1. Executive summary

In the face of increasing costs of energy, and uncertainty about the impact of the broader cost of living crisis, accurate insight into how consumers are coping is key to informing the design of consumer support and advice schemes.

Consumer Scotland commissioned YouGov Plc to conduct a series of online quantitative surveys to regularly monitor the impact of the cost of living crisis for energy consumers in Scotland. The fieldwork for the first of these tracker surveys was undertaken 27th September – 10th October 2022. This covered the period spanning the end of the last Energy Price Cap and the introduction of the Energy Price Guarantee on 1st October 2022.

Understanding the consumer experience during the crisis is important to make sure there is an appropriate and durable response and to inform the future of the retail market. This report summarises research into the impact of the cost of living crisis on energy consumers in Scotland using an online tracker survey. The evidence provides insight into how consumers are currently coping with the high costs of energy.

The key findings are summarised below:

Next Steps

Successive waves of the Energy Affordability Tracker will help us identify issues and trends to improve the provision of support and advice for energy consumers. Nonetheless, this iteration of the research has highlighted a number of issues for key players in the energy sector to address:

• Support for prepayment meter customers should be reviewed by the UK

Government, Ofgem and the industry in light of the significant affordability

challenges for these consumers

• Comprehensive equalities impact assessments on all energy support schemes should be undertaken to identify which groups may be disproportionately disadvantaged as a result of policy change

• Sufficient provision of holistic advice and income maximisation support is key to support consumers and the Scottish and UK Governments, industry and advice providers should work together to achieve that

• Energy suppliers’ ability-to-pay assessments should also reflect current

inflationary pressures to help avoid consumers having to cut back on essential

goods and services to pay their energy bills

• The Scottish Government continues with its recent promotion of local and

nationally provided financial support for consumers and look to improve

awareness where it remains low. Consumer Scotland will continue to monitor

consumer awareness of available support schemes in future waves of this survey to help monitor progress

• The UK Government and Ofgem should work closely with industry and other

stakeholders with the purpose of structuring the future GB-energy retail market so that it is:

o designed to take into account its impact on different groups of consumers,

including those with different types of heating systems and payment

methods; and

o is structured with a consumer protection outcome framework at its heart

that takes into account the needs of the most disadvantaged consumers

2. Who we are

Consumer Scotland is the statutory body for consumers in Scotland. Established on 1 April 2022 under the Consumer Scotland Act 2020, we are independent of government and accountable to the Scottish Parliament.

Consumer Scotland uses data, research and analysis to inform our work on the key issues facing consumers in Scotland. As the statutory body for consumers we work with business, the public sector and consumer champions to put consumer rights, needs and interests at the heart of markets, services and policy.

3. Research rationale

In 2022-23 Consumer Scotland commissioned research to monitor over time the impact of the cost of living crisis on energy consumers in Scotland, using an online tracker survey that could be repeated at regular intervals. This approach was taken because it would allow us to be responsive to a rapidly changing landscape by providing insight into current consumer experience including seasonal variation. This also allows us to understand how consumers are managing with the high cost of energy and what support and other policy responses they might need now and in the future.

4. Policy context

Consumers across Scotland continue to face ongoing uncertainty about the impact of the cost of living crisis on their energy bills given successive increases in the Energy Price Cap since October 2021.1 Recent policy interventions, such as the Energy Price Guarantee (EPG) and the Energy Bill Support Scheme (EBSS) (both from October 2022), have been critical for reassuring and supporting consumers in the short term. However, the UK Government has announced that the EPG will expire in April 2023, to be replaced by a revised Energy Price Guarantee running until April 2024.2

The November 2022 Autumn Statement confirmed the revised EPG would be set at a higher level of £3,000 for the average household (compared to £2,500 currently), with further support more narrowly targeted to fewer households.3 For the most vulnerable consumers, additional cost of living payments will be introduced in 2023, including:

• £900 to households on means-tested benefits

• £300 to pensioner households

• £150 for individuals on disability benefits

Understanding the consumer experience during the current crisis is important to inform an appropriate and durable response that protects consumers from unaffordable rises in the costs of energy. Given the complexity and ever-changing landscape of energy crisis support funding, there is a need to ensure that support schemes are reaching those who need the most help. Central to this should be identifying those who may be struggling the most. Further, all consumers should be made aware of, and receive the support that they are

entitled to.

