1. Acknowledgements

The authors are grateful to staff at Scottish Water, the Water Industry Commission for Scotland (WICS), the Scottish Government and the Independent Customer Group for helpful discussion and comment on previous versions of this research.

The authors also wish to express their thanks to Professor Ashwin Kumar at Manchester Metropolitan University, who provided invaluable advice on and support of the underlying modelling that informed this work.

2. Executive Summary

Background

Scottish Water provides water and wastewater services to around 2.6 million dwellings in Scotland[i].

Charges levied on households fund Scottish Water to deliver these services. The average charge per household was £410 in 2023/24, generating revenues for Scottish Water of just over £1bn. The specific charge faced by any household is determined by the council tax band that the property falls within, plus various discounts, reductions and exemptions.

Determining the appropriate level and structure of water charges is about balancing two competing considerations.

- On the one hand, ensuring sufficient income is raised from customer charges to adequately fund existing services and invest in the infrastructure required for the future.

- On the other hand, ensuring that these customer charges don’t unfairly burden consumers in general, and those least able to pay in particular.

These issues and trade-offs will be at the heart of the forthcoming Strategic Review of Charges, the process which determines the trajectory for customer charges during the 6-year period from 2027-2028 to 2032-2033.

This report aims to inform that debate by examining the affordability of water and sewerage charges in Scotland in the recent past and considering the outlook for coming years. It also considers some of the options for enhancing the affordability of water charges, examining the impact of these on bill affordability and on revenues from charges.

Evolution of charges

During the 2021-2027 plan period, Scottish Water is permitted to increase domestic water charges by up to a maximum of two percentage points above the CPI rate of inflation (CPI+2%) on average each year.

Charges were increased by CPI+2% in 2021-2022. They were then increased by less than CPI+2% in both 2022-2023 and 2023-2024, before increasing by 8.8%, almost double the CPI rate of 4.6%, in 2024-2025.

The result is that the water charge is around the same level – in inflation-adjusted terms – in 2024-2025 as it was in 2021-2022. However, charges in 2024-2025 are around 7% below where they would have been had a CPI+2% pathway been followed in each year, equivalent to around £50 for the typical household.

Measuring water affordability

This report considers water affordability by examining trends in a widely-recognised measure of ‘water poverty’. This measure deems that households spending more than 3% of disposable income on water and sewerage services are in ‘water poverty’, and households spending more than 5% of disposable income are in ‘severe water poverty’.

Limitations of these measures include that they ignore other aspects of households financial wellbeing, such as debt and assets, and income volatility and uncertainty. Nonetheless, the water poverty measures used in this report remain the most pragmatically useful, given the availability of data, and they allow for comparisons to be made across time for different types of customer.

Recent trends in water poverty

We estimate that around 10.6 per cent (275,000) households in Scotland are in water poverty in 2024-2025. Within this group, 120,000 households are deemed as being in severe water poverty (4.6% of all households).

These estimated water poverty rates are broadly in line with the decade preceding the cost-of-living crisis. Between 2011-2011 and 2021-2022, the water poverty rate was consistently between 11-12%, while the severe water poverty rate was consistently around 4-5%.

The water poverty rate is estimated to have been slightly lower in 2022-2023 and 2023-2024. This reflects the fact that Scottish Ministers and Scottish Water agreed not to increase water charges by the possible CPI+2% in recognition of the pressure on households, such that the water charge increased more slowly than household incomes, partly because of temporary boosts to social security payments associated with the cost-of-living crisis.

Illustrating trade-offs

Our analysis also shows what may have happened to water poverty rates if the water charge had increased by CPI+2% in each year of this SRC period, (i.e. a 6.2% increase in charges in 2022-2023 and a 13.1% increase in 2023/24, rather than the actual increases of 4.2% and 5% respectively).

- We estimate that the 3% water poverty rate would have been around 1.5 percentage points higher by 2023-2024 had this scenario occurred, implying an additional 38,000 households in water poverty.

- However, the flipside is that higher charges would also have generated additional revenues for Scottish Water. We estimate that Scottish Water revenues would be almost £100m higher in each year from 2023-2024 onwards had this alternative charging scenario been followed.

- This illustrates the challenges in trading off, on the one hand, the requirement to raise revenues from customer charges to fund investment in the water network, and on the other hand, the imperative of ensuring that water charges are affordable to current consumers.

Characteristics of households in water poverty

The most significant risk factor for water poverty is having low income. Amongst the ten per cent lowest income households, seven in ten are in water poverty. This falls to two in ten amongst households in the second lowest income decile.

Virtually no household in the top half of the income distribution spends more than 3% of its income on water and sewerage.

Of the 275,000 households in Scotland in water poverty, nearly all are also in low income poverty. Only 25,000 households are in water poverty but not in low income poverty.

Other household characteristics are less directly correlated to water poverty, but include:

- Council tax band: water poverty rates are higher in council tax bands E, F, and G than in A, B, C and D. This reflects wide variation in household income within each band, combined with the fact that charges are systematically higher in higher banded properties.

- Family type: Water poverty rates are lower amongst pensioner households than working age households. But water poverty is fairly ubiquitous across household composition.

- Housing tenure: Water poverty rates have tended to be higher amongst households in the private and social rented sector than owner occupiers. There is some evidence that increases in mortgage rates in 2022-2023 and 2023-2024 has narrowed this gap in water poverty rates by tenure.

Our analysis suggests that only around one third of households in water poverty are in receipt of the Water Charges Reduction Scheme (WCRS), the scheme which provides bill reductions to low income households. On the other hand, a majority of WCRS-recipient households are not in water poverty. This mismatch between water poverty and receipt of the WCRS demonstrates the challenges in targeting bill support when the financial circumstances of households can never be known with certainty.

Modelling the impacts of policy change

We model the impact of various potential policies to enhance water affordability. We model the impact of these changes in 2024-2025 because there is greater certainty about the parameters, but the findings will be generalisable to future years.

- The increase in the Water Charges Reduction Scheme (WCRS) from 25% to 35% - which was implemented in 2021-2022 – is estimated to have brought an additional 185,000 households into the scheme. The water poverty rate is around 0.3 percentage points lower (equivalent to 8,000 households) as a result.

- Increasing the WCRS to 50% would reduce water poverty by a further 0.5 percentage points (13,000 households) at a cost of around £22m. All WCRS recipient households would benefit financially from this change; its impacts are thus broader than indicated by the poverty analysis alone.

- These costs of increasing the WCRS would tend to be funded by higher charges on customers more generally. Increasing the WCRS from 35% to 50%, at a cost of £22m, would imply an additional £8 annually on all bills.

- The key reason why increases in the WCRS don’t have more of an impact on the poverty rate is that there is some misalignment between households in water poverty and households in receipt of Council Tax Reduction (which is the condition for WCRS receipt).

- Halving the Single Person status discount would reduce spending on this discount by around £40m, potentially freeing up resources that could be allocated to supporting households facing the most acute affordability challenges. Single Person households in receipt of WCRS would be insulated from the effects of reducing the Single Person discount. But Single Person households not in receipt of the WCRS would be exposed to the effects of any increase in charges. The water poverty rate would increase by just over half a percentage point, equivalent to around 13,500 households.

Conclusions

The current Strategic Review of Charges (SRC) has recently commenced and will consider the outlook for charging during the 2027-2032 period. There is likely to be a significant need to support growth in investment to maintain service levels and invest for the future, particularly given the challenges of adapting to climate change.

This is likely to lead to a need for above-inflationary increases in the water charge. It is therefore important that improvements to affordability mechanisms are robustly considered alongside the SRC process.

The Scottish Government has made clear that it does not intend to fundamentally revisit the structure of water charges and the affordability mechanisms in advance of the 2027-2033 charging period.

However, in light of the likely increases in charges during this period, it is vital that low-income consumers are protected from the impacts of those charges. Whilst the WCRS is not perfect – in the sense that not all consumers in water poverty receive it – it will remain the most effective tool available to the government to support low-income consumers with their bills.

Consumer Scotland therefore recommends that the level of discount provided through the WCRS is increased from 35% to 50% in April 2027, and maintained at that level throughout the duration of the 2027-2032 period. This is likely to represent a relatively cost-effective way of helping to keep bills affordable for many households in the short term, particularly if it coincides with efforts to raise the take-up of Council Tax Reduction. This policy change would reduce the number of households in water poverty, and improve the affordability of bills for some low-income households who are not technically in water poverty.

However, an increase in the WCRS would not benefit all households in water poverty, since a large number of those households are not in receipt of it. Because of this, Consumer Scotland also recommends to the Scottish Government that there is a case for scoping the potential for introducing an additional ‘by-application’ mechanism to offer reductions in charges for customers who fall through the gaps of existing affordability support mechanisms. This would only be practical if an appropriate mechanism for delivering such a by-application scheme could be designed and administered for costs that are commensurate with the expected level of take-up. It would be a temporary measure until better a targeted structure of affordability support could be introduced in the longer-term.

Progressing these recommendations would act to provide meaningful support and additional protection for those who may struggle to afford their water and sewerage charges in the upcoming charging period, while the sector explores more comprehensive reform to the structure of water charges in the coming years.

3. Introduction

Scottish Water provides water and wastewater services to around 2.6 million dwellings in Scotland. The annual charge paid by households for these services is determined by the council tax band that the property falls within, with various discounts, reductions and exemptions also available to certain households.

Charges levied on these households for waste and wastewater services (after reductions and deductions) totalled just over £1bn in 2023-2024, equivalent to an average charge per household of £410.

Determining the appropriate level and structure of water charges is about balancing two competing considerations. On the one hand, ensuring sufficient income is raised from customer charges to adequately fund existing services and invest in the infrastructure required to address the challenges of climate change and ageing infrastructure. On the other hand, ensuring that these customer charges don’t unfairly burden consumers in general, and those least able to pay in particular.

Getting this trade-off between these considerations ‘right’ is partly about determining the overall level of consumer charges and how these are increased over time. But it is also about how those charges are shared across customers via the tariff structure, and how various discounts and reductions are targeted.

