consumers did not action incurred detriment.

*Note: ‘Other reasons’ includes factors such as COVID-19 related reasons and fears of incurring additional costs.

Where consumers do take action, satisfactory resolution is not always achieved. CPS22 defines a negative resolution as an outcome where consumers received nothing, or did not receive what they asked for. A positive resolution is defined as an outcome where consumers received what they asked for; received what they asked for and something else; or received some form of compensation even if this was not requested.

Overall, 56% of actioned consumer detriment incidents resulted in a positive resolution and 55% were described as having a satisfactory outcome. In 19% of actioned incidents, there was a negative resolution, and in 25% of cases, nothing was asked for or offered. The most achieved outcomes were replacement/repair (48%), refunds (27% full, 10% partial), apologies (42%), and explanations (27%). These were also the four most frequently requested actions.

According to CPS22, consumer complaints were most likely to result in a negative resolution in the Renting services (38%), Medical and dental services (38%), and Internet provision (29%) sectors. A negative resolution was also more likely if the product value was over £5,000. It is possible that expensive or specialised products result in repair, replacement or compensation being more difficult or prohibitively expensive. However, further research would be required to ascertain this. At 60%, CPS22 participants who complained regarding Internet provision were the most likely to achieve a satisfactory outcome. The study noted that detriment due to poor quality came with a lower likelihood of achieving a positive resolution (51%) than other causes of detriment (58%).

We noted a relatively low level of consumer contact with advice bodies in relation to broadband and mobile phones. Insights by Ofcom suggest this may be due to consumers seeking a resolution directly with their service provider initially, and subsequently via Alternative Dispute Resolution, or by contacting Ofcom.[14] Ofcom does not handle individual complaints, but is able to signpost consumers to other bodies.

6. Conclusions and next steps

Available evidence on consumer detriment shows that the experience of individual consumers is dependent on a variety of factors. This includes personal factors such as age and socio-economic circumstances, and the sector the product or service was purchased in. These factors affect the likelihood of experiencing detriment, as well as how consumers can take action to resolve issues and the chances of achieving a satisfactory outcome.

Overall, poor quality of goods and services is the most prevalent cause of detriment consumers experience. This is particularly worrying as consumers continue to experience challenges in terms of affordability. This emphasises how important it is that consumers are able to make purchases that provide adequate value for money, and that are of acceptable quality.

While detriment can cause financial consequences, it can also have a profound impact on health and wellbeing. This is not only in the form of stress, but also physically, for example, when consumers become ill due to poor quality housing or unable to access other services through poor broadband quality or issues with financial services.

Further research and analysis may improve our understanding of the detriment consumers experience and what actions might help improve consumer outcomes. Research into the impact of factors such as household income and education may provide insight into which consumers are most prone to detriment. Research may also examine the reasons for the fluctuation of detriment levels in certain sectors throughout time.

Consumers appear to respond differently in relation to detriment experienced in different sectors. When consumers take action to address detriment they also make use of different pathways. A deeper understanding of consumer awareness of and access to information around their rights, complaints, and redress may help identify how consumers can be supported to resolve issues more easily and effectively.

In line with our strategic objective of enhancing the understanding and awareness of consumer issues by strengthening the evidence base, we examined multiple data sources from across the research, advice, regulatory, and dispute resolution landscape. This has enabled us to compile a general overview of the level, causes, and impact of consumer detriment in Scotland. This overview can now be used to inform the future activities of Consumer Scotland and other organisations, in the research and policy space.

Consumer Scotland intends to work with partner organisations to address current and future evidence gaps so that consumer detriment can be better understood, and appropriate actions can be taken. In particular we note that follow up work to the CPS is currently in progress, and we will conduct our own analysis of these findings once available.

7. Spotlight case studies

While the category ‘renting a home and associated services’ had a relatively small sample size in Scotland in CPS22, this sector contained the highest level of net monetised detriment (£7.4 billion UK-wide), with 17% of purchases associated with detriment. Consumers experienced a median net monetised detriment of £442 per incident across the UK. This is only surpassed by the category second-hand vehicles, where the median net monetised detriment was £463.

In December 2023 CAS published its report In a Fix, an analysis of housing repairs advice across the CAS network.[15] Across all tenures and including owner-occupiers, water, damp and mould were the most prevalent cause of detriment. Damp and mould led to many instances of health-related detriment, and were often cited as “being a significant cause of stress and worry” especially when they were experienced over the long-term. It noted concerns, especially from PRS tenants, about the reported “threat of eviction or illegal eviction” when reporting repair issues. As a result, the problem can be left and often deteriorates further. CAS recommended that the Scottish Government conduct in-depth research on this topic.

The Scottish Housing Regulator’s National Panel of Tenants and Service Users 2023 to 2024 showed that while 49% (down from the 53% the previous year) of survey respondents believed the rent they paid was good value for money, 35% (26% in the previous year) indicated that the value was poor or very poor.[16] This suggests increasing levels of dissatisfaction with the value for money presented by rental properties.[17]

Notably, most participants in the qualitative element of this report mentioned the inability of a home to be efficiently heated as an indicator of a lack of quality when judging the value for money. Another major concern for participants was the lack of responsiveness of landlords when carrying out repairs, indicating low-quality service.