Prior to this research, Consumer Scotland’s assessment of evidence and engagement with stakeholders had already highlighted particular concerns about specific groups of consumers, such as:

Those in, or at risk of falling into, fuel poverty – Rates of fuel poverty are more in flux now than at any time previously as a result of increasing energy prices. In November 2022 the Scottish Government published cross-government analysis of a wide range of sources to provide an overview of emerging evidence on the cost of living crisis.4 This scenario modelling estimated that the price cap increasing to £2,500 for a typical household in October 2022 would result in around 860,000 (35%) fuel-poor households in Scotland, of which 600,000 (24%) would be in extreme fuel poverty.5 This is a major increase in the Scottish Government’s official estimate of 613,000 (25%) households living in fuel poverty in 2019 and 311,000 (12%) living in extreme fuel poverty.6

The near doubling in the modelled increase in extreme fuel poverty is particularly stark since it would mean that these households will be spending in excess of 20% of their household income to heat their homes to an adequate standard.

Prepayment meter consumers who are less able to spread the cost of energy across the whole year – The consequence for prepayment meter customers of paying for their energy as they go is that they may pay £150 per month more than a typical direct debit customer over the same period.7 This is because payments made by direct debit customers are smoothed throughout the whole year. For customers paying by prepayment meter the monthly amounts they pay vary between summer and winter as the amount of energy they use goes up. If these customers do not have room in their budgets to absorb such large increases they can face difficult decisions over heating or other expenditure such as food.8

Households requiring an enhanced heating regime – These consumers may have higher than ‘typical’ energy demand resulting in them potentially paying more for the energy they need. This will include people in vulnerable circumstances, such as those with disabilities or other medical or health conditions, or it may also include consumers in vulnerable circumstances who live in homes with poor levels of energy efficiency.9,10

All of this presents a challenge for policymakers and consumer representatives requiring reliable evidence on the specific ways the energy market is impacting Scottish consumers, including the impact of the current cost of living crisis. To address some of these challenges within the context of the current cost of living crisis, Consumer Scotland undertook internal

analysis of the Office for National Statistics (ONS) Living Costs and Food Survey.11

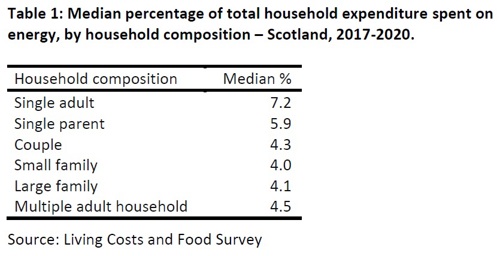

As noted in Table 1, our analysis highlighted that low-income single adult and single parent households (i.e. single income households) have the highest expenditure on energy as a proportion of total expenditure.

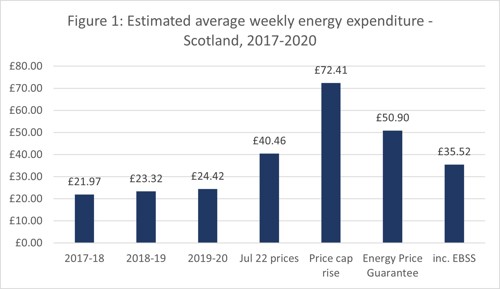

Our analysis (summarised in Figure 1) also considered the impact of the current EPG and the EBSS, where it was estimated that the combination of both meant that energy expenditure – as a weekly average 12 – would be lower than it otherwise would have been under the April 2022 price cap. The analysis in Figure 1 is based on an estimate of what prices would have been at July 2022 as a result of inflationary pressures at that date.13

Sources: Living Costs and Food Survey, CPIH Inflation Price Indices, Ofgem, BEIS

The nature of the flat-rate discount households will receive through the EBSS means that households with lower incomes, which tend to spend lower sums of money on energy, will see their energy expenditure drop by proportionally more than households with higher incomes, which tend to spend higher sums of money on energy. For households with prepayment meters or who pay on receipt of a bill, the seasonal fluctuation in prices mean these customers are likely to face much higher energy bills in the winter months than the ‘weekly average’. As noted previously, for prepayment customers this is a result of these consumers paying more ‘as they go’ for their energy for heating compared to direct debit customers who can spread the cost throughout the year.