The trade-off is particularly challenging at present. Household finances are continuing to recover from the cost-of-living crisis and long period of income stagnation that preceded it. At the same time, there is a need for significant investment in the water network, both to sustain and enhance service quality whilst mitigating the impacts of climate change.

These issues and trade-offs will be at the heart of the forthcoming Strategic Review of Charges, the process which determines the trajectory for customer charges during the 6-year period from 2027-2028 to 2032-2033.

This report aims to both inform the context for the upcoming Strategic Review of Charges, and support future discussions on the basis of charging, by examining the affordability of water and sewerage charges in Scotland in the recent past and considering the outlook for coming years. It considers how the affordability of water bills have evolved over time, and which type of consumers are most likely to face affordability challenges. It also considers some of the options for enhancing the affordability of water charges, examining the impact of these on bill affordability and on revenues from charges.

In theory at least, there are a wide range of options for reform of the approach to water charging. In the extreme, these options could include moving away from the current approach to levying charges on the basis of council tax band, perhaps to a system of metering. In practice however, Scottish Ministers have indicated that the current approach to charging – with local authorities billing and collecting charges for unmetered households on the basis of council tax band – will broadly remain in place throughout the 2027-2033 period, with the prospect of more fundamental reform in the longer term.[ii]

In this context, this report sets out options for changes to affordability mechanisms that could work practically within the existing tariff structure. The report recognises that, whilst the current charging system is imperfect, it will likely remain in place, broadly in its current form, until at least 2033. Whilst there is some appetite for more fundamental reform, fundamental change would require an extensive period of analysis, deliberation and consultation.[iii]

The report argues that there are practical steps that can be taken within the existing tariff system to better protect those at risk of water poverty, notwithstanding the more fundamental reforms that may take place in the longer term.

4. Water charging policy

The framework for water charging policy

The determination of water charges in Scotland is framed by a six year plan period. The current charging framework covers the period from April 2021 to March 2027.

During the two years prior to the commencement of a six-year plan period, a Strategic Review of Charges (SRC) is undertaken involving government, regulators, Scottish Water and customer representation to determine the basis for water charging during the six-year plan period itself. This culminates in an agreed tariff structure for water charges, and leaves some discretion for Scottish Water to determine annual increases in charges, within an overall financial envelope set by the regulator.

During the SRC, Scottish Ministers set out objectives for Scottish Water, and a Statement of Charging Principles. The objectives for 2021-2027 cover aspirations in relation to standards of service, asset maintenance, supporting economic growth, addressing issues relating to climate change, flooding and the environment, amongst others[iv].

The Statement of Charging Principles 2021-2027[v] establishes five principles that Ministers expect Scottish Water and WICS to follow, when determining charges. These principles are set-out in Box 2.1. In addition, the Statement of Charging principles establishes in legislation the tariff structure to be applied over the six-year plan period, i.e. the ratio of charges applied to different council tax bands, as well as the design of reductions and discounts).

Box 2.1: Summary of Scottish Ministers Principles of Charging 2021-2027

|

The Scottish Government, in its Principles of Charging report for 2021-2027, identifies five key principles for water charging: 1. Charges should be reasonably stable over time (having regard to inflation); 2. There should be full-cost recovery (Charges should cover the full costs of providing services to customers) 3. Charges should be harmonised geographically (i.e. similar customers in different parts of Scotland should not face different charges for equivalent services) 4. Charges should be cost-reflective (this is effectively a finer grained version of the full-cost recovery principle, i.e. charges for drinking water to households should reflect the cost of providing drinking water to households) 5. Charges should be fair, equitable and affordable both to the present and future generations. |

With the overall tariff structure determined by Scottish Ministers in the Principles of Charging, Scottish Water sets the annual increase in the charge. However, its proposed annual increase must be approved by WICS within the context of guidelines set out by WICS during the SRC, in a document known as the Final Determination.

The ‘Final Determination’ represents WICS’ judgement of the level of revenue Scottish Water needs to collect through customer charges in order to deliver the objectives set for it by Scottish Ministers, consistent with the ‘Principles of Charging’.

Specifically, in its ‘final determination’, WICS determines the ‘lowest reasonable overall cost’ that Scottish Water will have to incur to meet Ministers’ environmental, quality and service objectives for the industry, taking into account Scottish Water’s costs and efficiency.

The outcome of WICS’ Final Determination is thus a maximum amount of charges that Scottish Water can levy during the six-year regulatory control period.

The SRC process is informed by customer views. During the SRC for 2021-2027 this customer engagement was through a Customer Forum, an innovative attempt to build consumers into the process.

To summarise, water charges in a six-year charge period are determined as the outcome of a series of decisions and guidance by Ministers, WICS and Scottish Water during the Strategic Review of Charges. Key elements include:

Scottish Ministers set a series of objectives for Scottish Water, together with a set of principles of charging, and determine the overall tariff structure.

WICS makes a judgement about the level of revenue Scottish Water needs to collect through customer charges in order to deliver the objectives set for it by Scottish Ministers. This determines the maximum permissible increase in charges over the plan period.

Scottish Water then determines the annual increase in the charge, within the context of the guidance issues by WICS and the tariff structure established by Scottish Ministers.

In the rest of this chapter we examine the structure of water tariffs in more detail, and then go on to consider how the overall level of the water charge has evolved over time.

Council tax bands and the water charge

Every household served by Scottish Water has to pay for the supply of water and, when connected to the sewerage system, for the collection and treatment of wastewater.

Unlike in England and Wales, domestic water users in Scotland tend not to be metered and are not billed on the basis of water use. Instead, household charges for water and sewerage are primarily determined by council tax band, with higher banded properties paying progressively more compared to lower-banded properties.

The charges for 2024-2025 are shown in Table 2.1. Annual charges for combined water supply and waste water collection (before any reductions are applied) range from £364 for properties in band A to £1,093 for properties in band H. Note that these charges are before any reductions or discounts are applied.

Table 2.1: Households water and sewerage bills are determined primarily by council tax band

Metered household water and sewerage charges, 2024/2025

|

Council Tax Band |

Water Supply |

Wastewater Collection |

Combined Services |

|

Band A |

£168.60 |

£195.66 |

£364.26 |

|

Band B |

£196.70 |

£228.27 |

£424.97 |

|

Band C |

£224.80 |

£260.88 |

£485.68 |

|

Band D |

£252.90 |

£293.49 |

£546.39 |

|

Band E |

£309.10 |

£358.71 |

£667.81 |

|

Band F |

£365.30 |

£423.93 |

£789.23 |

|

Band G |

£421.50 |

£489.15 |

£910.65 |

|

Band H |

£505.80 |

£586.98 |

£1,092.78 |

Source: Scottish Water

Discounts and exemptions

Not all households are subject to the full water and sewerage charge shown in Table 2.1. A number of status discounts, exemptions and reductions are available.

The two main types of status discount are the single occupancy discount and the disregard occupancy discount:

- The single occupancy discount provides households that consist of only one adult eligible for council tax a 25% on its water and sewerage bill.

- The disregard occupancy discount provides a 50% discount to households that consist entirely of individuals who are exempt from paying council tax (this group includes long-term hospital patients, student nurses, prisoners, and members of religious communities).

Both of these discounts align with equivalent discounts for council tax.

Some households are fully exempted from water and sewerage charges. These include households occupied solely by students, solely occupied by adults that are severely mentally impaired, and short-term vacant households.

The disabled banding reduction provides a reduction for households that have been adapted to meet the needs of a disabled person. Specifically, the reduction works by charging the household the charge for a property one band below that at which the property is currently valued.

The Water Charges Reduction Scheme

Some households have their water and sewerage charge reduced. Low-income households can have their charge reduced through the Water Charges Reduction Scheme (WCRS). The WCRS provides a bill reduction to households which are in receipt of Council Tax Reduction.

The extent to which a household’s bill for water and sewerage can be reduced is proportionate to the amount of Council Tax Reduction (CTR) the household receives. However, the extent to which a household can see its water charge reduced through the WCRS is less extensive than the level of reductions available through CTR. The maximum reduction available under the WCRS is 35%. In comparison, Council Tax Reduction can extend to 100% of a household’s Council Tax bill.

Specifically, a household in receipt of CTR will receive a reduction on its water bill equivalent to 35% of the reduction it receives for CTR. If a household receives full, 100% relief on its council tax bill (i.e. its council tax bill is reduced to 0 through CTR), it qualifies for a 35% reduction in its water and sewerage charge.

If a household receives a 50% reduction in their council tax bill via CTR, it receives 50% of the maximum discount available on their water and sewerage bill (i.e. 50% x 35% = 17.5%).

It is also important to note that the WCRS is not additional to the single person status discount. 35% is the maximum by which a household’s water bill can be reduced by, including both the single person discount and the WCRS. So a single person household in full receipt of CTR will receive a 25% status discount on their bill, but only an additional ten percentage points of bill reduction on top of this via the WCRS, bringing their total reduction to the 35% maximum. A single person household receiving 50% reduction on their council tax bill would receive a 25% single person status discount but no more (since 50% of 35% is 17.5%, which is less than 25%).[vi]

The reductions available for water and sewerage charges are noticeably less generous than those available for council tax. However, it is important to note that the WCRS is somewhat more generous now than it was in the recent past. In previous charging periods (up to and including 2020-2021), the maximum support under the WCRS was 25%. This meant that a single person household in receipt of CTR would receive no additional bill support compared to a single person not in receipt of CTR (since both households would receive the single person 25% status discount, the maximum available). The increase in the WCRS to 35%, introduced in 2021-2022, redresses this anomaly to some extent. We discuss its impacts in subsequent sections.

The cost of reductions, exemptions and discounts

The value of these various discounts, reductions and exemptions is shown in Table 2.2. Gross charges (before any reductions) totalled almost £1.2bn in 2022-2023. Discounts, almost entirely for single person status, were worth over £100m, whilst exemptions (for properties that are occupied but where nobody is liable for the charge) were worth £60m.