Spotlight 2 - An increasingly essential sector: Broadband internet

Access to quality broadband has become increasingly important, leading to some commentators arguing that broadband should be designated as an essential utility.[18] While CPS22 does not provide data on what constitutes poor quality in internet provision, it did highlight a problem around quality in internet provision with 50% of detriment instances relating to internet provision being due to poor quality. Other research suggests that internet speed and reliability are important to consumers and issues with these could explain the high prevalence of quality problems experienced. According to Ofcom, in January 2024, an estimated 16,297 residential and commercial premises in Scotland were still unable to access ‘decent’ broadband (10 Mbit/second download and 1 Mbit/second upload speed) via a fixed line. These issues are likely to continue for some time to come, particularly in remote, rural and island communities.[19]

CPS22 found that 27% of purchases of internet provision services in Scotland (29% UK-wide) had resulted in the consumer experiencing detriment. This sector also had the fourth highest net monetised detriment UK-wide, at a cost of £3.4 billion. Consumers who reported issues with Internet provision experienced a median net monetised detriment of £55 per incident. PAT demonstrated that 26% of respondents had experienced detriment relating to their broadband internet services and subscriptions.

Ofcom reported in April 2024 that the three key drivers of complaints it received from July-September 2023 relating to both broadband services and monthly mobile phone contracts were complaints handling; faults, service and provisioning; and billing, pricing, and charges.[20] While 55% of CPS22 respondents who experienced detriment relating to telecoms and other digital subscriptions obtained a positive resolution, 25% resulted in a negative resolution. This is the highest percentage of negative resolutions after the Housing-related services category.

Chart 5. Complaint Handling was the highest driver of complaints received in relation to broadband and pay-monthly mobile

Key drivers of broadband and pay-monthly mobile services complaints

Source: Ofcom - Report: Complaints about broadband, landline, mobile and pay-TV services - Ofcom

Spotlight 3 - An essential sector based on customer service: Banking

In a sector that is based on services rather than a tangible product, detriment is more likely to be experienced in the form of poor customer service and IT-issues. A look at consumer detriment experienced with the financial services of current accounts, loans, and banking illustrates this.

CPS22 found that 11% of participants in Scotland and 8% of participants UK-wide had experienced detriment in the current accounts, loans and bank services category. At UK level, this generated a net monetised detriment value of £1.1 billion, at a median net monetised detriment of £28 per incident. Interestingly, this is not a sector that featured particularly prominently for requests with advice from the ADS consumer service, however this may be because consumers were able to seek resolution themselves.

The FCA reports that in the category of day-to-day accounts and consumer credit regulated agreements, respectively 14% and 16% of respondents UK-wide reported having experienced detriment.[21] Extrapolated to the 52 million adults who use financial services in the UK, this would translate to 7 million and 6.4 million consumers respectively. The most commonly reported customer service issue concerned contacting financial services providers, with 14% of adults who held financial products reporting they were unable to reach providers. Of those who were able to contact their provider, 7% did not receive the requested information or support (which would extrapolate to 3.6 million people), while 4.3 million adults said they received information which they could not understand, was not what was needed, or was not timely. These are significant numbers.

The Financial Lives Survey found that 24% of respondents experienced technology issues such as IT failures and service disruption; however, only 3% of them said they had been severely affected by this. Poor customer service, unexpected changes to services or terms and conditions, and issues around costs or fees were also frequently reported quality of service issues.

The Financial Ombudsman Service has reported record levels of complaints regarding the use of credit cards over the period October to December 2023. [22] Over the year 2023/2024, the majority of these complaints (56%) concerned financial providers not taking enough responsibility to protect the consumer from unaffordable lending.[23] Figures show that the largest number of complaints is consistently about current accounts.

The FCA Consumer Duty came into force on 31 July 2023, which should result in financial service providers offering better and more accessible support, clear communications, and products and services that are right for the consumer.[24] It is anticipated that over time this will reduce consumer detriment levels in the financial sector.

8. Endnotes

[1] Consumer Scotland Act 2020 (legislation.gov.uk)

[2] consumer-spotlight-energy-affordability-tracker-3.pdf

[3] the-affordability-of-the-universal-postal-service.pdf (consumer.scot)

[4] 304252-Toolkit-recommendation-booklet.pdf (oecd.org)

[5] Consumer protection study 2022 - GOV.UK (www.gov.uk) This is the most up to date version available at the time of publication of this briefing

[6] DESNZ PAT Spring 2023 Consumer Issues (publishing.service.gov.uk) The most up to date version available at the time of publication of this briefing

[7] Scottish Government: GDP Quarterly National Accounts - 2021 Quarter 1

[8] december_2023_dashboard.pdf (cas.org.uk)

[9]Report: Complaints about broadband, landline, mobile and pay-TV services - Ofcom

[10] Anxiety nation: Britain’s epidemic of mental health problems and rampant economic insecurity | Joseph Rowntree Foundation (jrf.org.uk)

[11] Pressure on pay, prices and properties • Resolution Foundation

[12] Consumer harm in the UK: What does the Consumer Detriment Study tell us? - Which? Policy and insight

[13] Trying-times.pdf (resolutionfoundation.org)

[14] Telecoms and pay-TV complaints - background and methodology (ofcom.org.uk)

[15] In a Fix | Citizens Advice Scotland (cas.org.uk)

[16] National Panel of Tenants and Service Users 2022/23 (housingregulator.gov.scot)

[17] National Panel of Tenants and Service Users 2022 to 2023 | Scottish Housing Regulator

[18] Harnessing technology for the long-term sustainability of the UK’s healthcare system: report - GOV.UK (www.gov.uk)

[19] Interactive report 2024 - Ofcom

[20] Report: Complaints about broadband, landline, mobile and pay-TV services - Ofcom

[21] Financial Lives 2022 survey | FCA

[22] Quarterly complaints data: Q3 2023/24 (financial-ombudsman.org.uk)

[23] Annual complaints data and insight 2023/24 (financial-ombudsman.org.uk)

[24] Consumer Duty sets higher standards for financial services customers | FCA