Finally, it should also be noted that the increasing difficulties with energy affordability is happening in the wider context of increases in costs of living and rising inflation rates. Recent UK Consumer Price Index (CPI) puts inflation at 11.1% which is contributing to the wider cost of living difficulties consumers are currently facing.14 The Scottish Government’s cross-government analysis of emerging evidence on the cost of living crisis shows that low income households are the ones most at risk, with particular households (such as larger families, those with a disabled person, those who rent and single person and single parent households) being the ones most exposed to the impacts of rising costs – with women and ethnic minorities being particularly exposed to financial difficulties.15

5. Methodology

Consumer Scotland commissioned YouGov Plc to conduct an online quantitative survey on our behalf, administered in three waves, to an existing research panel of members resident in Scotland. The total sample size in the autumn 2022 wave was 1,586 adults (aged 16+).

Fieldwork was undertaken 27th September – 10th October 2022. The fieldwork therefore straddled the period covering the end of the last Energy Price Cap and the introduction of the Energy Price Guarantee on 1st October 2022.

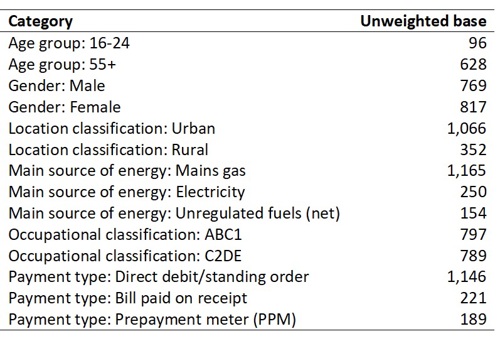

The results were weighted to be representative of all Scottish adults and by age, gender, region, occupational classification and urban vs rural geographic location. The sample included a boost of 80 to those living in a rural location, increasing the size of this audience to 350. All of the results were weighted back to be representative of the population at the data analysis stage. The unweighted base sizes are shown in the annex.

A previous wave of the survey was undertaken in spring 2022 (25th – 31st March 2022) by the Energy Consumers Commission, a predecessor body to Consumer Scotland.16 The total sample size in this earlier wave was 2,012 adults. The spring 2022 survey was also carried out online and the figures weighted to be representative of all Scottish adults (aged 16+). We have noted in our analysis where notable differences exist in the responses to questions that were repeated across both waves. However, seasonality differences and the changeable nature of energy crisis support between the spring and autumn waves of the research may have had an impact on the results that are reported.

6. Our evidence: YouGov affordability tracker

Industry stakeholders and regulators regularly conduct consumer surveys across the GB energy market, however many are not specific to Scotland. To help us fully understand issues that can disproportionately affect consumers in Scotland, Consumer Scotland commissioned YouGov Plc to undertake survey research throughout 2022-23 that would reveal the experiences of consumers in Scotland and their views of the regulated energy retail market.

The objective of the autumn 2022 wave of research was to gather data to ascertain the impact over time of regulated energy retail market price increases on energy consumers resident in Scotland, building on previous work that was undertaken by the Energy Consumers Commission – most notably in spring 2022. It is our intention to undertake further waves of polling during the 2022-23 winter and beyond to investigate how consumers’ attitudes and experiences are changing during a time of unprecedented market volatility.

In this section we summarise key findings to emerge from our evidence:

• The extent to which households feel they are managing financially now and their expectations for how they will be managing in 3 months’ time

• How easy or difficult it is for consumers to be keeping up with their energy bills now compared with last year

• The extent of energy rationing taking place and other areas of spending being cut back to pay for energy bills

• How easy or difficult consumers are finding it to contact their supplier

• General awareness of the financial support that is currently available to consumers to help them navigate the current crisis

The results from our YouGov Plc survey are presented below. All results are statistically significant, unless otherwise stated.

6.1 Consumers’ financial resilience

In autumn 2022, most people in Scotland (61%) reported they are managing well financially, with only 8% stating they are managing very well currently. Even before the start of the winter heating period, when fuel needs are usually much higher, over a third (36%) of the population stated that their household is not currently managing well financially, with as many as one in ten (11%) stating they are not managing financially at all.