The WCRS was worth £25 million. Part of the explanation as to why this might seem a relatively small amount is that, where a household is eligible for a 25% single person status discount and full WCRS at 35%, the majority of that household’s bill reduction (25/35) is accounted for as status discount. Disability relief is worth £1m, and received by some 14,000 dwellings.

Table 2.2: Reductions and reliefs are worth almost £200 million

Value of charges, reductions, exemptions and discounts, 2022/23

|

Expenditure |

£ million |

As percentage of gross charges |

|

Gross charges |

£1,184 |

100% |

|

Disability relief |

£1 |

0% |

|

Discounts |

£106 |

9% |

|

Exemptions |

£61 |

5% |

|

Water Charge Reduction Scheme |

£25 |

2% |

|

Net charges |

£991 |

84% |

Source: Supplied by Scottish Water to Consumer Scotland. Note: figures are estimates

Collecting charges

The responsibility for billing and collecting water charges does not rest with Scottish Water but with local authorities. Local authorities collect water charges together with council tax, and return to Scottish Water the relevant share of the total amount collected. Scottish Water makes payments to local authorities in exchange for them assuming the function of billing and collecting charges.

Consumers in Scotland thus receive one annual notification (or Demand notice) containing two bills, one for council tax and one for water and sewerage services. However, the fact that the system of reductions is different for water and sewerage compared to council tax can lead to confusion amongst some consumers regarding their liabilities for the water charge. Previous research shows that a majority of consumers who receive a 100% reduction for council tax assume that the same discount applies to water, do not pay and subsequently find themselves in debt. Consumer Scotland has recommended improvements to the information that consumers who are exempt from Council Tax due to their financial circumstances receive about the water and sewage charges they are liable for[vii].

Recent increases in the water charge

For the 2021-2027 plan period, WICS determined that the maximum amount of charges that Scottish Water can levy on its customers is CPI+2% on average for each year of the regulatory control period.

WICS’s Final Determination set out that this above inflation increase was necessary to maintain service levels in the face of ageing assets, combined with the response required to a changing climate, and aspirations that the water industry achieves a net-zero status by 2040. Above-inflationary charge increases are deemed necessary to respond to the challenges posed by the climate crisis and ageing infrastructure, and realise the Water Sector Vision.[viii]

What has happened to charges during the first three years of the plan period?

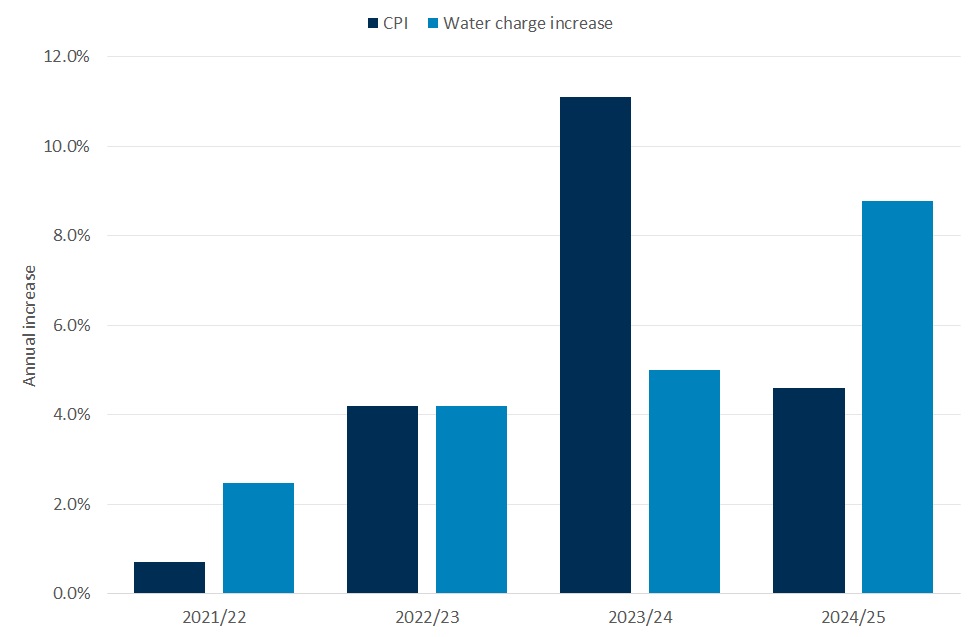

- In 2021-2022, the first year of the plan period, charges increased by 2.5% in cash terms. Given that the rate of CPI inflation in October 2020 was 0.74% (it is the rate of inflation the previous October which sets the context for the bill increases in April), this increase was very slightly below, but broadly in line with, the CPI+2% maximum average for the six-year plan period (Chart 2.1).

- In 2022-2023, Scottish Water increased the charge by 4.2% in cash terms. This uplift was in line with the value of CPI in October 2021. The impact of this decision was thus that the water charge remained unchanged in real terms, and hence fell short of the CPI+2% envisaged for the plan period as a whole.

- For 2023-2024, Scottish Water announced that charges would increase by 5%. This is significantly below the annual rate of CPI inflation in October 2022 which was actually 11%.

- In 2024-2025, the water charge will increase by 8.8%, almost double the CPI rate of 4.6% in October 2023.

Thus over the first four years of the plan period, charges have increased by some 21.9% cumulatively. This is identical to the cumulative rise in the CPI index, implying that charges in real terms have remained unchanged. But this is substantially below the increase in charges of 31.5% that would have been observed had charges followed a CPI+2% pathway.

As a result, charges in 2024-2025 are around 7% below where they would have been had the CPI+2% pathway been followed.

Chart 2.1: The water charge has increased below CPI+2% on average so far in this charging period

Annual rate of change of the Consumer Prices Index and water charges in Scotland

Source: Consumer Scotland analysis of ONS Consumer Prices Index, and Scottish Water water charges pages

The below anticipated increases in the charge is likely to have improved the affordability of bills for today’s customers, relative to the CPI+2% scenario that might have been. However, the lower than potential increases in the water charge might imply lower levels of resources to fund investment in the water network.

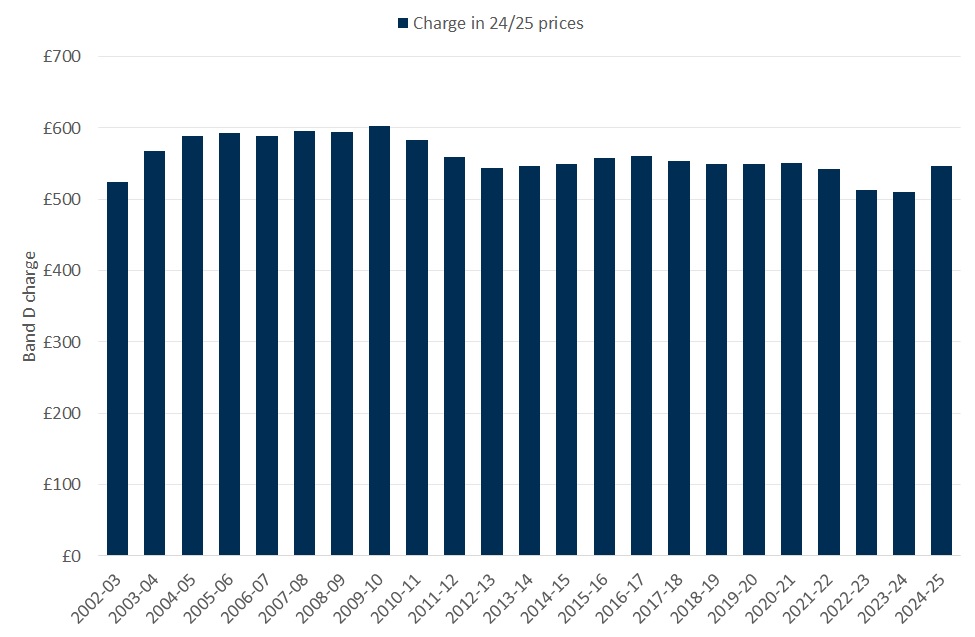

Chart 2.2 shows the evolution of the water charge in real terms since 2002, when Scottish Water was established. After having declined in real terms following the recession of 2008-2009 (the charge was frozen in cash terms for four years), the water charge remained unchanged in real terms for ten years, from 2012-2013 until 2021-2022.

The water charge declined in real terms between 2021-2022 and 2022-2023 before the above-inflationary increase in 2024-2025 realigned it with its recent real terms level. (The real terms decline in 2021-2022 may seem difficult to reconcile with chart 2.1; the difference is due to the fact that chart 2.1 compares the increase in the charge in a given financial year with CPI of the previous October, which is what is relevant to charge setting; whereas chart 2.2 takes the charge in a given financial year and deflates this by the average CPI for that same financial year, which is what is most relevant to thinking about the affordability of charges for households).

Chart 2.2: The water charge declined in real terms during the cost-of-living crisis

Combined water and sewerage charge for band D property in 2024/2025 prices

Source: Consumer Scotland analysis of Scottish Water charges data. Charges are deflated using the Consumer Prices Index published by ONS; for 2024/2025, CPI is forecast to grow 1.6% in line with the latest forecast from the Office for Budget Responsibility.

Part of the justification for increasing the generosity of the WCRS from 25% to 35% at the start of the 2021-2026 SRC period was that this ‘charges for those receiving the full [WCRS] discount will increase at less than the rate of inflation over the 2021-2027 regulatory control period’.[ix]

It is worth noting that it remains the case that bills (for those in receipt of WCRS) will go up less than inflation over the 2021-2026 period, despite much higher inflation than had been anticipated when this objective was set.

In fact, the rate of inflation is immaterial to the achievement of the objective. To see this, note first that if charges increase by CPI+2% for six years, this equates to a cumulative real terms increase of 12.6%. But for those in receipt of WCRS, an increase in the discount from 25% to 35% equates to a bill reduction of 13.3%, offsetting the above inflationary rise. (The bill for a WCRS recipient household declines by 13.3% because this is the difference between paying 75% of a bill and 65% of a bill).

5. Defining and measuring water affordability

Defining the affordability of water and sewerage services

The extent to which water charges are affordable depends on the level of the water charge faced by any household relative to the disposable income of that household.

In the UK, households that spend more than 3% of their disposable income on water and sewerage charges are deemed to be in ‘water poverty’. Households which spend more than 5% of their income on water and sewerage charges are deemed to be in ‘severe water poverty’.

The use of the three per cent water poverty threshold in England and Wales can be traced back to at least 1999, when it was used as a measure of water affordability on the grounds that it represented twice the median spend by households on water charges as a percentage of disposable income[x].

The 3% and 5% water poverty definitions have been used extensively to assess the affordability of water and sewerage charges in England and Wales[xi], and in Scotland in the past[xii]. These measures have also been applied in a wide variety of countries and contexts outside the UK[xiii].

In these analyses, household income is measured net of direct taxes (income tax, national insurance contributions and council tax), and includes income from pensions, and from social security payments (both means tested and non means tested). It is measured after housing costs, which means that households’ spending on rent and mortgage interest payments are deducted. Household income is also equivalised, which means it is adjusted to take account of household size[xiv].

The strength of the 3% and 5% poverty measures is that they explicitly take account of households’ financial means, placing the water charge in that context. They allow for comparisons across time, places and consumer groups.

But no measure of water affordability or poverty is perfect. The extent to which water charges are affordable for a household is likely to depend on other measures of financial wellbeing beyond income, including for example financial wealth, and the nature of any debt owed. In principle, data on debt and assets could be included in a water poverty definition if good data existed on it.

The extent to which water charges create financial distress for individual households might also reflect households’ perceptions of the security of their income or their living situation more generally. In this sense, whilst statistically based definitions and measures of water affordability are useful in quantifying the scale of affordability issues for different groups over time, they don’t necessarily reflect the lived experience for those who face affordability challenges.

A further limitation of the 3% and 5% measures is that the extent to which water charges create affordability challenges might depend on the level of household income as well as the percentage of that income that is spent on water charges. For example, a household with an income of £30,000 spending £900 on water charges might not face the same level of affordability challenge as a household with an income of £10,000 spending £300 on water charges. In chapter 4 we introduce an alternative water poverty measure that takes into account income level as well as the percentage spent on water charges.

Despite these caveats, the income based definitions of water affordability, and the 3% and 5% definitions of water poverty, are useful in understanding the extent to which water charges create affordability issues for different groups of consumers over time.

Measuring water poverty

To monitor trends in water poverty we use the ‘households below average income’ (HBAI) dataset. The HBAI is derived from the Family Resources Survey (FRS), an annual survey of households’ income.

The FRS is overseen by the Department of Work and Pensions. The survey is designed to be representative of households in each nation and region of the UK. Each year, around 3,000 households in Scotland are surveyed, ascertaining a range of information on each household including demographic and socio-economic characteristics, and information on the level of income from different sources.

The latest HBAI/FRS survey results available to us related to the 2022-2023 financial year.

To estimate water affordability in years after this, we use the IPPR Tax-Benefit model to create uprated iterations of the 2022-2023 data for subsequent years.[xv] In practice this means uprating the 2022-2023 data in line with latest statistics, where these have been published, on growth in earnings, pension income, social security payments and other forms of income, and incorporating known changes in tax policy and housing costs.

Where outturn data on these growth parameters has not yet been published, forecasts made by the Office for Budget Responsibility (OBR) and the Scottish Fiscal Commission (SFC) are used in the modelling to project the 2022-2023 data forward into 2023-2024 and subsequent years. For this forecasting, we draw on the latest available OBR and SFC forecasts, which date from March 2024 and December 2023 respectively.

These uprated iterations of the 2022-2023 HBAI data are combined with estimates of households’ water charges in 2023-2024 and beyond. For 2023-2024 and 2024-2025, we of course know what these water charges will be (for each household in the dataset, we can calculate that households water bill because we know their council tax band, its eligibility for status discounts and reductions). For years beyond 2024-2025, we generally assume that water charges increase at CPI+2% unless stated otherwise.

6. Trends and outlook for water poverty

This chapter examines trends in measures of water poverty in the past, and forecasts water poverty over the next few years. It then goes on to examine water poverty rates amongst different consumer groups.

Water poverty rates over time

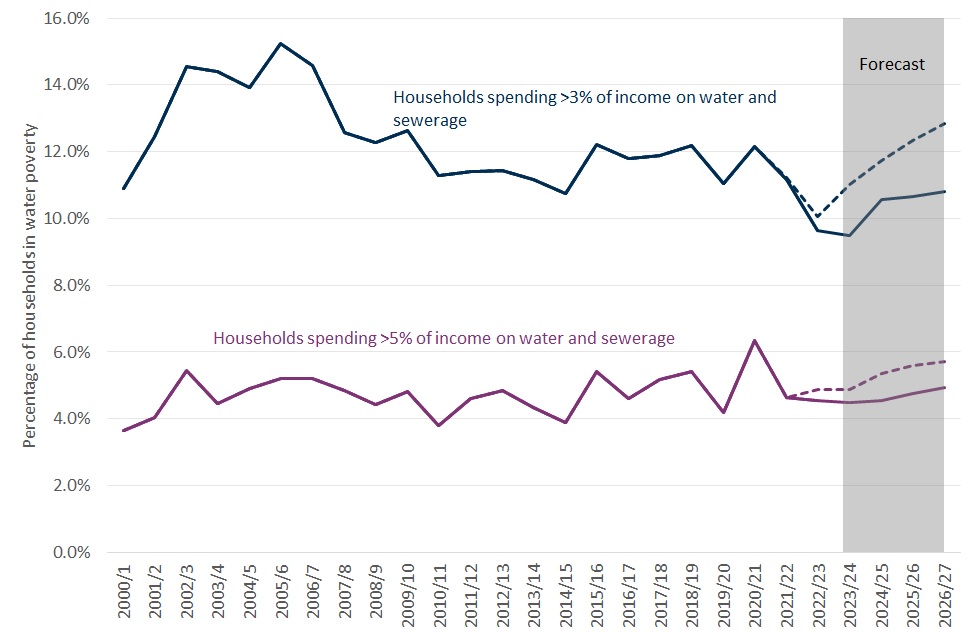

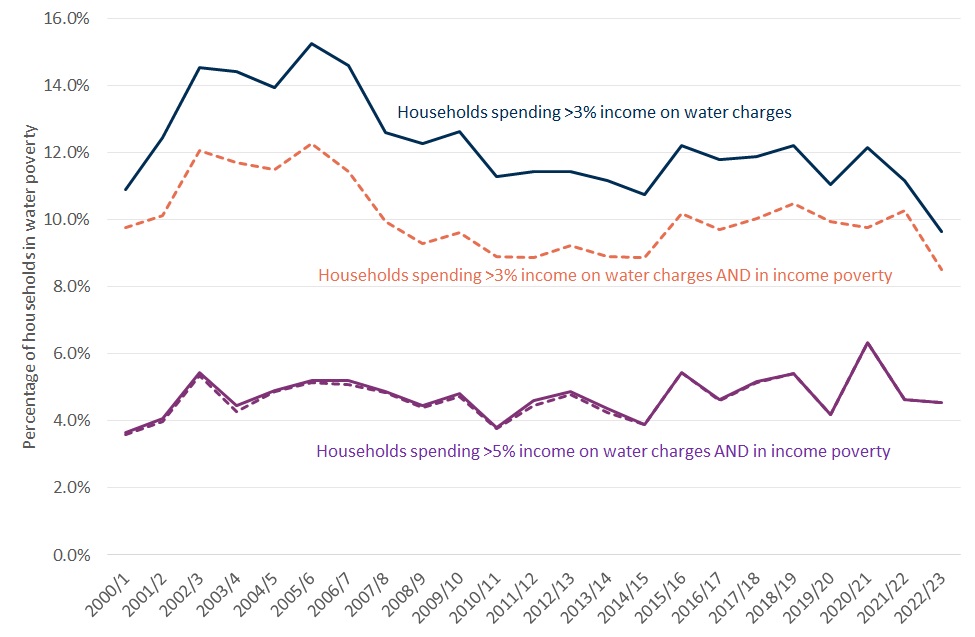

Chart 3.1 shows the evolution of the 3% and 5% definitions of water poverty in Scotland since 2002/3.

- Over the period until 2022-2023 these poverty rates are derived from published (outturn) HBAI statistics.

- From 2023-2024 until 2026-2027, these are forecasts. The core forecast (shown by a solid line) is an estimate of water poverty rates based on the ‘actual’ level of the water charge in 2023-2024 and 2024-2025, and under an assumption that the charge grows at CPI+2% in 2025-2026 and 2026-2027. This latter assumption is arguably somewhat conservative, since water charges could increase by more than CPI+2% in the final two years to make up for lower increases in some previous years of the strategic review period.

- A counterfactual scenario (shown by a dashed line) illustrates how water poverty rates would have evolved had they increased at CPI+2% in all years of the SRC period (this being the maximum average annual increase allowed over the 2021-2022 – 2026-2027 period). In practice this means an assumption that water charges increased by 6.2% and 13.1% in 2022-2023 and 2023-2024 respectively, rather than the 4.2% and 5% actually observed.

Water poverty prior to the cost-of-living crisis

The proportion of households in 3% water poverty declined somewhat in the mid noughties, largely reflecting relatively robust household income growth relative to the water charge. Between 2007-2008 and 2021-2022, the proportion of households in 3% water poverty remained essentially unchanged at around 12%. This means that around 310,000 households were in water poverty in 2021-2022.

The proportion of households in 5% water poverty remained largely unchanged at around 5% between 2002-2003 and 2021-2022 (individual years see some variation around 5%, but there is no statistically meaningful divergence from 5%).

It might be asked why the 3% poverty rate declined somewhat in the mid-noughties but the 5% poverty rate did not. The most likely explanation for this is that, whilst household income growth in the mid-noughties was generally fairly robust relative to the water charge, this was not so obviously the case for the lowest income decile of households, whose incomes grew less robustly[xvi].