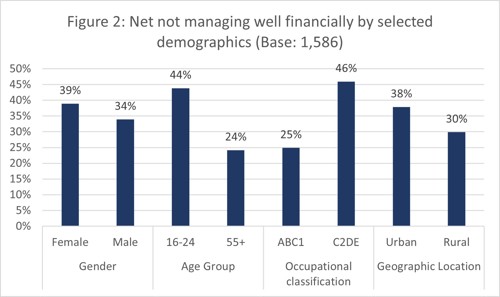

The extent to which households are not managing financially varies by key demographics. Figure 2 highlights the proportion of people across a range of key characteristics reporting they are not currently managing financially:

A number of differences exist in how different groups are managing financially, these include:

• Women are slightly more likely (39%) than men (34%) to state they are not

managing well financially

• Younger people (16-24) are more likely (44%) than older aged people (55+) (24%) to report they are not managing well financially

• Those in the C2DE occupational classification category 17 are more likely (46%) than those in the ABC1 category (25%) to state they are not managing well

• People living in urban areas are more likely (38%) than those living in rural areas (30%) to state they are not managing well financially

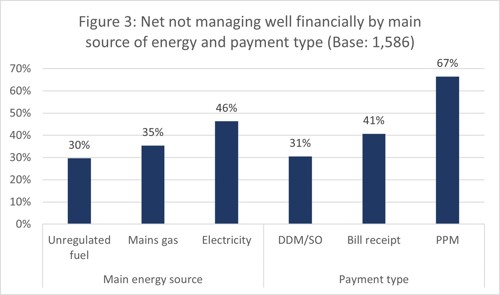

The financial resilience of the population does not just vary by key demographic categories. As summarised in Figure 3, it is also the case that a household’s main source of energy for heat and how a household pays for their energy both have a bearing on the extent to which a household reports if they are not managing well financially:

Specific examples of differences between consumers who are not managing well financially include:

• Consumers where electricity is their main source of energy for heat 18 are more likely (46%) to report they are not managing well financially, compared to people on the mains gas grid (35%), and people using nonregulated fuel types (30%)

• How consumers are paying for their energy also has an impact on whether they are not managing well financially. Overall, around 13% of the autumn 2022 sample (n=189, unweighted) were people paying for their energy using a prepayment meter. Sixty-seven per cent of these customers stated they are not managing well financially, compared with 41% of those who pay on receipt of an energy bill stating the same, and 31% of those paying by direct debit/standing order When asked to look three months ahead, 59% of people expect their household would be managing less well than they do now. Of those not managing well currently, 76% report they expect their household would be managing worse in three months’ time.

6.2 Difficulty managing energy bills

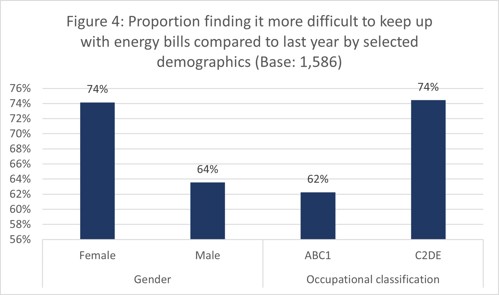

Our research found that two-thirds of people (69%) reported they are finding it more difficult in autumn 2022 to keep up with their energy bills compared with last year. This proportion was up from 56% of consumers in spring 2022. Figure 4 summarises the proportions of consumers in the latest wave finding it more difficult to keep up with their energy bills compared to last year by selected demographic categories:

• Women are more likely (74%) than men (64%) to report they are finding it more difficult in autumn 2022 to keep up with their energy bills compared with last year

• Those in the C2DE occupational classification category are more likely (74%)

than those in the ABC1 category (62%) to state they are finding it more difficult to keep up with their energy bills now compared with last year

• When comparing different age groups we find some differences between groups. Those aged 16-34 (71%), 35-54 (72%) and 55+ (65%) are all more likely than the 65+ age group (62%) to say they are finding it more difficult to keep up with their energy bills now compared with last year

• Our analysis by geographic location found no statistically significant differences in the proportion of people finding it more difficult to keep up with their energy bills now compared with last year

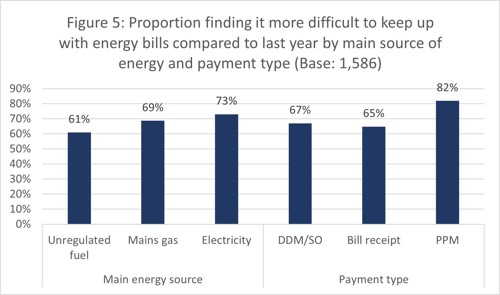

Figure 5 illustrates the proportion of people in autumn 2022 finding it more difficult to keep up with their energy bills compared to last year by main source of energy for heat and payment type:

Consumers whose main source of energy for heat is electricity are more likely

(73%) than those using unregulated fuels (61%) to report that they are finding it more difficult to keep up with their energy bills compared to last year. Similarly, those on the mains gas grid were more likely (69%) than those using unregulated fuels (61%) to report that they are finding it more difficult to keep up with their energy bills compared to last year

• People paying for their energy by prepayment meter are much more likely (82%) than direct debit/standing order customers (67%) and customers paying for energy on receipt of a bill (65%) to report that they are finding it more difficult to keep up with their energy bills compared to last year

6.3 Rationing energy due to financial concerns

Alongside the decreasing proportion of people saying it is easy to keep up with their energy bills, there has been a sharp increase in the proportion of people in Scotland stating they are using less energy overall. Forty-three per cent stated in autumn 2022 they cannot heat their home to a comfortable level due to financial concerns, up from 31% in spring 2022.

In addition, 68% of people stated in autumn 2022 that their household was rationing the amount of energy they are using due to financial concerns by reducing their use of heating or avoiding using electrical appliances, up from 52% in spring 2022.

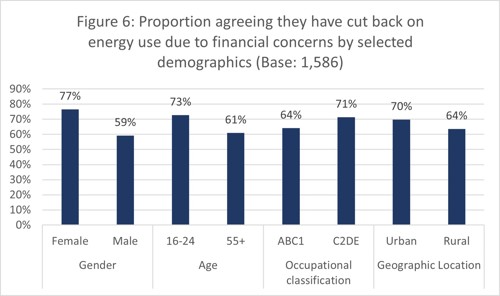

Figure 6 shows the proportion of people in autumn 2022 agreeing they have cut back on energy use due to financial concerns by selected demographics:

• Women were more likely (77%) than men (59%) to report they were rationing their energy use due to financial concerns

• Younger people (16-24) were more likely (73%) than older people (55+) (61%) to report they were rationing their energy use due to financial concerns

• Those in the C2DE occupational classification category were more likely (71%) than those in the ABC1 category (64%) to state they were rationing their energy use due to financial concerns

• Those living in urban areas were more likely (70%) than those living in rural areas (64%) to state they were rationing their energy use due to financial concerns

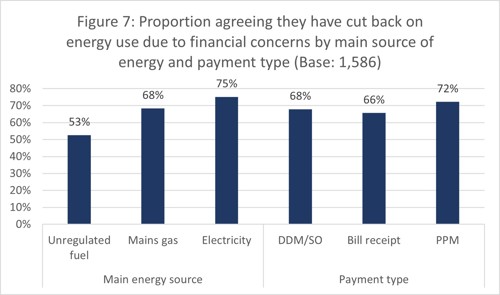

Figure 7 illustrates the proportion of consumers agreeing in autumn 2022 they had rationed their energy use due to financial concerns by main energy source for heat and payment type:

People with electricity as their main energy source for heat were more likely (75%) to report that they had rationed their energy use due to financial concerns, compared to those on the mains gas grid (68%) and those using unregulated fuels (53%)

• While marginally more households who pay for their energy use by prepayment meter report that they had cut back on energy use due to financial concerns (72%), compared to direct debit/standing order customers (68%) and customers paying for their energy on receipt of a bill (66%), these small differences are within the margin error so there is no statistically significant difference between the categories

• In addition, 28% of prepayment customers also reported in autumn 2022 that they had reduced the amount of money they usually put into their meter, with 24% being unable to top up because they couldn’t afford to

6.4 Cutting back spending in other areas

Consumers are not only cutting back on their energy spending due to financial concerns, they are also cutting back spending in other areas to afford their energy bills. Overall, our results show that 73% of consumers stated they had cut back in autumn 2022 on at least one of their other financial commitments to pay for their energy bills. This was up from 62% in spring 2022. The individual areas most likely to have been cut back were:

• General spending (56% of all consumers)

• Entertainment, holidays and treats (54% of all consumers)

• Clothing (46% of all consumers)

• Food (37% of all consumers)

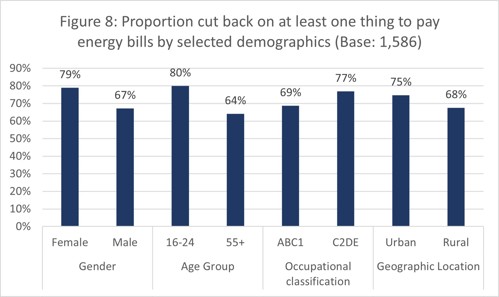

Figure 8 shows the proportion of people stating they had cut back on at least one thing in autumn 2022 to pay their energy bills by selected demographics:

• Women were more likely (79%) than men (67%) to report they had cut back on at least one thing to pay their energy bills

• Younger people (16-24) were more likely (80%) than older people (55+) (64%) to report they had cut back on at least one thing to pay their energy bills

• Those in the C2DE occupational classification category were more likely (77%) than those in the ABC1 category (69%) to report they had cut back on at least one thing to pay their energy

• Those living in urban areas were more likely (75%) than those living in rural

areas (68%) to report they had cut back on at least one thing to pay their energy

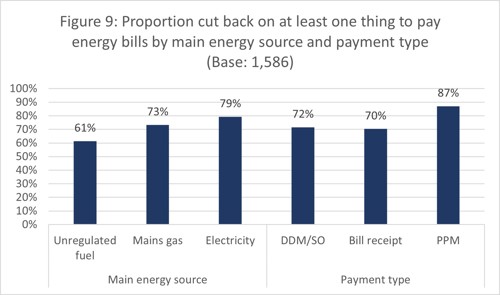

Figure 9 shows the proportion of people stating they had cut back on at least one thing to pay their energy bills by main source of energy for heat and payment type:

• People whose main energy source for heat is electricity were more likely (79%) than those using unregulated fuels (61%) to report that they had cut back on at least one thing to pay for their energy bills. Similarly, those on the mains gas grid were more likely (73%) those using unregulated fuels (61%) to report that they had cut back on at least one thing to pay their energy bills. There was no statistically significant difference between the other categories

• Households paying for their energy by prepayment meter were much more likely (87%) to report that they had cut back on at least one thing to pay for their energy bills, compared to with direct debit/standing order customers (72%) and customers paying on receipt of a bill (70%)

• Prepayment meter customers were the group most likely to be cutting back on spending in other areas to pay for their energy. The areas prepayment meter customers were most likely to be cutting back on were general spending (64%); clothing (57%); entertainment, holidays, treats (57%); and food (50%)

6.5 Difficulty contacting supplier

Our tracker survey also asks a range of questions on consumers’ perception of service satisfaction. In the context of rising energy bills, consumers being able to contact their supplier is a particularly important issue. We will be providing more detailed analysis of this issue alongside other service satisfaction data in a future report.

In autumn 2022 our data found that 52% of consumers agreed that their energy bill provides guidance about what to do if they are worried about paying their bill, with 17% of consumers disagreeing. It should be noted that this figure was almost unchanged between the last two waves of research, with 53% agreeing and 14% disagreeing with the statement in spring 2022.

We also find in our data some variation across the spring and autumn waves of the research and between some categories of consumers reporting how easy or difficult they are finding it to contact their energy supplier. Forty-five per cent of all consumers report they are finding it easy to contact their supplier in autumn 2022. This compares with 51% stating the same in spring 2022. Twenty-seven per cent of consumers in autumn disagreed that it was

easy for them to contact their supplier, which was a slight increase from the spring when it was 21%.

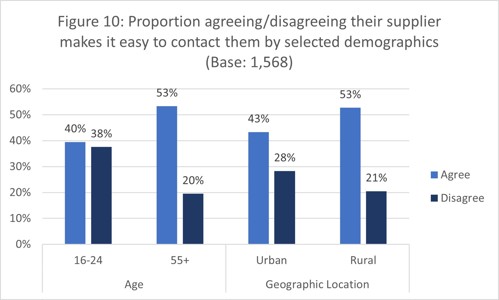

Figure 10 shows the proportion of people in selected demographics agreeing or disagreeing with the statement that their supplier makes it easy to contact them:

• The older age group (55+) are more likely (53%) than the younger (16-24) age group (40%) to agree that their supplier makes it easy to contact them. Conversely younger people are more likely (38%) than older people (20%) to disagree with the statement that their supplier makes it easy to contact them

• Those in rural areas are more likely (53%) than those in urban areas (43%) to agree with the statement that their supplier makes it easy to contact them. Those in urban areas are more likely (28%) than those in rural areas (21%) to disagree with the statement that their supplier makes it easy to contact them

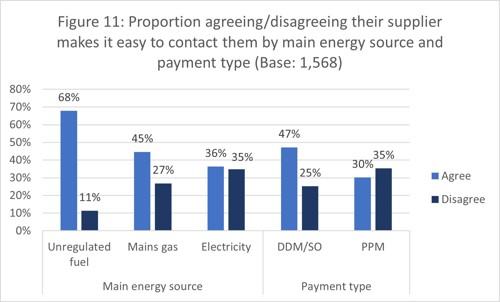

Figure 11 shows the proportion of people agreeing or disagreeing with the statement that their supplier makes it easy to contact them by main source of energy for heat and payment type:

• Unregulated fuel users are most likely (68%) to report finding it easy to contact their supplier. This is compared to 45% of those using mains gas and 36% of those whose main source of energy for heat is electricity. Those who main source of energy for heat is electricity are more likely (35%) than those using mains gas (27%) and unregulated fuels (11%) to disagree with the statement

• Those paying for their energy by direct debit/standing order are more likely (47%) than those using prepayment meters (30%) to agree with the statement that their supplier makes it easy to contact them. Those paying for their energy by prepayment meter are more likely (35%) than those paying by direct debit/standing order (25%) to disagree with the statement

6.6 Awareness of financial support

Understanding the extent of consumers’ awareness of financial support is important to ensure everyone is able to access and claim all of the support that they are entitled to. Although consumers’ awareness of financial support may be expected to be lower among specific groups who are not the intended target group, our findings highlight that more needs to be done to ensure consumers are generally aware of the support they might be able to access. Ensuring consumers are claiming all financial support available to them will

reduce the risk of self-disconnection for some or accruing arrears by others due to financial pressure.

In September 2022 the Scottish Government launched a dedicated website detailing the help that might be available to the public during the cost of living crisis.19 This was launched at around the same time as our autumn 2022 fieldwork was taking place, so we would not reasonably expect to see this having an impact on our results. We will continue to monitor public awareness of the support available.

Our research also examined if respondents were aware of a range of financial support that could be available to help their household with the cost of energy this winter. Whilst 7 in 10 of all consumers (72%) in autumn 2022 had at least some general awareness that there was financial support available, awareness was poor overall on the specific schemes or programmes available to help during the crisis.

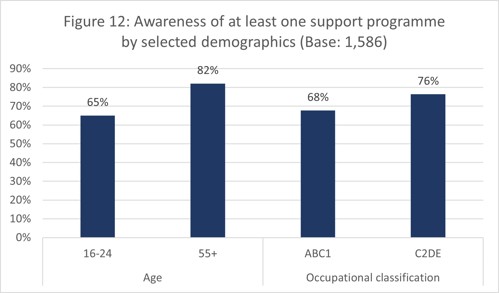

Figure 12 summarises awareness of at least one support programme by selected demographics. Awareness was generally higher (82%) among the older age group (55+) compared to the younger age group (16-24) (65%) and those in the C2DE occupational classification category (76%) compared to those in the ABC1 category (68%). This is perhaps a result of the targeting of support schemes towards specific groups:

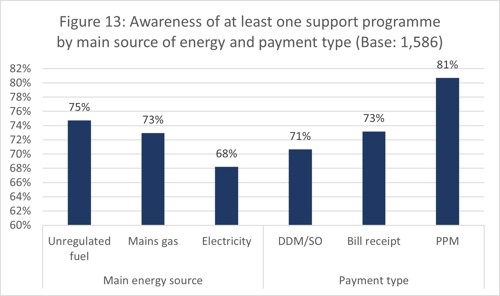

Figure 13 shows awareness of at least one support programme by main source of energy for heat and payment type. While there was marginally more awareness of support schemes among respondents using unregulated fuel types (75%) compared to mains gas (73%) and those whose main source of energy for heat is electricity (68%), there was no statistical difference between any of the categories. There was greater awareness of at least one

support programme among prepayment customers (81%) compared to those paying by direct debit/standing order (71%). While there was also marginally less awareness of support programmes among customers paying on receipt of a bill (73%), the difference was not statistically significant from the other categories.

Most consumer awareness was for Winter Fuel Payments (49%) and Cost of Living payments (41%). When it comes to GB or UK fuel poverty support, 27% of consumers were aware of the Warm Home Discount, but only 3% were aware of the Energy Company Obligation. Awareness of crisis support was also fairly low – with only 15% of people aware of crisis grants and 2% aware of fuel vouchers.