In Chapter 3 we noted that one potential criticism of the water poverty measure is that it considers only the proportion of income spent on water charges, regardless of the level of household income. Box 3.1 considers an alternative definition of water poverty, one that takes into account the extent to which a household has low income, as well as simply the proportion of its income that it spends on water and sewerage. The key takeaway is that whilst this results in slightly fewer households deemed to be in water poverty compared to the standard 3% measure, it doesn’t change conclusions as to the long term trend in water poverty.

Water poverty during the cost-of-living crisis

The outturn HBAI data for 2022-2023 suggests that the 3% water poverty rate declined to under 10% in that year – the lowest rate of water poverty since the establishment of Scottish Water.

The extent of this drop in water poverty may reflect a degree of annual volatility that inevitably occurs in any survey like this. But the fact that there is some decline in water poverty is not in itself a surprise, as it reflects:

- A real terms fall in the water charge; the increase in water charge of 4.2% was somewhat lower than the increase in earnings (and the National Minimum Wage increased by 6.7% in April 2022).

- A series of ‘cost-of-living payments’ to families in receipt of means tested and disability related social security benefits which acted to boost the incomes of some households. Consumer Scotland’s analysis indicates that, of the 1.5 percentage point fall in the water poverty rate in 2022-2023, around 0.6 percentage points can be attributed to the temporary social security top-ups.

The 5% poverty rate did not fall as significantly in 2022-2023 as the 3% poverty rate. This seems to reflect in part the distribution of households with respect to the water charge as a percentage of income[xvii].

Water poverty in 2024-2025 and beyond

Our forecasts suggest that in 2024-2025, the water poverty rate will return to its level in 2021-2022. This reflects the 8.8% increase in water charge, and, to a slightly lesser extent, the removal of the temporary cost-of-living social security top-ups.

In subsequent years, and assuming that the water charge increases at CPI+2%, our forecasts suggest modest increases in the water poverty and severe water poverty rates. In both cases, water poverty remains in line with past levels (severe water poverty) or slightly lower than past levels (in the case of the 3% water poverty rate).

As noted above, the assumption that increases in the water charge increase at CPI+2% is arguably conservative. Scottish Water is permitted to increase charges by CPI+2% each year on average over the six year charge period. Technically speaking, given that charges increased by less than CPI+2% in two of the first four years of the charge period, Scottish Water has scope to increase charges by substantially more than CPI+2% in each of the remaining two years. If this occurred, water poverty rates would increase by more than set out in Chart 3.1.

What might have happened?

The analysis in Chart 3.1 also indicates what is likely to have happened to water poverty rates if the water charge had increased by CPI+2% in each year of this SRC period. Notably this would imply a 6.2% increase in charges in 2022-2023 and a 13.1% increase in 2023-2024.

Our analysis suggests that the 3% water poverty rate would have been around 1.5 percentage points higher by 2023-2024 had this scenario occurred, implying an additional 38,000 households in water poverty. The severe water poverty rate would have been around 0.3 percentage points higher, implying an additional 10,000 households in severe water poverty.

Of course whilst higher charges would have meant higher water poverty, the flipside is that higher charges would also have generated additional revenues for Scottish Water; and these additional revenues may to an extent have benefited future consumers through higher investment today.

Our analysis suggests that Scottish Water revenues would have been over £100 million higher in 2023-2024 under a scenario where charges had increased at CPI+2% in 2022-2023 and 2023-2024. Some of this difference would also be baked into future years, so that Scottish Water revenues would also be higher (by around £90 million per year) throughout the subsequent three years of the SRC period.

There was no absolute requirement on Scottish Water to increase charges by CPI+2% each year – this is a maximum average annual increase over the six year charging period, 2021-2022 to 2026-2027. And there is nothing to say that, having increased charges by less than CPI+2% in recent years, Scottish Water can’t increase charges in subsequent years by more than CPI+2% to ‘make up the difference’.

Nonetheless, this illustrates the challenges in trading off, on the one hand, the requirement to raise revenues from customer charges to fund investment in the water network, and on the other hand, the imperative of ensuring that water charges are affordable to current consumers.

Chart 3.1: Water poverty rates are expected to remain below historic highs Percentage of households in Scotland spending above 3% or 5% of disposable income on water charges

Percentage of households in Scotland spending above 3% or 5% of disposable income on water charges

Source: Consumer Scotland analysis of Households Below Average Income dataset 2001/2 – 2022/23, and Family Resources Survey via IPPR Tax-Benefit model. Notes: the dashed line shows the estimated path of water poverty if charges had followed a CPI+2% trajectory

Characteristics of water poverty

The rest of this chapter considers how water poverty rates vary by household characteristic. For this analysis, we pool two years of HBAI data in order to maximise the sample size.

Water poverty and income

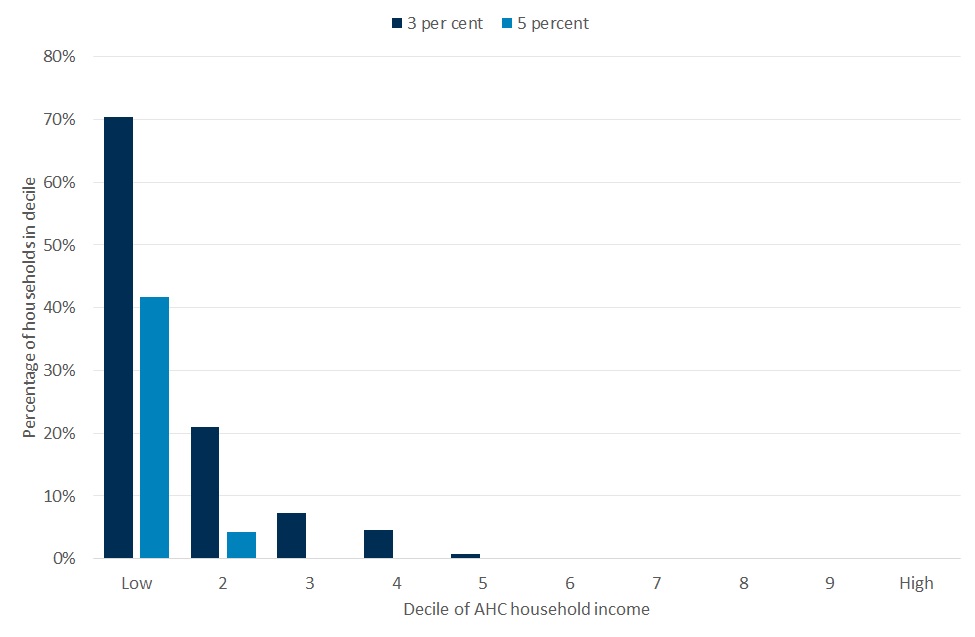

There is a strong relationship between household income and the risk of water poverty. Chart 3.2 divides the 2.6 million Scottish households into ten deciles of net income, from the lowest income ten per cent of households to the highest.

Consistent with previous research, this shows that the risks of being in water poverty are strongly related to income:

- Of households in the lowest decile of income, 70% are in water poverty (i.e. they spend more than three per cent of their income on water and sewerage charges). This falls to 20% of households in the second decile, and 7% in the third decile. Virtually no household in the top half of the income distribution spends more than 3% of its income on water and sewerage.

- Similarly, being in extreme water poverty (i.e. spending more than 5% of disposable income on water and sewerage charges) is uniquely a feature of low household income. 42% of households in the lowest income decile are in extreme water poverty. Only 4% of households in the second decile are in water poverty, and no household outside of the lowest income fifth is in extreme water poverty.

It is therefore no surprise that rates of water poverty are highest amongst households living in low-income poverty.

Of the 260,000 households in Scotland in water poverty in 2021-2022 and 2022-2023, nearly all are also in low income poverty. Only 25,000 households are in water poverty but not in low income poverty.

And, as noted above, all households in severe water poverty are also in low-income poverty.

Chart 3.2: Low income is the biggest predictor of water poverty

Percentage of households in Scotland spending above 3% or 5% of disposable income on water charges by decile of After Housing Cost income, 2021/22 – 2022/23

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/23.

Water poverty and council tax band

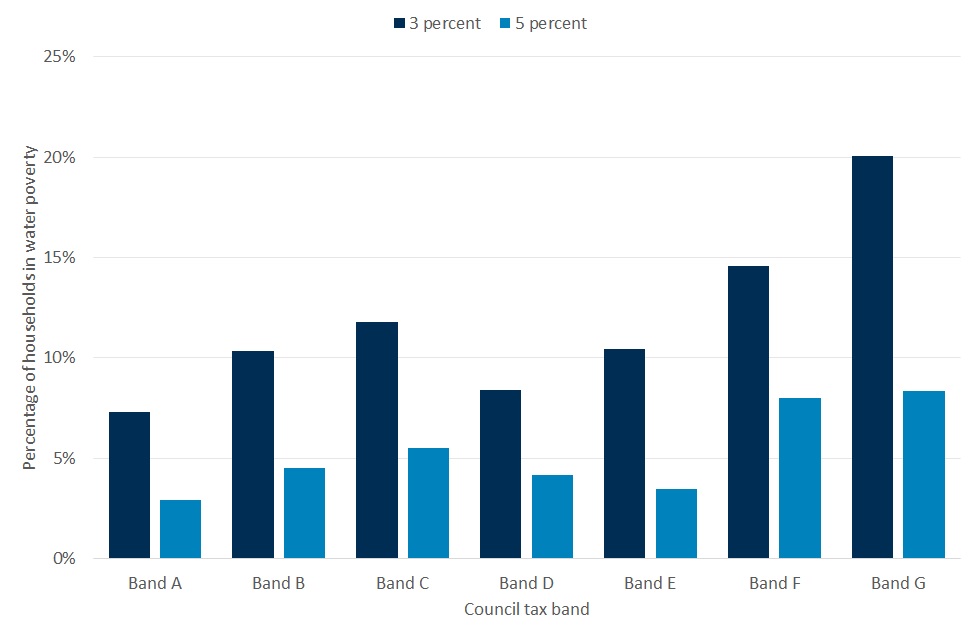

Chart 3.3 shows the water poverty rates for households in different council tax bands. It shows that that a larger proportion of households in council tax bands F and G are in poverty compared to those in bands A-E.

The finding that water poverty rates are higher in higher banded households is consistent with previous research[xviii]. Nonetheless, the finding can initially appear paradoxical – after all, household incomes are an increasing function of council tax band.

However, whilst it is the case that average income of households increases as we move from bands A through G, what is more relevant is the fact that, within each council tax band, there is a wide variation in household income.

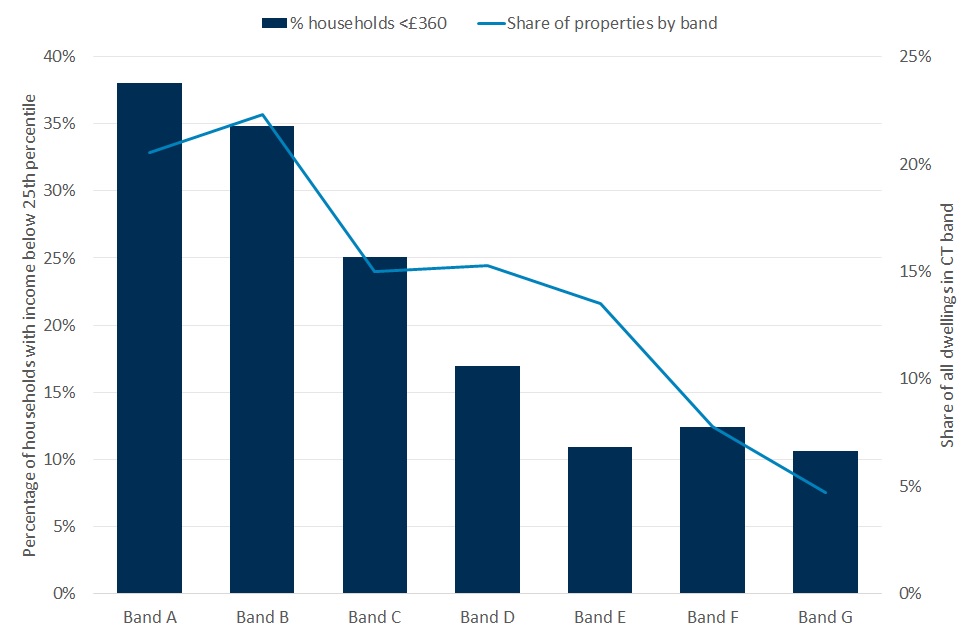

This is illustrated in Chart 3.4, which shows the percentage of households in each council tax band who have weekly net incomes below £360 per week (this amount corresponds to the 25th percentile nationally, so across Scotland as a whole, 25% of households have weekly incomes lower than £360).

Over a third of households in bands A and B have incomes below the 25th But low income households are also found in the higher bands. Over 10% of households in bands E, F and G have weekly incomes below the 25th percentile nationally.

The takeaway is that, whilst average incomes rise through council tax bands, there are nonetheless a reasonable number of low income households living in higher banded properties. Combining this observation with the fact that higher banded properties by definition pay higher water charges helps to explain why water poverty rates are higher in bands F and G.

Whilst recognising that water poverty rates are higher in higher banded properties, it is important also to remember that there are proportionately fewer properties in the higher council tax bands. So whilst water poverty rates are higher in bands F and G, a greater share of all households in water poverty are actually in band B. In other words, whilst water poverty rates are lower in bands A and B, the fact that there are more properties valued in bands A and B means that these bands account for a large share of all households in water poverty.

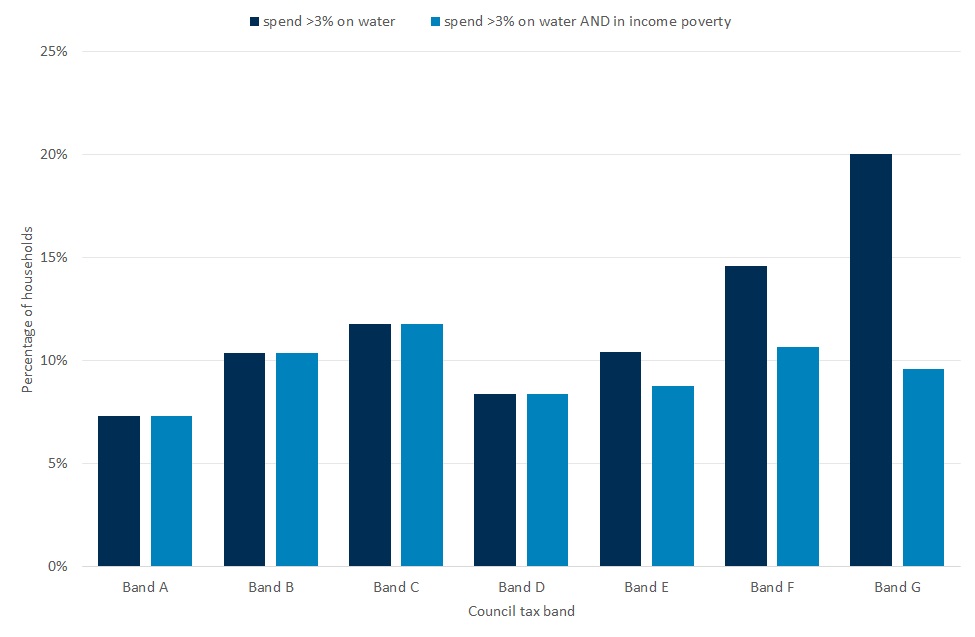

Box 3.1 examines the extent to which the conclusion that water poverty rates are highest in bands F and G holds if we take into account households’ level of income (in addition to just the percentage of income spent on water charges). It finds that households in water poverty but which are not in income poverty are most likely to be in bands F and G – and that on an alternative definition of water poverty, differences in water poverty rates across council tax bands are less marked.

Chart 3.3: Water poverty rates are highest in council tax bands F and G

Percentage of households in Scotland spending above 3% or 5% of disposable income on water charges by council tax band, 2021/22 – 2022/23

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/23. N = 7,455. Note: band H excluded due to few observations.

Chart 3.4: More than one in ten households in higher banded properties have low incomes

Percentage of households in Scotland with incomes below the 25th percentile (£360 per week) by council tax band, 2021/22 – 2022/23; and share of dwellings by council tax band

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/23. N = 7,455. Note: band H excluded due to few observations.

Box 3.1: Water poverty, income poverty and council tax band

|

One potential criticism of the 3% measure of water poverty is that it is possible for a relatively better-off household to be deemed in water poverty. This arises because of the way that water charges increase significantly as we move through the council tax bands. Taking 2021/22 to illustrate, the band A combined charge was £306. A couple household with an annual net income below £10,200 would be deemed in water poverty; but an income above this level would be deemed not to be in water poverty. In contrast, the band G charge was £765. This means that a couple household with income of up to £25,500 would be deemed to be in water poverty. This raises the question – does a charge of £765 place the same degree of financial pressure on a household with £25,500 income as does a charge of £306 for a household with £10,200 income? The relevant income poverty threshold in 21/22 was approximately £17,000. So in the example above, the band A household is clearly in income poverty; whereas the band G household, despite being in water poverty, is well above the income poverty threshold. Given these potential ambiguities, some have argued that the 3% water poverty definition could be misleading as an indicator of the degree to which water charges place financial pressure on different households. One way of addressing this criticism would be to add an additional criterion to the water poverty definition, so that households were only deemed to be in water poverty if they both spent more than 3% of income on water charges, and also had low income poverty. Chart 3.5 shows the historic evolution of this alternative water poverty measure alongside the 3% and 5% measures shown previously. The proportion of households in water poverty on this alternative definition is always slightly lower than the conventional 3% figure, reflecting the fact that, under the traditional 3% measure, some households in ‘water poverty’ are indeed not in income poverty. However, constraining the 5% definition to households that are also in income poverty makes no difference because any household that spends more than 5% of its income on water charges is by definition in income poverty. |

Chart 3.5: Most households spending more than 3% of income on water charges are also in income poverty

Percentage of households in Scotland in various definitions of water poverty

|

The alternative definition of water poverty – that constrains water poverty status to only be applicable to households who are in income poverty – does change the extent to which water poverty rates are higher in council tax bands F and G compared to other bands (Chart 3.6). On the alternative definition of water poverty, water poverty rates are in fact similar across council tax bands. However, the patterns of water poverty on other dimensions – such as family type or tenure – is not fundamentally changed by whether the 3% measure is or isn’t constrained by the additional income criterion. There are several takeaways from this. First, only a small proportion of households spend more than 3% of income on water charges but have an income high enough not to be in income poverty; as such, constraining the water poverty definition to only include households on a low level of income generally makes little difference to assessment of the numbers of households in water poverty or the trend over time. However, given that most of the households in water poverty who are not in income poverty are in higher council tax-banded properties, constraining the water poverty definition to exclude higher income households does change the conclusion that water poverty rates are highest in bands F and G. |

Chart 3.6: Households in higher banded properties who spend more than 3% income on water are not always income poor

Percentage of households in Scotland in two definitions of water poverty by council tax band

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/23. N = 7,455. Note: band H excluded due to few observations.