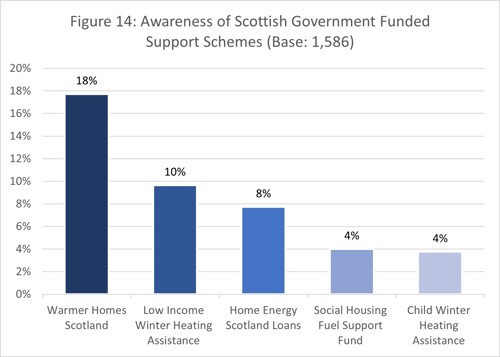

Figure 14 summarises consumer awareness of Scottish Government-funded support programmes in autumn 2022:

Our research suggests there is generally low awareness of Scottish-specific support available, with the Warmer Homes Scotland (18%) and Low Income Winter Heating Assistance (10%) programmes having the most awareness among the people of Scotland.

7. Next Steps

Successive waves of the Energy Affordability Tracker will help us identify issues and trends to improve the provision of support and advice for energy consumers. Nonetheless, this iteration of the research has highlighted a number of issues for key players in the energy sector to address:

• Support for prepayment meter customers should be reviewed by the UK

Government, Ofgem and the industry in light of the significant affordability

challenges for these consumers

• Comprehensive equalities impact assessments on all energy support schemes should be undertaken to identify which groups may be disproportionately disadvantaged as a result of policy change

• Sufficient provision of holistic advice and income maximisation support is key to support consumers and the Scottish and UK Governments, industry and advice providers should work together to achieve that

• Energy suppliers’ ability-to-pay assessments should also reflect current

inflationary pressures to help avoid consumers having to cut back on essential

goods and services to pay their energy bills

• The Scottish Government continues with its recent promotion of local and

nationally provided financial support for consumers and look to improve

awareness where it remains low. Consumer Scotland will continue to monitor

consumer awareness of available support schemes in future waves of this survey to help monitor progress

• The UK Government and Ofgem should work closely with industry and other

stakeholders with the purpose of structuring the future GB-energy retail market so that it is:

o designed to take into account its impact on different groups of consumers,

including those with different types of heating systems and payment

methods

o is structured with a consumer protection outcome framework at its heart

that takes into account the needs of the most disadvantaged consumers

Annex – Unweighted bases in categories

8. End Notes

1 Ofgem (2022) Default Tariff Cap | Ofgem

2 BEIS (2022) Energy bills support fact sheet

3 HM Treasury (2022) The Autumn Statement 2022 speech

4 Scottish Government (2022) Chapter 3: Analysis of the UK Government's Response - The Cost of Living Crisis in Scotland: analytical report

5 The fuel poverty rates are calculated based on 2019 SHCS data, with energy prices uprated in line with the

Energy Price Guarantee of £2,500 for the typical dual fuel household. Figures are presented net of the following mitigations: £400 Energy Bills Support Scheme payment, £650 Cost of Living payment for those on means-tested benefits, £300 Pensioner Cost of Living Payment for pensioner households who receive the Winter Fuel Payment, £150 Disability Cost of Living Payment and £150 Council Tax rebate for households in council tax bands A-D or that receive council tax reduction. They do not include the £100 payment for off-gas grid households under the Energy Bill Relief Scheme.

6 Scottish Housing Condition Survey (2019) Scottish house condition survey: 2019 key findings - gov.scot (www.gov.scot)

7 Fuel Bank Foundation (2022) Fuel Bank Whitepaper

8 Fuel Bank Foundation (2022) Fuel Bank Whitepaper

9 These consumers will not experience a proportionately similar benefit from the Energy Support Scheme as other consumers.

10 Scottish Government (2022) The Fuel Poverty (Enhanced Heating) (Scotland) Regulations 2020

11 Office of National Statistics (2017-2020) Living Costs and Food Survey - Office for National Statistics (ons.gov.uk)

12 That is, a household’s total annual expenditure on energy divided by 52.

13 Note that the figures from July 2022 onward assume no change in behaviour - i.e. these are the average amounts households would have to pay now to use energy in the same way they did in 2017-2020.

14 Office of National Statistics (2022) Consumer price inflation, UK - Office for National Statistics

15 The Cost of Living Crisis in Scotland: An Analytical Report (www.gov.scot)

16 Energy Consumers Commission - gov.scot (www.gov.scot)

17 Occupational classification is a socio-economic classification used in the analysis of spending habits and consumer attitudes. See explanation here: Social grade (approximated) | Scotland's Census (scotlandscensus.gov.uk)

18 This category includes electricity being used for storage heaters, heat pumps or electric panel heaters.

19 Cost of living crisis - Cost of Living Support Scotland (campaign.gov.scot)