Household composition and water poverty

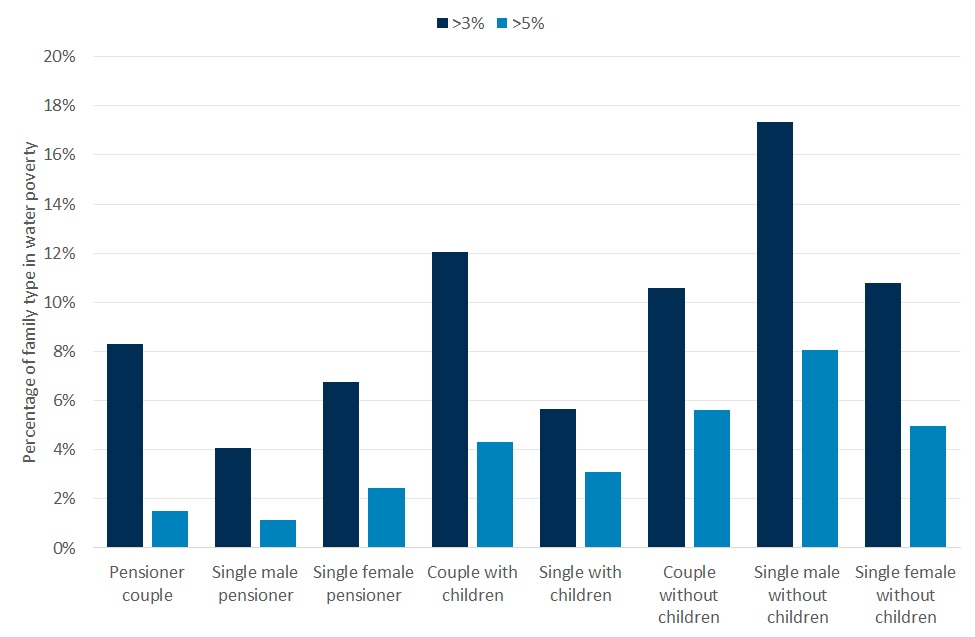

Chart 3.7 shows the percentage of various family types living in households in water poverty.

- The variation in water poverty rates by family type is quite pronounced. Single males are most likely to be in water poverty, with a rate of 17%; single women have a poverty rate of 11%.

- In contrast, single pensioners are relatively unlikely to be in water poverty, with a rate of 4% for single male pensioners and 7% for single female pensioners.

- Working age couples (with or without children) are more likely to be in water poverty than single parents.

A variety of factors lie behind these findings. Single males are disproportionately likely to have low incomes, as to a slightly lesser extent are single females.

Single parents are also relatively likely to have low incomes. But they tend to be more likely to live in lower band properties and to qualify for benefits and hence be in receipt of the WCRS. Around half of single parents receive WCRS, compared to a quarter of single people without children (single people without children are also more likely to share accommodation, so don’t necessarily receive the single person discount).

Working age couples are less likely to have very low incomes, but they are more likely to live in higher banded properties (than single people) and less likely to be in receipt of WCRS than single people.

The takeaways are that pensioners are somewhat less likely to be in water poverty than working age families, and that single males are particularly likely to be in water poverty. These patterns to an extent reflect the distribution of family types in low income poverty. Single people, particular males, are particularly likely to be in income poverty, and pensioners are less likely to be in income poverty. But it also reflects the distribution of family types by council tax band, and their eligibility for the WCRS.

Chart 3.7: Pensioner households are less likely to be in water poverty than working age households

Percentage of households in Scotland spending above 3% and 5% of income on water and sewerage charges, 2021/2022 – 2022/2023

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/2023. N = 7,455.

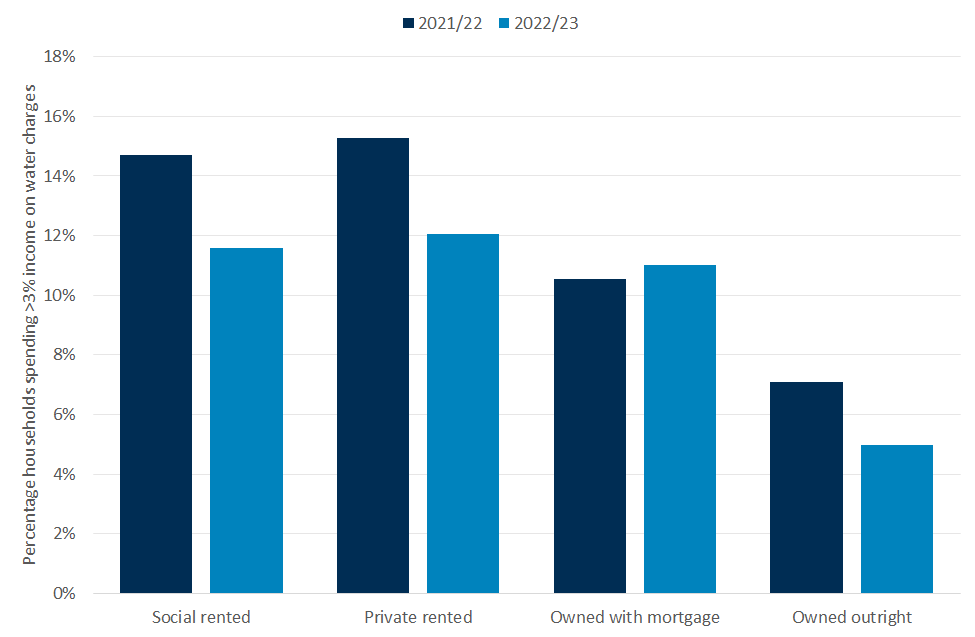

Housing tenure and water poverty

Households in the private and social rented sector have in recent years been more likely to be in water poverty than owner occupiers (Chart 3.8). This is unsurprising in that owner occupiers have tended to have higher after housing cost incomes than those in the private rented or social rented sectors.

It might be asked whether water poverty rates would increase for mortgagers following the increase in interest rates during the cost-of-living crisis. Bank rate increased from 0.1% in November 2021 to 5.25% by August 2023.

Our analysis indeed finds that mortgagers are the only tenure type for whom water poverty rates did not decline between 2021-2022 and 2022-2023 (Chart 3.6).

Caution needs to be taken in reading too much into a single year’s figures, but this does provide emerging evidence that rising interest rates may shift the pattern of water poverty across tenures. The poverty rate for mortgagers may worsen further in 2024-2025, although robust outturn data will be required to test this hypothesis. (Most mortgagers are on fixed rate mortgage deals, and are only affected by increased interest rates when their current fixed term ends and they have to roll-on to a new deal; the Bank of England estimated in June 2024 that around one third of mortgage holders are yet to reprice onto higher rate deals but will do so between now and 2026[xix].)

Chart 3.8: Water poverty rates amongst mortgaged households did not fall in 2022/2023

Percentage of households in Scotland spending more than 3% of income on water charges by housing tenure, 2021/2022 and 2022/2023

Source: Consumer Scotland analysis of Households Below Average Income dataset 2021/22-2022/23. N = 7,455

7. Considering policy options

This chapter examines the impact of various potential changes to water discounts and discounts on water poverty and Scottish Water revenues. The options are modelled in 2024-2025 for illustrative purposes, but the general size of the results should be broadly transferable to future years.

The impact of varying the WCRS

One option for increasing the affordability of water charges is to increase the generosity of the Water Charges Reduction Scheme. But what impact would increases in the WCRS have on consumers, and at what cost?

Table 5.1 provides a summary of the impact of changing the amount allocated through the WCRS.

To provide context, it shows that a WCRS set at 25% (as was the case until 2021/2022) would result in a 3 percent water poverty rate some 0.3 percentage points higher than with the WCRS at 35%. This means that around 8,000 fewer households are in water poverty because the WCRS is at 35% compared to what would be the case if the WCRS were set at 25%.

What about the impact of further increases in the WCRS? Increasing the WCRS to 50% would reduce water poverty by 0.5 percentage points; increasing the WCRS to 100% would reduce water poverty by more than a full percentage point compared to the WCRS at 35% (equivalent to 25,000 fewer households in water poverty).

Recall that our policy modelling is undertaken for 2024-2025. In broad terms, the scale of the modelled impacts on water poverty in 2024-2025 should be transferable to future years. We would anticipate that, the faster that future charges rise above inflation, the larger the likely impact of a given policy scenario on water poverty rates.

It is important to remember that the impact of changing the WCRS is broader than simply what is indicated by the poverty line analysis. When the WCRS is increased, all households in receipt of the WCRS benefit from the support, and all recipient households should find therefore that the affordability of their water charge should become more manageable.

Increasing the WCRS from 25% to 35% brought an additional 185,000 households into the scheme. Why did the number of recipient households increase despite the fact that eligibility criteria have not changed? The explanation is that, when the WCRS was 25%, single person households, who already received a 25% bill reduction, could not benefit from the WCRS. Once the WCRS increases to 35%, single person households become receive an additional ten percentage points of bill reduction through the WCRS.[xx]

Increasing the WCRS from 35% to 50% or 100% doesn’t materially change the number of recipient households[xxi], but it does increase the average amount of bill support by recipient household. The average amount of annual bill support for recipient households through the WCRS would increase to £130 and £290 if the WCRS was 50% or 100% respectively.

There is clearly a cost to increasing the WCRS. Our analysis suggests that increasing the WCRS from 25% to 35% implicitly cost around £14m. Increasing it from 35% to 50% would cost £22m. Increasing it to 100% would cost a further £71m.

These increased costs of the WCRS would tend to be funded by higher charges on customers more generally. Increasing the WCRS from 35% to 50%, at a cost of £22m, would imply an additional £8 annually on all bills, somewhere between 1.5-2% of a typical bill.

Table 5.1: Increasing the WCRS provides additional support for recipient households but does not eliminate water poverty

Impact of varying the Water Charges Reduction Scheme on recipient households, water poverty, and scheme cost, 2024/2025

|

|

WCRS reduction |

|||

|

25% |

35% |

50% |

100% |

|

|

3 per cent poverty rate |

10.9% |

10.6% |

10.1% |

9.4% |

|

5 per cent poverty rate |

4.7% |

4.6% |

4.4% |

4.3% |

|

No. of WCRS recipients |

271,000 |

456,000 |

460,000 |

467,000 |

|

Average reduction per WCRS recipient |

£83 |

£80 |

£127 |

£286 |

|

Total annual cost (£m) |

£20m |

£34m |

£56m |

£127m |

Source: Consumer Scotland analysis using IPPR Tax-Benefit model.

Misalignment between water poverty and WCRS

The previous discussion showed that increasing the WCRS from 35% to say 50% would benefit a large number of households and provide relatively significant bill reductions to those households.

However, despite the broad based benefit, increasing the WCRS appears to have relatively limited impact on the headline water poverty metric. Why is this?

The answer lies in the distinction between the households which are in water poverty and those that receive the WCRS. Not all households in water poverty are in receipt of CTR, and hence the WCRS; in fact our analysis suggests that only around one third of households in water poverty are in receipt of WCRS. On the other hand, a reasonable number of WCRS-recipient households are not in water poverty (Table 5.2).

The fact that there is some misalignment between households in water poverty and those in receipt of the WCRS isn’t a surprise. It is generally accepted that a significant number of income poor households do not receive any means tested benefits. This is because of a combination of less than full take-up, and eligibility rules that preclude certain households.

Eligibility for the WCRS is based on receipt of CTR; eligibility for CTR is in turn based on receipt of various passporting benefits, notably including Universal Credit, and various other income parameters.

Whilst the eligibility criteria for CTR and qualifying benefits like UC are based primarily on household income, they also take into account things like number of children in the household, housing costs, and the presence of disability. They are clearly not benefits that are targeted explicitly on household water charges as a percentage of income. This helps explain why many households in receipt of the WCRS are not in water poverty. Universal Credit (which passports households onto CTR and hence WCRS) is paid to a reasonable number of families in the middle of the income distribution, and it is estimated that some 29% of working age families will be in receipt of UC when it is fully rolled out[xxii].

The fact that receipt of WCRS amongst households in water poverty is relatively low can be explained in part because some households eligible for CTR are not in receipt of it. This ‘under-claiming’ of CTR can occur for several reasons – people might not want to subject themselves to the income assessment, they might not know how to apply, or they might not know that CTR exists (and even if households are in receipt of a qualifying benefit such as UC, they have to notify their local authority of that fact in order to receive CTR). It is difficult to estimate the extent of under-claiming with any certainty, with previous studies suggesting that between a quarter and a third of households who are eligible for CTR may not be in receipt of it[xxiii].

Table 5.2: There is some misalignment between WCRS receipt and water poverty

Relationship between WCRS receipt and water poverty, 2024/2025

|

In receipt of WCRS |

Not in receipt of WCRS |

|

|

In water poverty |

68,000 |

201,000 |

|

Not in water poverty |

389,000 |

1,883,000 |

Source: Consumer Scotland analysis using IPPR Tax-Benefit model.

The impact of changing the Single Person discount

We model the impact of a reduction in the Single Person discount to examine the extent to which it would increase revenues from higher income single person households that could be used to cross-subsidise other consumer groups.

Currently, single person households are entitled to a 25% discount on the ‘standard’ water charge for their property. There is an implicit justification for the single person discount from both income and consumption perspectives. Single person households are likely to have, on average, lower incomes than multi-occupancy households, and to consume less water.

However, not all single person households have low income; and offering a 25% discount to all households comes at relatively high cost (the total value of single person status discounts is almost £100m).

What might be the effect of reducing the Single Person status discount? Would it increase the number of households facing affordability challenges with their water bills? And could any costs saved be used in a more targeted way to offset affordability challenges?

In this section we model the impact of reducing the single person status discount from 25% to 12.5%.

Halving the Single Person status discount would at face value halve spending on the Single Person discount, from around £100m to £50m. But this would be somewhat offset by an additional £8.5m spending on the WCRS. The reason for this is that, assuming the WCRS remains at 35% in this scenario, single person households in receipt of WCRS would see the amount they receive under the WCRS increase to offset the reduction in SP status discount (i.e., WCRS-recipient households receive a total discount of 35% regardless of how this is balanced between WCRS and the Single Person status discount).

The typical bill for a single person household would increase by around £40-£45 annually as a result of this policy, after taking into account the offsetting impact of the WCRS.

Despite the automatic offsetting of the Single Person discount through higher WCRS, the water poverty rate would nonetheless increase by just over half a percentage point, equivalent to around 13,000 households. Our analysis suggests that a majority of these, around two-thirds, would be single pensioner households, while the remainder would be working age single person households.

In summary, recipients of the WCRS are effectively insulated from the effects of reducing the Single Person discount. But Single Person households not in receipt of the WCRS would be exposed to the effects of any increase in charges as a result of a lower Single Person discount. Some of those single person households may be relatively income-poor. A halving of the Single Person discount would bring an additional 13,000 households into water poverty (and worsen affordability challenges for Single Person households already in water poverty).

Of course the ‘saving’ from the halving the Single Person discount, at around £43m, is reasonably significant; and could be used for a combination of increasing the WCRS and/or reducing the annual increment in the charge.

Table 5.3: Halving the Single Person discount would increase the water poverty rate

Impact of varying the Single Person discount on water poverty, and scheme cost, 2024/2025

|

Single person discount 25% |

Single person discount 12.5% |

Difference |

|

|

Total cost of SP discount (£m) |

£103 |

£51 |

-£52 |

|

Total cost of WCRS (£m) |

£35 |

£44 |

£9 |

|

3% poverty rate |

10.6% |

11.1% |

0.5% |

|

5% poverty rate |

4.6% |

4.8% |

0.2% |

Source: Consumer Scotland analysis using IPPR Tax-Benefit model.

A ‘by-application’ fund

A major strength of the WCRS is that it is provided automatically to qualifying households, i.e. those in receipt of Council Tax Reduction. In other words, eligible households do not need to take any action to receive the WCRS since eligibility – being in receipt of CTR – guarantees the WCRS automatically.

This contrasts with the position in England, where affordability support is not provided automatically, but where households who meet various eligibility criteria have to apply to their water provider for access to bill support. It also contrasts with the position in the energy market in Scotland, and the market for broadband services across the UK, where all affordability support is provided on a ‘by application’ basis.

There are significant limitations of a ‘by application’ affordability schemes. Consumers may not know that ‘by application’ schemes exist, what the eligibility criteria are, or how they can apply. The process of applying can be time-consuming and difficult. These factors tend to mean that take-up of ‘by-application’ schemes is relatively low, particularly amongst consumers in vulnerable circumstances who are most in need of support. Furthermore, ‘by-application’ schemes create administrative burdens for the suppliers who deliver them.

For these reasons we would not advocate moving from an ‘automatic’ scheme to a more discretionary, ‘by-application’ scheme. However, a ‘by-application’ scheme could complement an automatic scheme, such as the WCRS.

As we demonstrated above, there is a significant degree of misalignment between the households in receipt of WCRS and those in water poverty. This is partly because the eligibility criteria for WCRS are not explicitly aligned with the factors determining water poverty. However, it also reflects the practical challenge of trying to target and administer support to a specific group of households in the absence of robust real time information on those households’ circumstances. In other words, there will always be a degree of mismatch between the households in water poverty according to some specific, detailed criteria, and how support can be targeted practically through proxy measures of need.

Given these difficulties in getting support to all households in water poverty, the presence of a ‘by-application’ scheme could supplement the WCRS. A ‘by-application’ scheme could operate to provide equivalent rates of bill discount as the WCRS to households who met certain low-income criteria, but for whatever reason were not in receipt of CTR.

We have not sought in this report to identify eligibility criteria for such a scheme, nor to model likely levels of uptake. But the concept of a ‘by application’ scheme that supplements the WCRS by providing a safety net for households not in receipt of WCRS is worthy of consideration.

Comparisons with affordability protections in England & Wales

To provide some comparative context, we have briefly set out the various affordability protections applied to household water bills in England & Wales.

Both the charging mechanisms and market structure across England and Wales are markedly different from Scotland. Households with water meters represent the majority of the market (60%[xxiv]) in England, whereas metered households are a negligible proportion of those in Scotland. Households in England and Wales can also be charged based on their 1990 rateable value[xxv] or via an assessed volume charge[xxvi].

Equally, the market structure itself differs by having a range of water companies supplying services across different areas of England and Wales, whereas Scottish Water acts as the sole provider in Scotland, with local authorities in Scotland acting as billing agents.

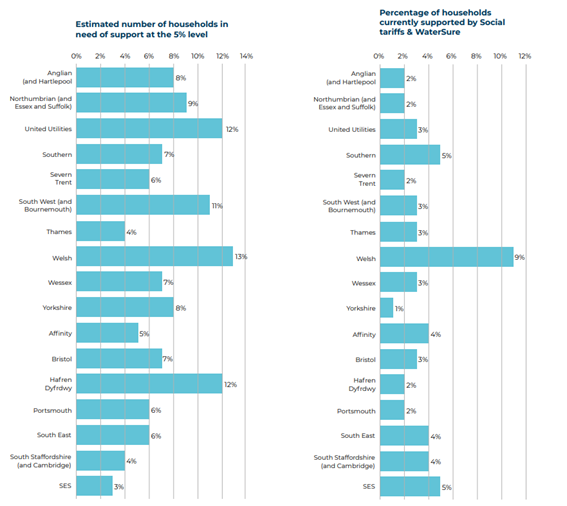

As outlined by the Consumer Council for Water (CCW) in their independent review of water affordability[xxvii], there are two primary schemes which act to provide bill reductions for specific households across England & Wales – social tariffs and the ‘WaterSure’ scheme.

Social tariffs are offered by individual water companies, funded through customer charges, and are developed in consultation with existing customers, based on evidence.

Social tariffs across providers differ in terms of eligibility criteria and level of support offered[xxviii]. As outlined in CCW’s Water Mark 2023 data[xxix], this creates significant variability in terms of the average bill reduction offered. Across water and sewerage companies in England & Wales, this varies from £73 to £313 in terms of the average annual reduction. For water only companies, the reduction is between £24 to £88. The average bill reduction across the sector is £151.

Eligibility and take-up also varies substantially. CCW’s Water Mark 2023 data highlighted approx. 1.4M customers registered to a social tariff in England and Wales, at a total cost of around £206M. However, customers registered per 10,000 households across providers varies considerably, from 637 to 190 across water & sewerage companies, and from 890 to 254 across water only companies. The industry average is 433 customers per 10,000 households.

Meanwhile, the WaterSure scheme is designed to protect low-income households on a meter from excessive charges, if their usage is higher than an average household due to essential needs. The scheme is designed to limit a recipient household’s charges to the average for their specific region, at most.